- Historical 1.8B XRP accumulation highlights $1.75 as a key support, reinforcing the level’s importance.

- TD Sequential flashes a buy signal, boosting confidence in XRP’s short-term recovery.

- ETF inflows and upcoming XRP ETF launches strengthen the market outlook.

Amid bearish momentum, the XRP price reached an intraday low of $1.89, a decline of over 2% in the last 24 hours and more than 16% in the last week. Notably, some analysts had predicted XRP could even fall below $1 as the bearish momentum intensified. However, the coin soon found support at the $1.85 level and is now making another attempt at the $2 level.

1.8 Billion XRP Bought at Key Level

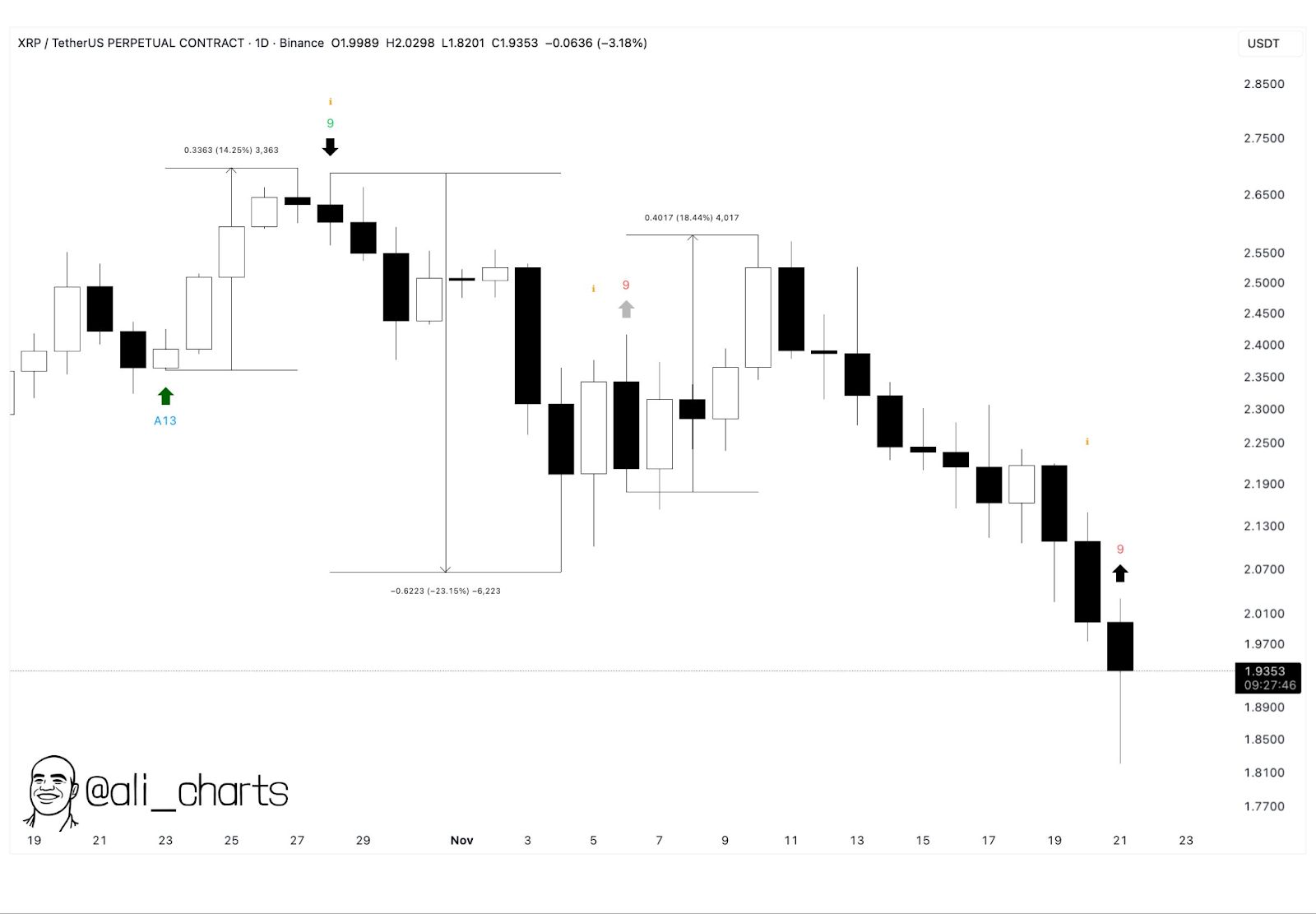

According to a chart shared by analyst Ali Martinez, 1.8 billion XRP were previously purchased at around $1.75, establishing this as a significant support level. Furthermore, the analyst said in a separate post that the TD Sequential indicator has flashed a buy signal for XRP. This indicator has historically predicted XRP’s bottoms, often leading to notable upside moves.

Specifically, Martinez noted that XRP rebounded by 14% and 18% in the last two instances when the TD Sequential indicator flashed a similar signal.

Source: X

Source: X

XRP ETF Inflows to Boost Outlook

Another factor supporting the bullish outlook is the ongoing trend of inflows into XRP ETFs. On Friday, XRP ETFs from Bitwise and Canry Capital recorded total inflows of $11.89 million. Cumulative total net inflow into XRP ETFs has now reached $422.66 million just one week after launch.

More ETFs Set to Launch

Grayscale will list its XRP (GXRP) spot ETF on NYSE Arca on Monday, expanding the company’s lineup of more than 40 crypto products.

Meanwhile, 21Shares has stirred speculation in the XRP community with a cryptic “get ready” message, widely interpreted as a hint that its long-awaited spot XRP ETF is nearing launch.

Related: Bitwise and 21Shares to Launch Spot XRP ETF: Is XRP Price Rebound Next?

The firm has been preparing the product for launch and updated its S-1 on Nov. 7, though earlier filings included language suggesting the debut might not happen in late November. Analysts remain optimistic about an imminent launch.

A fresh filing on Nov. 20 confirms that the ETF will list on Cboe BZX under the ticker TOXR, carry a 0.50% fee, and start with $500,000 in seed capital (20,000 shares at $25 each).

Related: Why Is the XRP Price Going Down Today and How Low Can It Fall Before a Bounce?