Bitcoin News Today: Bitcoin's Upward Trend Sparks Altcoin Rally, PIPPIN Jumps 148%

- Altcoins rebound as Bitcoin surges past $87,000, with PIPPIN surging 148% to $0.0577 in 24 hours. - TNSR (+49%), FARTCOIN (+22%), and DYM (+21%) follow, driven by Bitcoin's momentum and Abu Dhabi's IBIT holdings. - Analysts cite Bitcoin's "halo effect" and leveraged trading as key drivers, while BexBack introduces crash support tools amid volatility. - Risks persist from sharp price swings, regulatory scrutiny, and recent exploits like Aerodrome Finance's front-end attack. - Market remains in short-term

Altcoins Bounce Back As

On November 23, the cryptocurrency sector saw a significant recovery in altcoin values, spurred by Bitcoin breaking above $87,000. PIPPIN (PIPPIN), a relatively obscure token, spearheaded the surge,

This renewed activity in altcoins is consistent with broader market trends.

Experts link the altcoin rally to a mix of speculative enthusiasm and technical drivers. “Bitcoin’s ongoing strength creates a spillover effect, motivating investors to put money into smaller, fast-growing tokens,” a blockchain analyst noted in a recent analysis. The sharp rise in PIPPIN and others like MAV, which gained 20%,

Despite the positive sentiment, significant risks remain.

At present, altcoins seem to be enjoying a short-lived bullish run, supported by Bitcoin’s strength and institutional backing. Nevertheless, as BexBack’s support initiative indicates, market participants are bracing for possible instability, balancing bold strategies with risk management. The next few weeks will reveal whether this recovery marks the start of a lasting trend or is simply a brief spike in an uncertain global climate.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anti-CZ Whale Loses $61M Profit in 10 Days on Hyperliquid

Quick Take Summary is AI generated, newsroom reviewed. The "Anti-CZ Whale" lost $61 million in profit in 10 days, suffering losses on aggressive long positions in ETH and XRP. The whale's overall realized and unrealized profit dropped from $100 million to $38.4 million. One of the whale's accounts is running 12.22x leverage on a $255 million long exposure, with alarmingly thin 95.40% margin usage. The reversal highlights the high risk and volatility in perpetual futures trading, even for successful contrar

Watch Out: Numerous Economic Developments and Altcoin Events in the New Week – Here is the Day-by-Day, Hour-by-Hour List

‘I Won’t Back Down,’ Michael Saylor Reinforces Strategy’s Bitcoin Mission

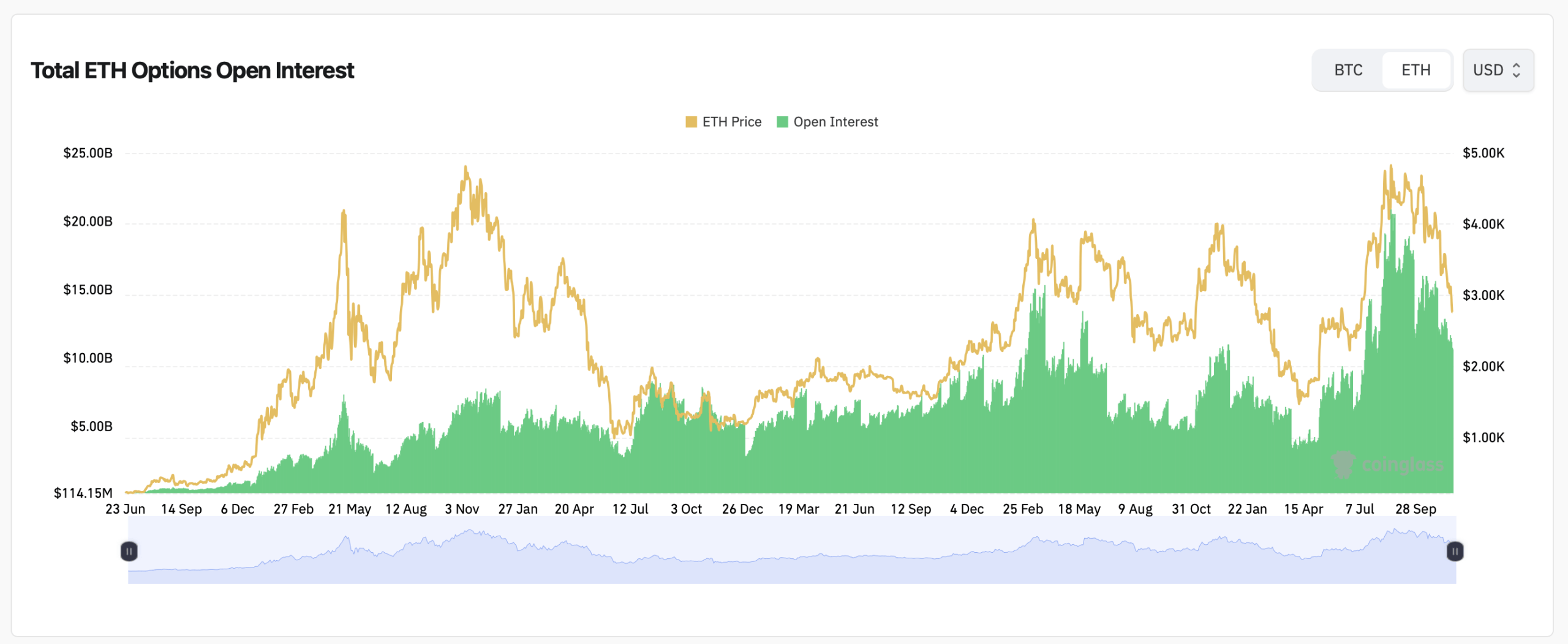

Ethereum Price Stalls as Derivatives Traders Load up for the Week Ahead