Xgram Integrates Enterprise-Grade Security with DeFi Management in a Combined Swap Platform

- Xgram launches Personal Manager Support, a first-in-industry service assigning human experts to oversee high-value crypto swaps exceeding $10,000. - The free, global feature offers real-time monitoring, pre-transaction verification, and instant Telegram access to managers, reducing user errors by 94% during beta testing. - Built on self-hosted nodes and cross-chain compatibility for 400+ assets, the non-custodial platform bridges institutional-grade support with DeFi principles. - By addressing a critica

Xgram, a fast-growing decentralized crypto swap service, has launched Personal Manager Support—a pioneering feature in the industry aimed at reducing risks in large-value transactions. For every swap over $10,000, users are automatically paired with a dedicated human specialist who provides live oversight, pre-swap verification, and assistance after the transaction is complete. This new service is designed to merge the high-touch support typical of institutional platforms with the core values of decentralized finance (DeFi),

Whenever a user starts a swap of $10,000 or more, the feature is triggered instantly, connecting them to a manager through the app’s chat function. Essential steps include verifying wallet addresses, networks, and transaction tags before proceeding, along with ongoing supervision throughout the process.

Andrew K., Chief Marketing Officer at Xgram, highlighted the importance of this solution: “A single incorrect character in an address or a mismatched network can result in losses of hundreds of thousands of dollars. Our goal was to remove that worry completely,” he said

The introduction

Early users have already started using the new feature. "

This development reflects a broader movement in the crypto world, where institutional adoption and enhanced user experience are coming together.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anti-CZ Whale Loses $61M Profit in 10 Days on Hyperliquid

Quick Take Summary is AI generated, newsroom reviewed. The "Anti-CZ Whale" lost $61 million in profit in 10 days, suffering losses on aggressive long positions in ETH and XRP. The whale's overall realized and unrealized profit dropped from $100 million to $38.4 million. One of the whale's accounts is running 12.22x leverage on a $255 million long exposure, with alarmingly thin 95.40% margin usage. The reversal highlights the high risk and volatility in perpetual futures trading, even for successful contrar

Watch Out: Numerous Economic Developments and Altcoin Events in the New Week – Here is the Day-by-Day, Hour-by-Hour List

‘I Won’t Back Down,’ Michael Saylor Reinforces Strategy’s Bitcoin Mission

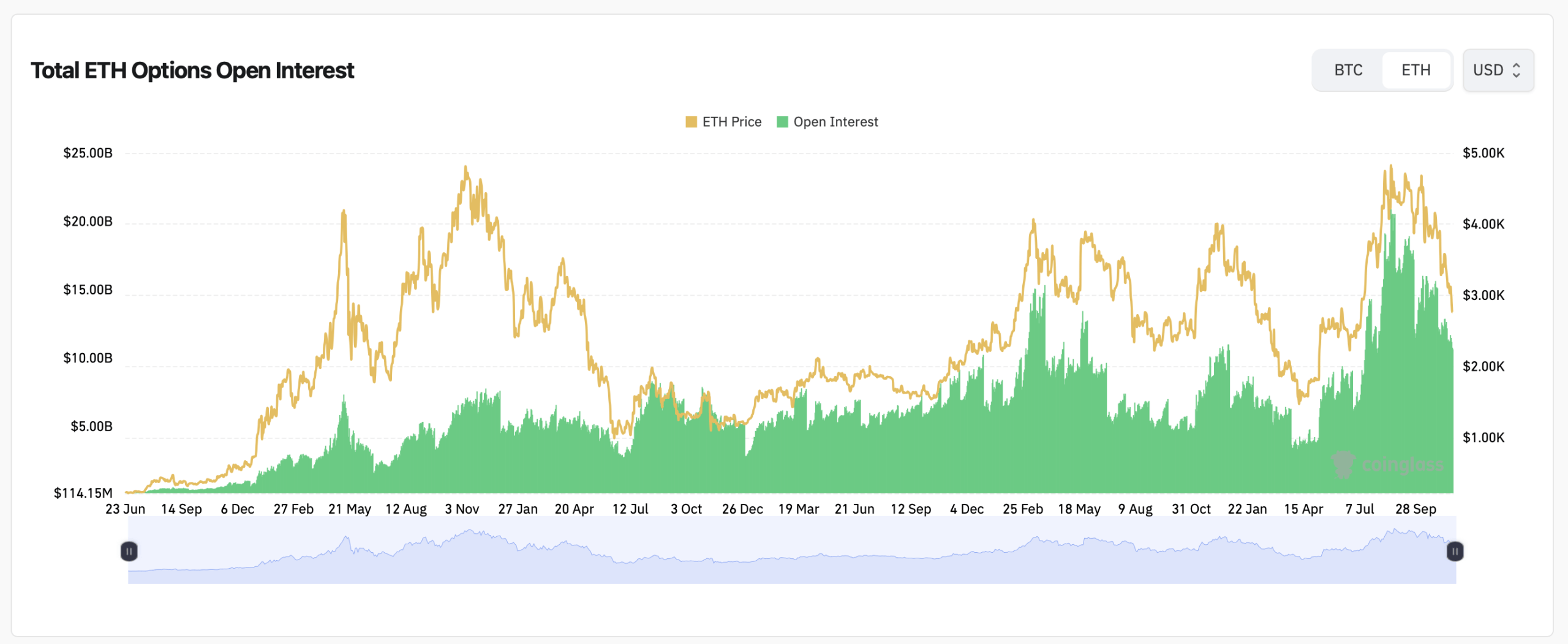

Ethereum Price Stalls as Derivatives Traders Load up for the Week Ahead