Chainlink Connects Blockchain with Traditional Finance, Driving a $35 Billion Boom in Tokenization

- Grayscale highlights Chainlink as blockchain's critical bridge to traditional finance via modular middleware infrastructure. - The platform now leads non-layer 1 crypto by market cap, enabling cross-chain interactions and enterprise compliance across ecosystems. - Tokenization of $35.6B+ assets relies on Chainlink's secure data verification and partnerships with S&P, JPMorgan , and Ondo Finance. - Its DvP settlement pilots and compliance tools address barriers to institutional blockchain adoption, aligni

Grayscale Investments, recognized as the largest investment platform specializing in digital assets globally, has

The report states that Chainlink’s technology has progressed well beyond its initial role as an oracle network, now standing as

The research also points to Chainlink’s significant partnerships, such as those with S&P Global and FTSE/Russell, as crucial to its leadership in tokenization. These collaborations,

Grayscale’s analysts believe that Chainlink’s infrastructure is uniquely equipped to tackle the compliance and interoperability issues that currently limit the widespread use of tokenized assets. By offering robust solutions for cross-chain settlements and data authentication, Chainlink is assisting established institutions in managing the complexities of blockchain adoption. This enhances its appeal to investors interested in the rapidly changing digital asset landscape.

The rise of Chainlink reflects larger industry movements, as regulatory improvements and growing institutional interest in tokenization gain momentum. With major financial entities such as JPMorgan and Mastercard increasingly turning to blockchain,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anti-CZ Whale Loses $61M Profit in 10 Days on Hyperliquid

Quick Take Summary is AI generated, newsroom reviewed. The "Anti-CZ Whale" lost $61 million in profit in 10 days, suffering losses on aggressive long positions in ETH and XRP. The whale's overall realized and unrealized profit dropped from $100 million to $38.4 million. One of the whale's accounts is running 12.22x leverage on a $255 million long exposure, with alarmingly thin 95.40% margin usage. The reversal highlights the high risk and volatility in perpetual futures trading, even for successful contrar

Watch Out: Numerous Economic Developments and Altcoin Events in the New Week – Here is the Day-by-Day, Hour-by-Hour List

‘I Won’t Back Down,’ Michael Saylor Reinforces Strategy’s Bitcoin Mission

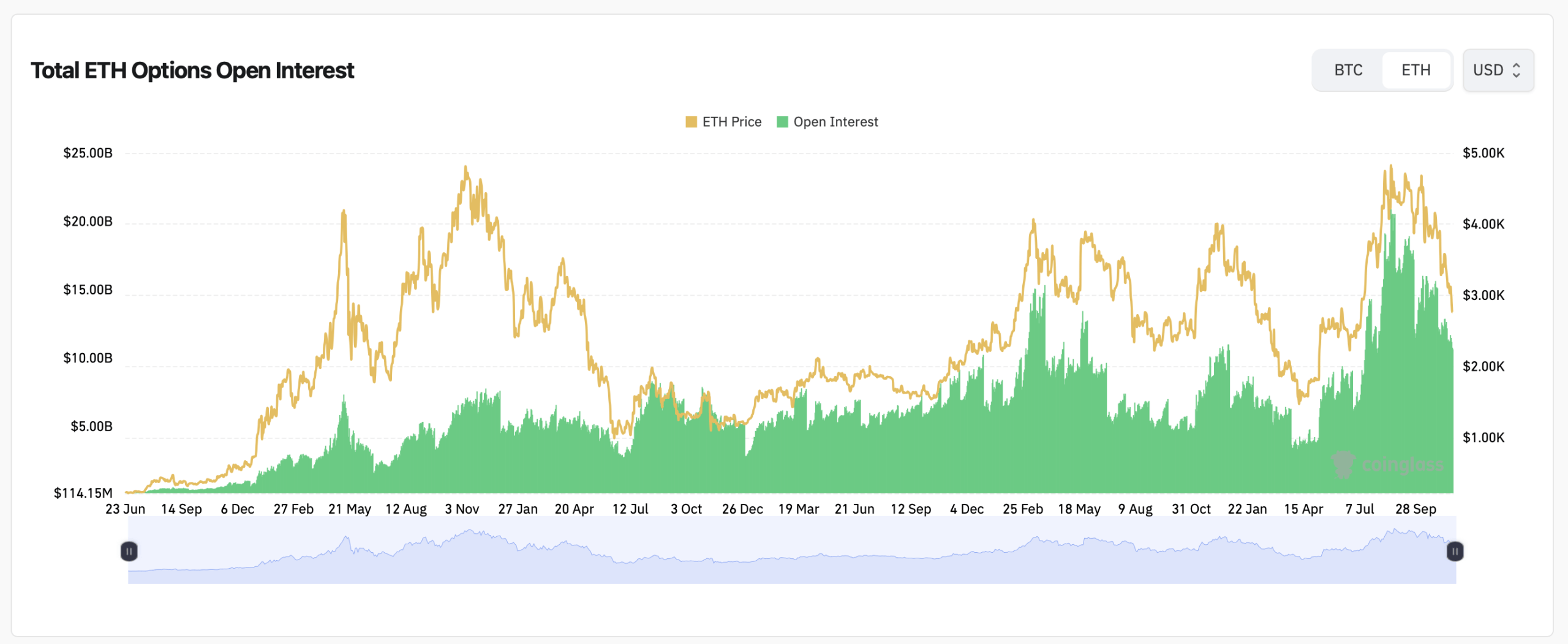

Ethereum Price Stalls as Derivatives Traders Load up for the Week Ahead