XRP News Update: XRP ETF Buzz vs. Death Cross: Can the $1.75 Support Level Remain Intact?

- XRP faces critical junctures near $2.14 as Grayscale's spot ETF (GXRP) launch looms, with $1.75 support level pivotal for short-term stability. - A death cross pattern raises bearish concerns, suggesting potential 55% price drop to $1 if technical indicators fail to hold. - Institutional crypto products like Leverage Shares' 3x ETFs and 1inch's liquidity pools highlight growing institutional interest amid market volatility. - DeFi struggles with $12B idle capital while projects like Mutuum Finance aim to

XRP's price movement has captured the attention of both traders and analysts, as mixed signals appear ahead of Grayscale’s expected spot

The upcoming launch of Grayscale’s spot XRP ETF (GXRP) on Monday introduces further unpredictability.

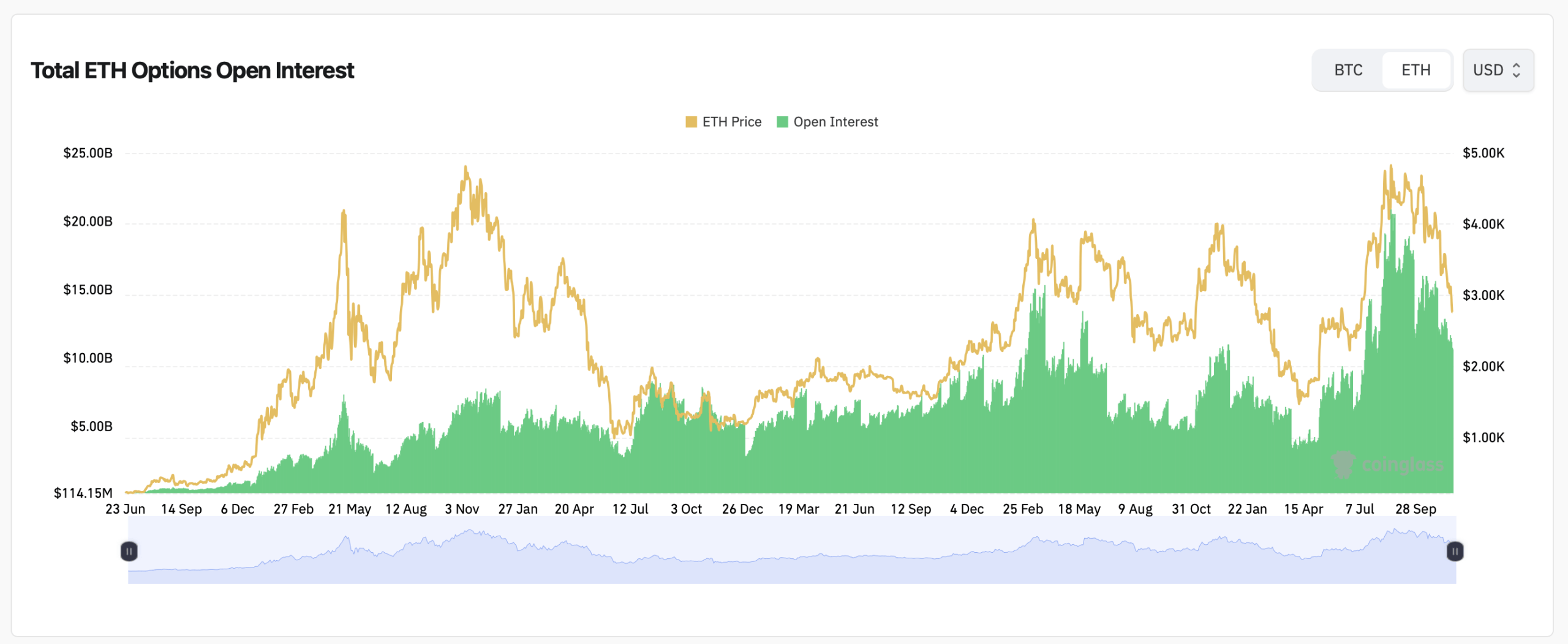

Ethereum investors are also preparing for increased leveraged trading as Leverage Shares gets ready to introduce 3x long and short ETFs for both BTC and

At the same time, DeFi continues to grapple with liquidity issues, with $12 billion in unused funds spread across various protocols.

The trending “apeing whitelist” craze has also brought attention to platforms such as Mutuum Finance. With Halborn Security currently auditing its smart contracts, the team

As participants in XRP and Ethereum markets contend with these shifting factors, the next few weeks will reveal whether technical strength, ETF introductions, and institutional progress can offset the prevailing bearish sentiment in the sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Anti-CZ Whale Loses $61M Profit in 10 Days on Hyperliquid

Quick Take Summary is AI generated, newsroom reviewed. The "Anti-CZ Whale" lost $61 million in profit in 10 days, suffering losses on aggressive long positions in ETH and XRP. The whale's overall realized and unrealized profit dropped from $100 million to $38.4 million. One of the whale's accounts is running 12.22x leverage on a $255 million long exposure, with alarmingly thin 95.40% margin usage. The reversal highlights the high risk and volatility in perpetual futures trading, even for successful contrar

Watch Out: Numerous Economic Developments and Altcoin Events in the New Week – Here is the Day-by-Day, Hour-by-Hour List

‘I Won’t Back Down,’ Michael Saylor Reinforces Strategy’s Bitcoin Mission

Ethereum Price Stalls as Derivatives Traders Load up for the Week Ahead