Pantera Partner: In the Era of Privacy Renaissance, These Technologies Are Changing the Game

A new reality is taking shape: privacy protection is the key driver for blockchain to go mainstream, and the demand for privacy is accelerating across cultural, institutional, and technological levels.

Original Title: Privacy Renaissance: Blockchain's Next Era

Original Author: Paul Veradittakit, Partner at Pantera Capital

Original Translation: Saoirse, Foresight News

Since the birth of bitcoin, the core concept of the blockchain industry has always been rooted in "transparency"—an open and immutable ledger that anyone can view; its trust is based on "verification" rather than institutional reputation. It is this transparency that enables decentralized systems to operate with integrity and accountability mechanisms.

However, as blockchain technology matures and its application scenarios expand, "transparency" alone is no longer sufficient. A new reality is emerging: privacy protection is key to driving blockchain into the mainstream, and the demand for privacy is accelerating at cultural, institutional, and technological levels. At Pantera Capital, we have believed in this from the very beginning—back in 2015, we invested in Zcash, one of the first projects to attempt to introduce privacy protection to immutable ledgers.

We believe the industry is entering a "privacy renaissance" era: this era deeply integrates the concept of open blockchains with the practical needs of global finance. Against this backdrop, privacy protocols built with "confidentiality" as a core principle (such as Zama, which is about to launch its mainnet) are seeing development opportunities. Zama's fully homomorphic encryption (FHE) technology is the "absolute stronghold" for driving mainstream blockchain adoption and can also defend against threats from quantum computing in the coming years. Blockchain applications are just one landing area for Zama's FHE technology, which can also be extended to other verticals such as artificial intelligence (like Zama's Concrete platform), cloud computing, and more.

Another noteworthy investment target is StarkWare—the inventor of zk-STARKs zero-knowledge proof technology and the Validium solution, providing a "hybrid solution" for blockchain privacy protection and scalability. StarkWare's cryptographic technology also features quantum resistance and focuses on blockchain application scenarios, especially with its newly launched "S-Two prover," which further enhances the practicality of the technology.

Cultural Shift: From "Surveillance Fatigue" to "Digital Sovereignty"

Globally, there has been a fundamental shift in people's awareness of data. Years of large-scale surveillance, algorithmic tracking, and data breaches have made "privacy" one of the core cultural issues of the past decade. Users are now gradually realizing that not only information and transaction records, but even metadata can reveal private details such as personal identity, wealth, location, and relationships.

"Privacy protection + user ownership of sensitive data" has become the new industry norm—this is also the direction Pantera Capital is optimistic about, which is why we have invested in projects such as Zama, StarkWare, Transcrypts, and World. As public awareness of privacy continues to rise, the blockchain industry must face a fact: digital currencies need "confidentiality," not "full traceability." In this environment, privacy is no longer a niche demand but an important component driving the development of "digital sovereignty."

Institutional Shift: Transparency Without Privacy Cannot Support Scalable Applications

More and more institutions are entering the blockchain ecosystem: banks, remittance platforms, payment processors, enterprises, and fintech companies are all launching pilots, preparing to handle real transaction volumes in tokenized assets, cross-border settlements, and multi-jurisdictional payment networks.

But these institutions cannot operate on a "fully transparent public ledger"—corporate cash flows, supplier networks, foreign exchange exposures, contract terms, and customer transaction records must never be disclosed to competitors or the public. What enterprises need is "selectively transparent confidentiality," not "complete exposure."

This is precisely the foundation laid by early pioneers like Zcash. When Pantera Capital invested in Zcash in 2015, we realized that privacy is not an ideological preference but a necessary condition for real economic activity. The core insight of Zcash is that privacy protection cannot be "added after the fact" to a system (especially when using zero-knowledge proof technology); it must be embedded in the core of the protocol—otherwise, subsequent use becomes extremely difficult, fragile, and inefficient.

Zcash was launched in 2016 as a bitcoin fork, introducing zk-SNARKs technology, which can both hide transaction details and ensure full verifiability of transactions. In addition, the mixing protocol Tornado Cash is also an important milestone in on-chain privacy development: as people sought ways to break the linkage of public chain transactions, this protocol once saw a large amount of real user activity.

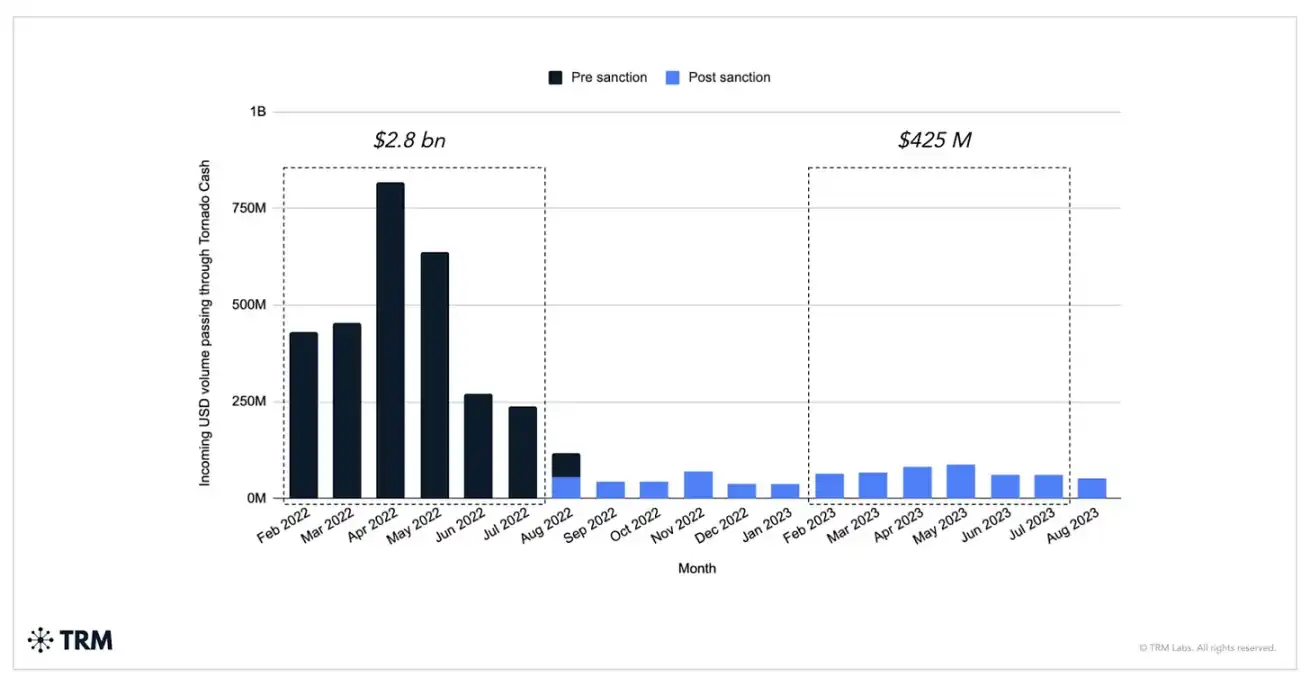

Changes in USD inflows to Tornado Cash before and after sanctions (Data source: TRM Labs)

However, the Tornado Cash model has flaws: it emphasizes strong privacy protection but lacks a "selective disclosure mechanism," ultimately leading to high-profile legal action by government agencies—even though the project is autonomously running code, it was still effectively forced to suspend. This outcome confirms a key lesson: privacy protection cannot come at the expense of "auditability" or "compliance pathways."

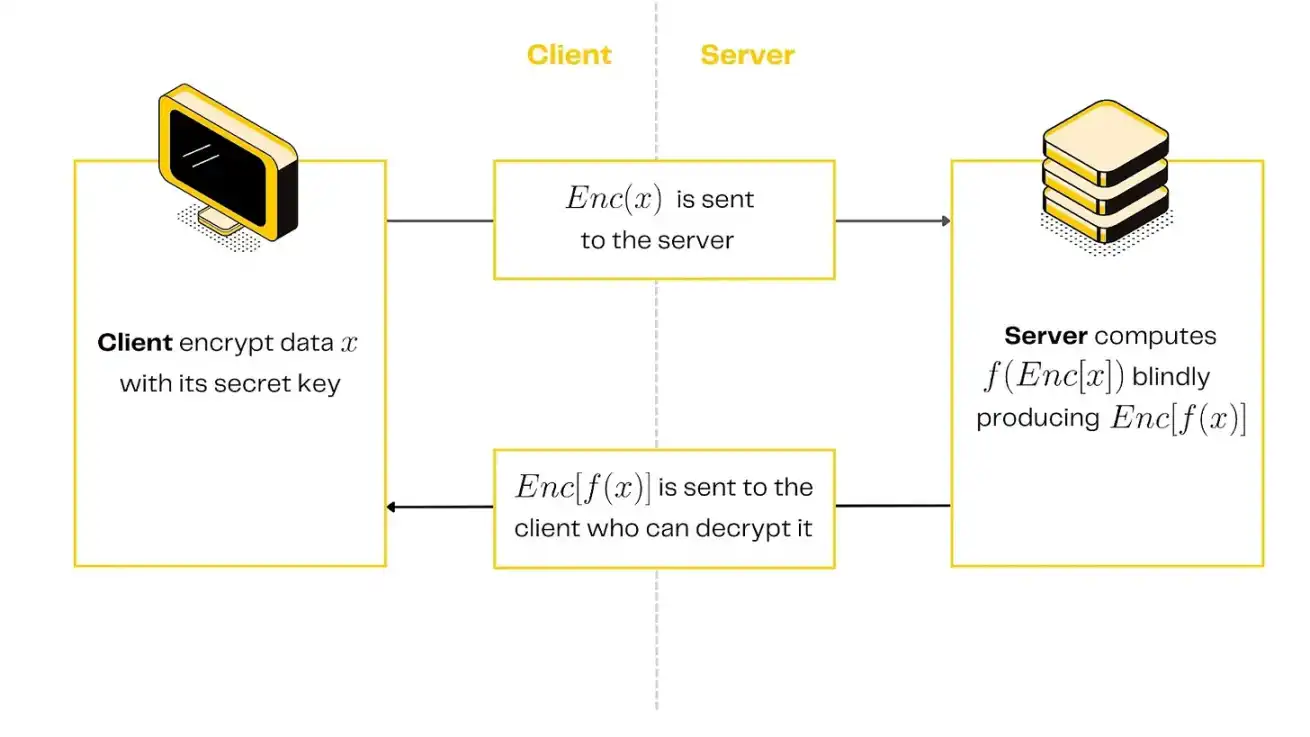

This is also the core value of Zama's fully homomorphic encryption technology: FHE supports direct computation on "encrypted data" while retaining the ability for "selective verification and disclosure of information"—a feature that mixing protocols like Tornado Cash lack by design.

The importance of fully homomorphic encryption is evident from the layout of tech giants: companies like Apple and Microsoft are investing resources in building FHE frameworks. Their investment sends a clear consensus: for both consumers and institutions, "scalable, compliant, end-to-end encryption technology" is the future of digital privacy.

The Demand for Privacy Is Accelerating

Data confirms this trend: crypto assets focused on privacy protection are gaining more attention from users and investors. But the real shift is not driven by retail speculation, but by practical application scenarios where "privacy and transparency must coexist":

• Cross-border payments are increasingly reliant on blockchain, but enterprises and banks cannot disclose every payment path;

• RWA requires confidentiality regarding "holdings" and "investor identities";

• In global supply chain finance, both parties need to verify events (such as shipping, invoicing, settlement) without revealing business secrets;

• Enterprise-grade trading networks require a model where "auditors and regulators can see, but the public cannot."

Meanwhile, retail users are increasingly dissatisfied with "highly monitored public chains"—on these chains, simple tools can reconstruct transaction relationship graphs. Today, "privacy protection" has become one of users' core expectations for digital currencies.

In short, the market is gradually recognizing a fact: blockchains that cannot provide confidentiality will face structural limitations in institutional-scale applications.

Canton, Zama, StarkWare and the New Generation of Privacy Architectures

With the arrival of the privacy renaissance era, a new generation of protocols is emerging to meet institutional needs.

Take the Canton blockchain as an example, which highlights the growing demand from enterprises for "private transaction execution on a shared settlement layer." Such systems allow participants to conduct private transactions while enjoying the benefits of "global state synchronization" and "shared infrastructure"—the development of Canton fully demonstrates that enterprises want the value of blockchain while avoiding public exposure of business data.

However, the most transformative breakthrough in private computing may come from Zama—which occupies a unique and more scalable position in the privacy technology stack. Zama is building a "confidentiality layer" based on fully homomorphic encryption (FHE), supporting direct computation on encrypted data. This means that the entire smart contract (including inputs, state, and outputs) can remain encrypted while still being verifiable on a public blockchain.

Unlike "privacy-first Layer1 public chains," Zama is compatible with existing ecosystems (especially the Ethereum Virtual Machine, EVM)—meaning developers and institutions do not need to migrate to a new chain, but can simply integrate privacy features within their existing development environments.

Private smart contracts using fully homomorphic encryption (FHE) (Data source: Zama)

Zama's architecture represents the next evolutionary direction for blockchain privacy protection: no longer simply hiding transactions, but enabling "scalable private smart contracts." This will unlock entirely new application scenarios—including private DeFi, encrypted order books, confidential real-world asset issuance, institutional-grade settlement and clearing processes, and secure multiparty business logic—all without sacrificing decentralization, with some applications expected to land in the short term.

Currently, privacy assets are receiving more attention: institutions are actively evaluating confidentiality layer technologies, developers want to achieve privacy computing without "off-chain system latency and complexity," and regulators are beginning to develop frameworks to distinguish between "legitimate confidentiality tools" and "illegal obfuscation methods."

Looking Ahead

The privacy narrative in the blockchain industry is no longer about the "opposition between transparency and confidentiality," but rather the realization that both are necessary conditions for the next era of DeFi. The combination of cultural attitudes, institutional needs, and breakthroughs in cryptographic technology is reshaping the evolutionary direction of blockchain for the next decade.

Zcash has proven the necessity of privacy protection at the protocol level; protocols like Canton reflect institutional demand for "confidential transaction networks"; and Zama is building infrastructure that may integrate these needs into a "cross-chain, universally scalable privacy layer."

Pantera Capital's early investment in Zcash stemmed from a simple belief: privacy protection is not "optional." Nearly a decade later, the relevance of this view is even more prominent—from tokenized assets to cross-border payments to enterprise settlements, the key to the next wave of blockchain application adoption lies in achieving a "secure, seamless, and private" technological experience.

As privacy protection becomes the core theme of this market cycle, protocols that can provide "practical, scalable, and compliant confidentiality solutions" will define the future landscape of the industry. Among them, Zama is emerging as a highly promising and timely leader in the "privacy supercycle."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hotcoin Research | Fusaka Upgrade Approaching: Analysis and Outlook on Ethereum Long and Short Positions

This article will review Ethereum's recent performance, provide an in-depth analysis of the current bullish and bearish factors facing Ethereum, and look ahead to its prospects and trends for the end of this year, next year, and the medium to long term. The aim is to help ordinary investors clarify uncertainties, grasp trends, and provide some reference to support more rational decision-making during key turning points.

Crypto Market Surges as Bitcoin Rebounds and Privacy Coins Shine

In Brief Bitcoin rebounded over the weekend, testing the $86,000 mark. Privacy-focused altcoins Monero and Zcash showed notable gains. Total market value surged, crossing the $3 trillion threshold again.

Crypto Markets Rebound as Traders Signal Seller Fatigue

In Brief Crypto markets rebounded amid significant liquidations and oversold RSI signals. Weekend trading conditions with thin liquidity influenced rapid price shifts. The rebound's sustainability remains uncertain, prompting scrutinous investor attention.

Cardano : Network security questioned after a major incident