Solana Price Crash To $100 Likely As SOL Nears Death Cross, But There’s A Catch

Solana is facing renewed bearish pressure as its price continues to slide, bringing the altcoin close to a critical support level that has not been tested in more than seven months. The ongoing decline reflects deepening market weakness, and technical indicators suggest that further losses may be ahead unless conditions shift quickly. Solana Investors Are

Solana is facing renewed bearish pressure as its price continues to slide, bringing the altcoin close to a critical support level that has not been tested in more than seven months.

The ongoing decline reflects deepening market weakness, and technical indicators suggest that further losses may be ahead unless conditions shift quickly.

Solana Investors Are Facing Heavy Losses

Solana’s exponential moving averages are signaling the potential formation of a Death Cross.

This pattern occurs when the short-term EMA crosses below the long-term EMA, often indicating the start of a prolonged downtrend. Historical behavior suggests that Solana may be repeating earlier market cycles seen in Q1 and Q2 of this year.

During those periods, SOL fell 59% from the local top before the Death Cross fully materialized.

A similar setup today would send Solana toward $98, extending its current 47% drop from the local top.

These conditions highlight weakening sentiment and reinforce concerns about continued downside risk.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Solana EMAs. Source:

Solana EMAs. Source:

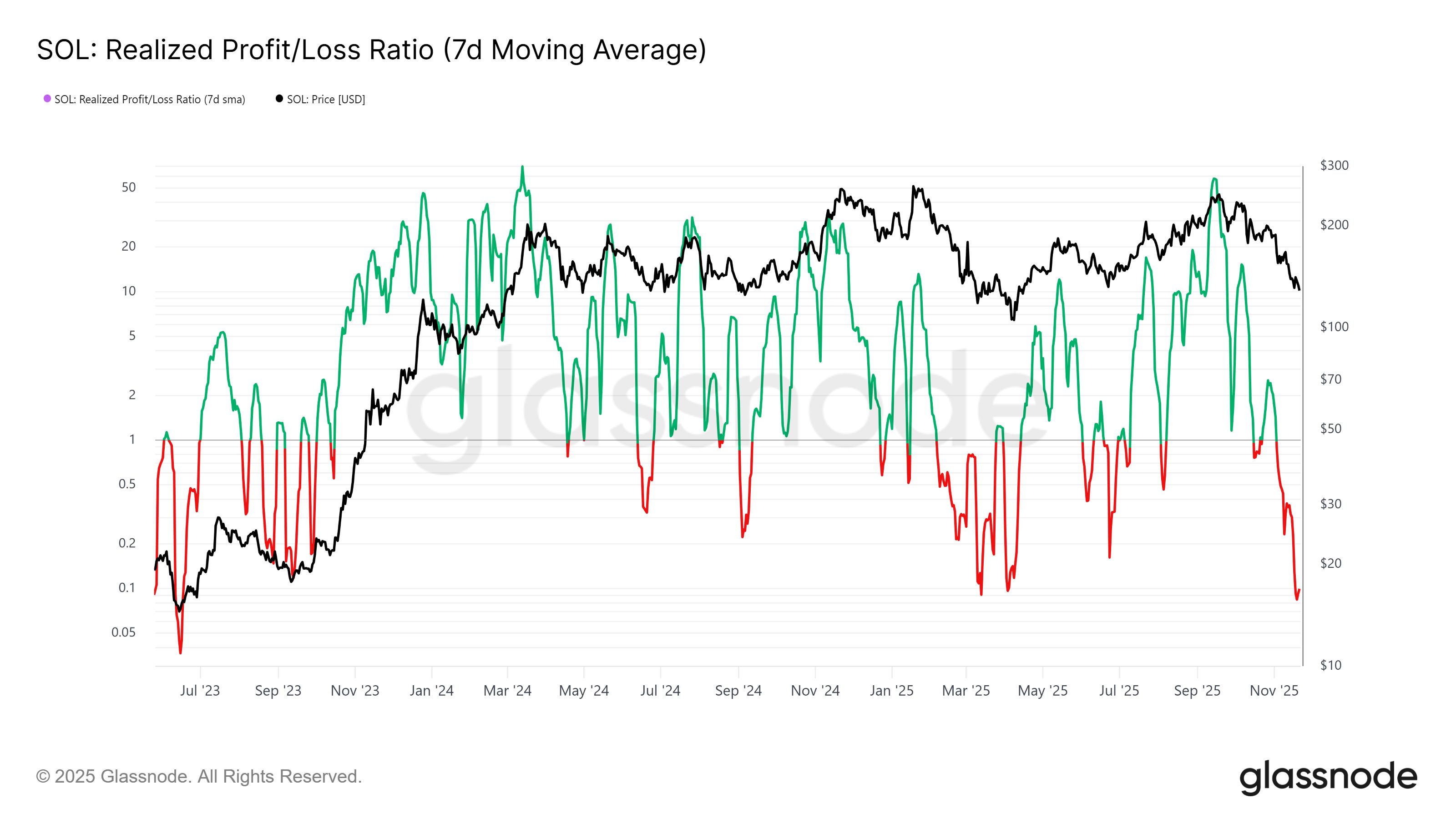

Macro momentum also appears fragile. Solana’s net realized profit/loss ratio has fallen to its lowest level since June 2023, showing that holders are facing significant realized losses following the recent decline.

This metric often reflects broader sentiment shifts as investors reassess risk during rapid market downturns.

However, there is a notable silver lining. When the net realized profit/loss ratio dips below 0.1, reversals have historically followed.

This pattern played out in March, April, and September of 2023, each time signaling the start of a recovery.

If this trend repeats, Solana could see a meaningful bounce as realized losses saturate and selling pressure stabilizes.

Solana Realized Profit/Loss. Source:

Solana Realized Profit/Loss. Source:

Macro momentum also appears fragile. Solana’s net realized profit/loss ratio has fallen to its lowest level since June 2023, showing that holders are facing significant realized losses following the recent decline.

SOL Price Is Vulnerable

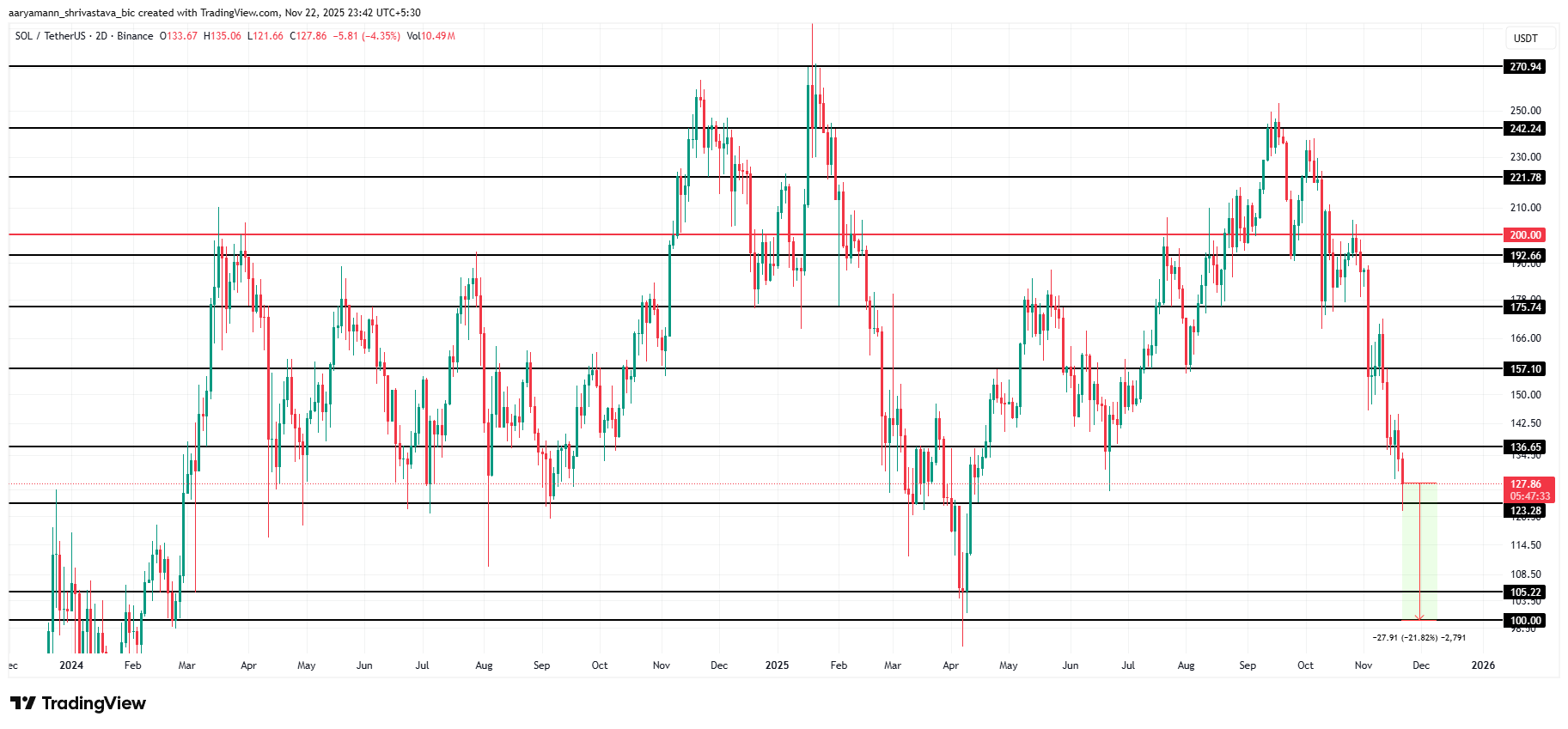

Solana trades at $127, holding just above the $123 support level. The altcoin is waiting for broader market stability and renewed investor confidence to fuel a rebound.

However, the indicators mentioned above suggest that the risks remain skewed to the downside.

If Solana moves closer to confirming a Death Cross, the price may continue falling, breaking below $123 and sliding to $105 or even $100.

Such a move would represent a 21.8% correction from current levels and revisit price zones last seen in March.

Solana Price Analysis. Source:

Solana Price Analysis. Source:

If realized losses stabilize and investor sentiment improves, Solana could bounce from $123 and attempt a climb to $136.

A break above this barrier would open the path toward $157, invalidating the bearish thesis and restoring a more bullish structure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DOGE drops by 0.22% as Government Efficiency Agency Faces Dissolution

- The Trump-era DOGE agency, dissolved 8 months early in Nov 2025, aimed to cut $2 trillion in federal spending but struggled with coordination and lacked legislative framework. - Despite Elon Musk's involvement and $335M in reported savings, DOGE's erratic operations and internal disputes led to its absorption into the Office of Personnel Management. - Legal challenges persist as former USAID staff seek transparency, while supporters argue its efficiency principles remain active despite the abrupt shutdow

LUNA Drops 0.27% as Stablecoin Market Cap Continues to Fall

- LUNA fell 0.27% in 24 hours to $0.0733, showing a 82.3% annual decline amid broader bearish trends. - Stablecoin market cap dropped to $3028.37B (-0.33% weekly), marking its largest monthly decline since 2022's LUNA collapse. - Analysts link LUNA's struggles to waning investor trust in algorithmic stablecoins and heightened regulatory scrutiny. - Market shifts favor fully collateralized stablecoins, pressuring complex mechanisms like LUNA's hybrid model.

ZEC rose by 0.18% on November 25 as a result of short-selling fluctuations and portfolio rebalancing

- ZEC rose 0.18% on Nov 25 despite a 20.61% weekly decline, surging 825.18% annually amid volatile short-position liquidations. - A top short trader lost $2.78M after 31 liquidations as BTC/SOL prices spiked, reducing their BTC short exposure by 47%. - The "Top ZEC Short" opened a $3.48M MON short at $0.032, while the largest MON long faces liquidation at $0.0248. - Market dynamics highlight ZEC's role as a short-term confidence barometer, with institutional short-covering rallies under bearish pressure.

Bitcoin Updates: Senate Deadlock Over CLARITY Act Triggers Volatility in Crypto Markets

- Bitcoin fell below $82,000, losing $1 trillion in value due to macroeconomic risks and stalled U.S. crypto regulation (CLARITY Act). - Federal Reserve's delayed rate cuts and political gridlock over CLARITY Act deepened uncertainty, eroding market confidence. - Firms introduced leveraged tools and AI staking to navigate volatility, highlighting sector resilience amid leverage risks. - Deutsche Bank warned Bitcoin's 46% Nasdaq correlation weakens its value proposition, while political crypto advocacy grow