Billionaire ‘Bond King’ Jeffrey Gundlach Says He’s Bullish on One Asset, Warns US Stocks Among Least Healthy in His Entire Career

DoubleLine Capital founder Jeffrey Gundlach says that he’s leaning towards a mostly cash position in markets due to “incredibly high” valuations in equities.

In a new interview with Bloomberg, the “bond king” says he has been very bullish on gold and “gold-like things” for the last year.

“I’ve been very, very bullish on gold. We do a podcast that gets up on our website in early January every year. It’s called Rountable Prime… And we have a bunch of thought leaders there. It’s the same group every year, and we go through – one of the segments is, what are your best ideas? My number one best idea for this year was gold, because I think gold is now a real asset class.

I think people are allocating to gold – not just the survivalists and the crazy speculators – people who are allocating real money because it’s real value, and of course, gold has been a top performing asset for the year, certainly for the last 12 months.”

For now, Gundlach says the gold trade is still on, but notes the precious metal has most likely entered a consolidation phase.

Other than a 15% position in gold and similar safe haven assets, the investor says the ideal portfolio should be heavy in cash waiting for a revaluation of the stock market.

I was at one point, I was advocating 25% of a portfolio in gold-like things. Real assets, high-quality land, gold, high-value assets. I think that’s too high right now because I think that trade as played out so very well and gold seems to have stalled out in the last month or so at a at very high levels, it’s been consolidating…

For the time being I’d probably be more at like a 15% or something like that, and the rest I think I would be in cash, because I think valuations are just incredibly high and the health of the equity market in the United States – it’s among the least healthy in my entire career..”

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hash Ribbon Flashes Signal That Often Marks Cyclical Bottoms for Bitcoin Price

Bitcoin whale opens $56.7M Bitcoin long after 18 months on the sidelines

Analyst sees dogecoin breakout forming as falling wedge hints at explosive upside

Solana News Update: Institutional Investments Boost Solana Despite Security Concerns and Negative Market Trends

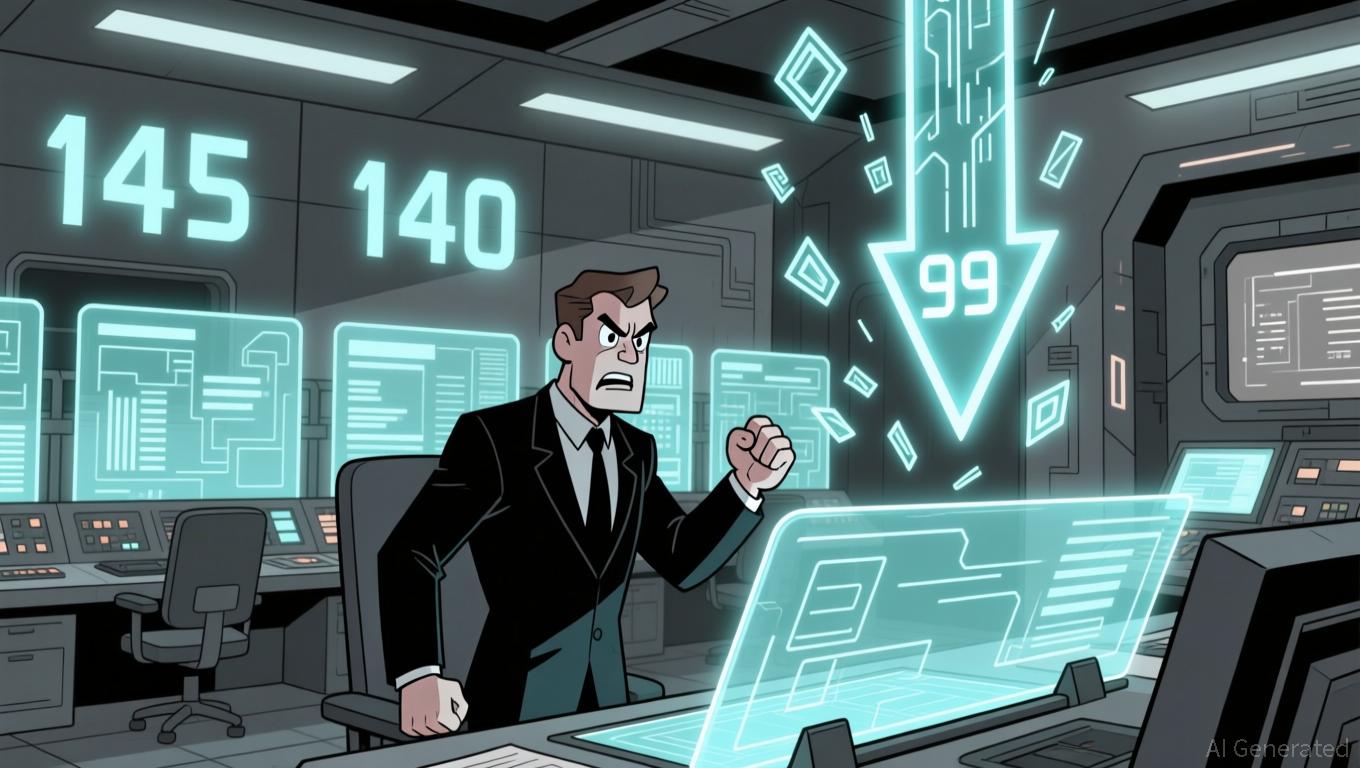

- Analysts predict Solana (SOL) will likely stay below $150 due to bear flag patterns and weak momentum, with key support at $140 potentially triggering a 30% drop to $99 if breached. - Despite technical headwinds, Solana's ETF inflows ($531M in first week) outpace Bitcoin and Ethereum , driven by 7% staking yields and lower fees compared to Bitcoin's $900M outflows. - Security risks persist after Upbit halted Solana withdrawals following a $37M hack, exposing vulnerabilities in hot wallet storage while CM