BlackRock executive: Clients invest in bitcoin mainly as "digital gold," not for global payment scenarios

According to ChainCatcher, citing a report from Cointelegraph, Robbie Mitchnick, Head of Digital Assets at BlackRock, stated that most clients of the world's largest asset management company do not consider Bitcoin's widespread use in daily payments when deciding whether to invest in it.

In a podcast interview released on Friday, Mitchnick said: "I think, for us and for most of our clients today, they are not really investing based on the global payments network use case." He described the possibility of Bitcoin being widely used for daily payments in the future as "potentially an out-of-the-money-option-value upside."

Mitchnick emphasized that this does not mean Bitcoin will never achieve widespread payment use, but he called this scenario "more speculative," and highlighted that investors are currently more focused on the narrative of Bitcoin as "digital gold" or a store of value. He believes that for a shift to payment use cases to occur, "a lot more needs to happen," including the development of technologies such as Bitcoin scaling and Lightning.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin market capitalization rebounds to surpass $1.7 trillion, rising to 8th place among global assets

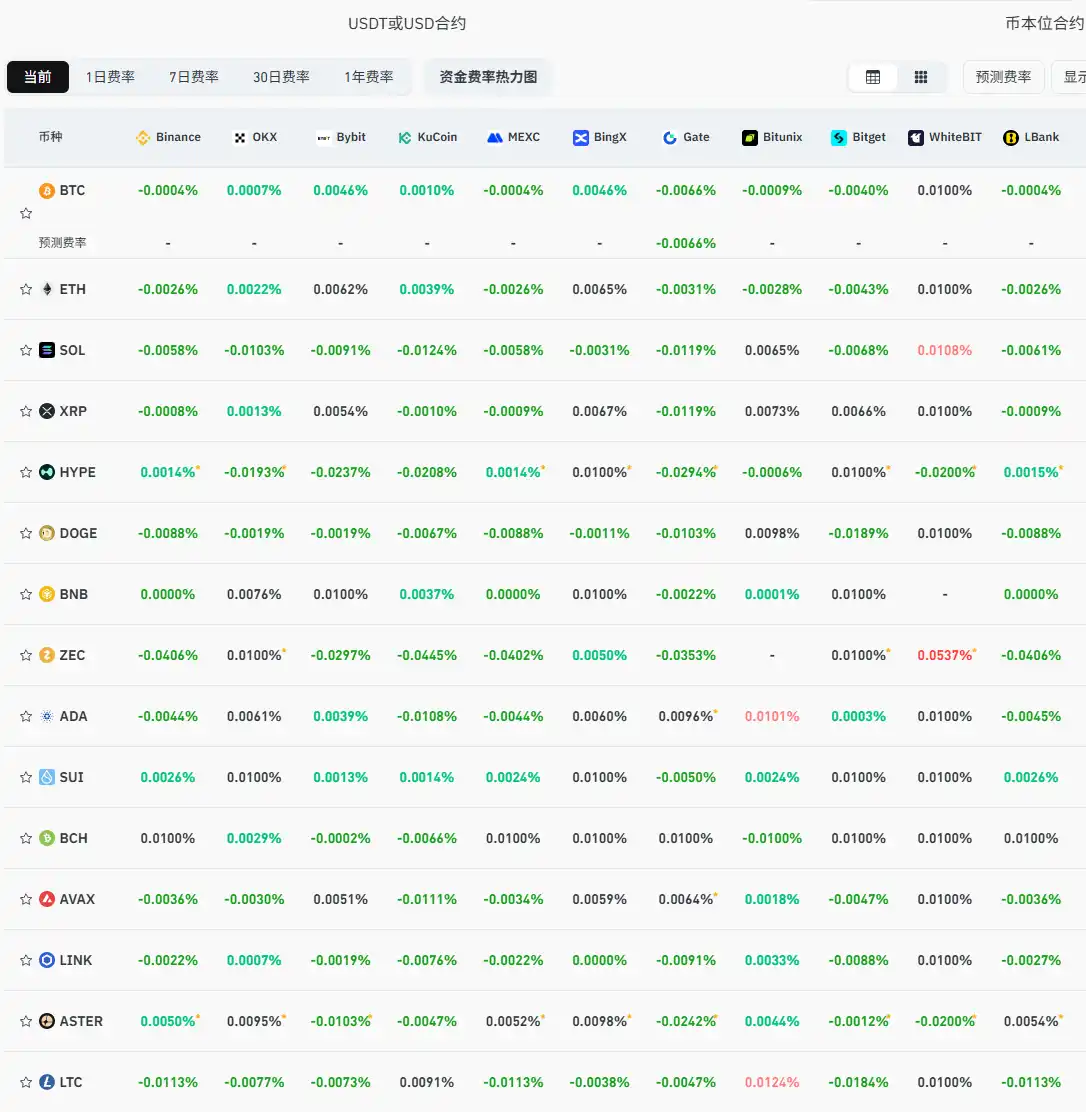

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish