Pi Coin Price Rise May Slow Down As Investors’ Bullishness Saturates

Pi Coin’s recent upward momentum has started to cool, with the altcoin facing a 5% pullback in the past 24 hours. The rise in price earlier this week has now met short-term resistance as inflows show signs of saturation. This shift suggests that the strong buying activity supporting the rally may slow in the near

Pi Coin’s recent upward momentum has started to cool, with the altcoin facing a 5% pullback in the past 24 hours. The rise in price earlier this week has now met short-term resistance as inflows show signs of saturation.

This shift suggests that the strong buying activity supporting the rally may slow in the near term.

Pi Coin Faces Slight Bearishness

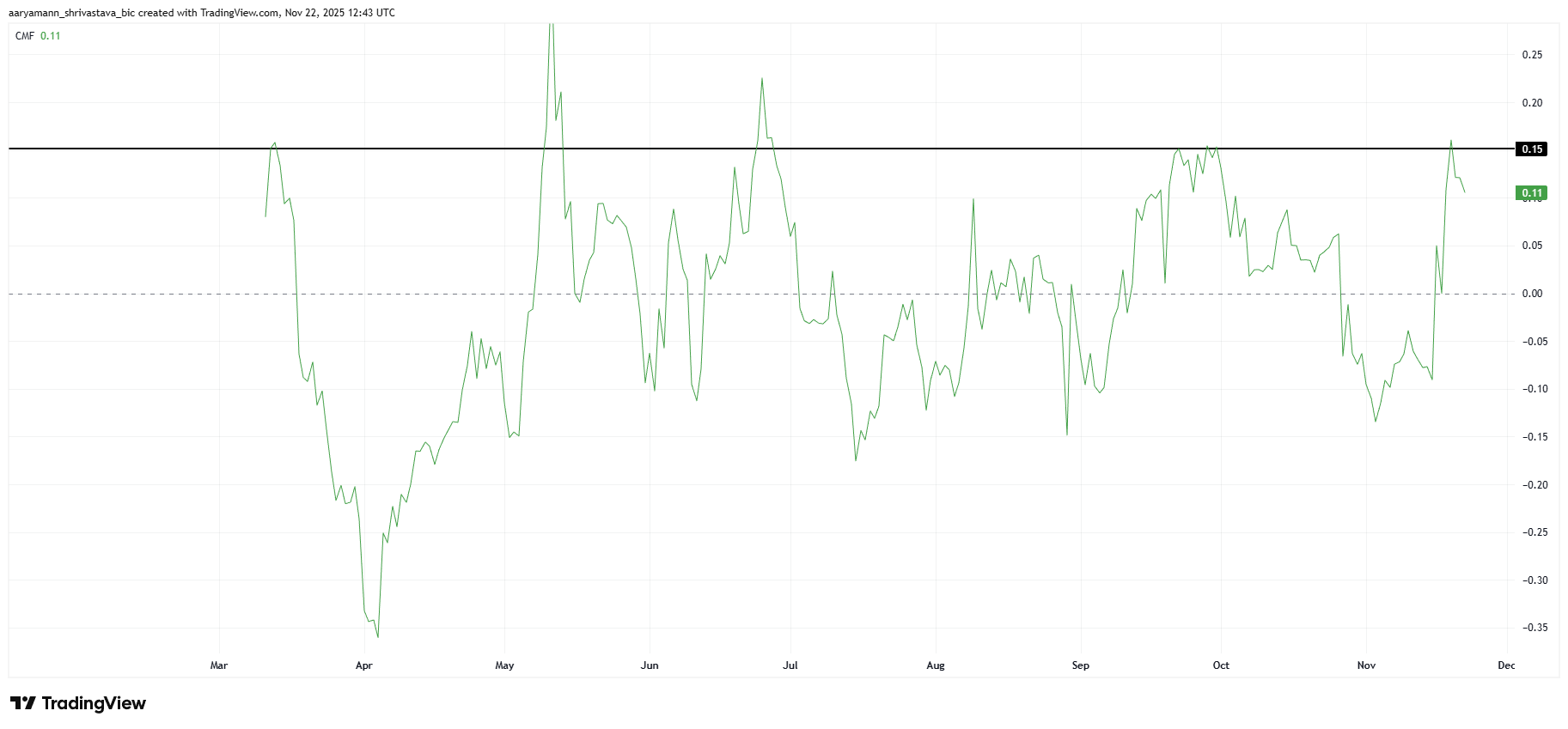

The Chaikin Money Flow is slipping after touching the 0.15 level, signaling weakening capital inflows.

CMF tracks money entering and exiting an asset, and while 0.20 is typically viewed as a saturation point, Pi Coin’s threshold appears lower. Historically, a move above 0.15 has often led to both price reversals and netflow declines.

This pattern may repeat, as Pi Coin has struggled to maintain inflows once CMF breaks above this zone.

A renewed drop in capital could pull the price lower in the coming sessions, creating short-term bearish pressure.

Want more token insights like this? Sign upa for Editor Harsh Notariya’s Daily Crypto Newsletter

Pi Coin CMF. Source:

Pi Coin CMF. Source:

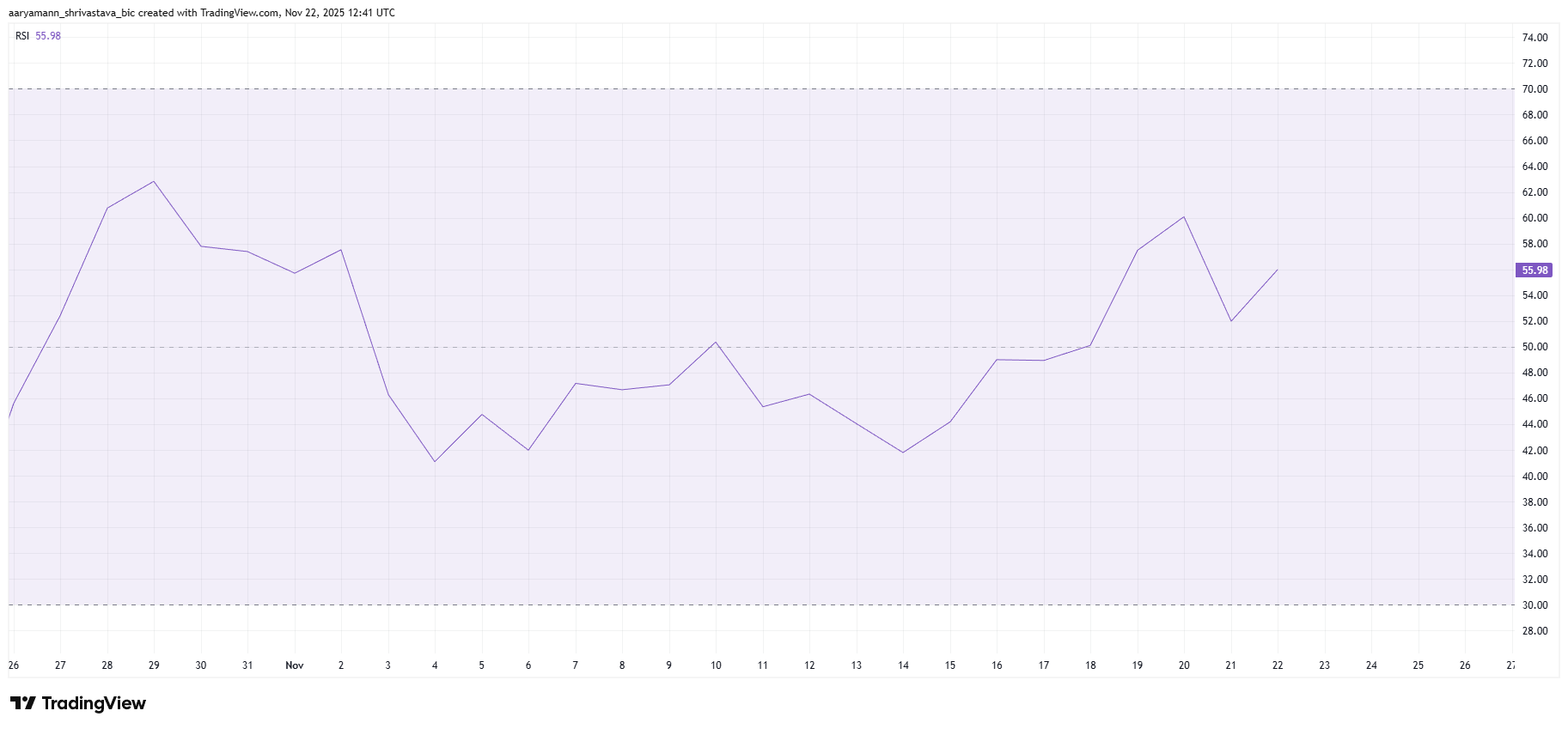

Despite the slip in sentiment, macro indicators still show pockets of strength. The Relative Strength Index remains in bullish territory above the neutral line.

This means Pi Coin is managing to sustain buying interest even as broader market sentiment trends bearish. Strong RSI readings often imply underlying resilience.

One contributing factor is Pi Coin’s negative correlation with Bitcoin.

As BTC weakens, Pi Coin has avoided following the typical market trend, allowing it to maintain upward movement independently. This divergence continues to support the asset, even with inflows softening.

Pi Coin RSI. Source:

Pi Coin RSI. Source:

PI Price Is Finding Its Footing

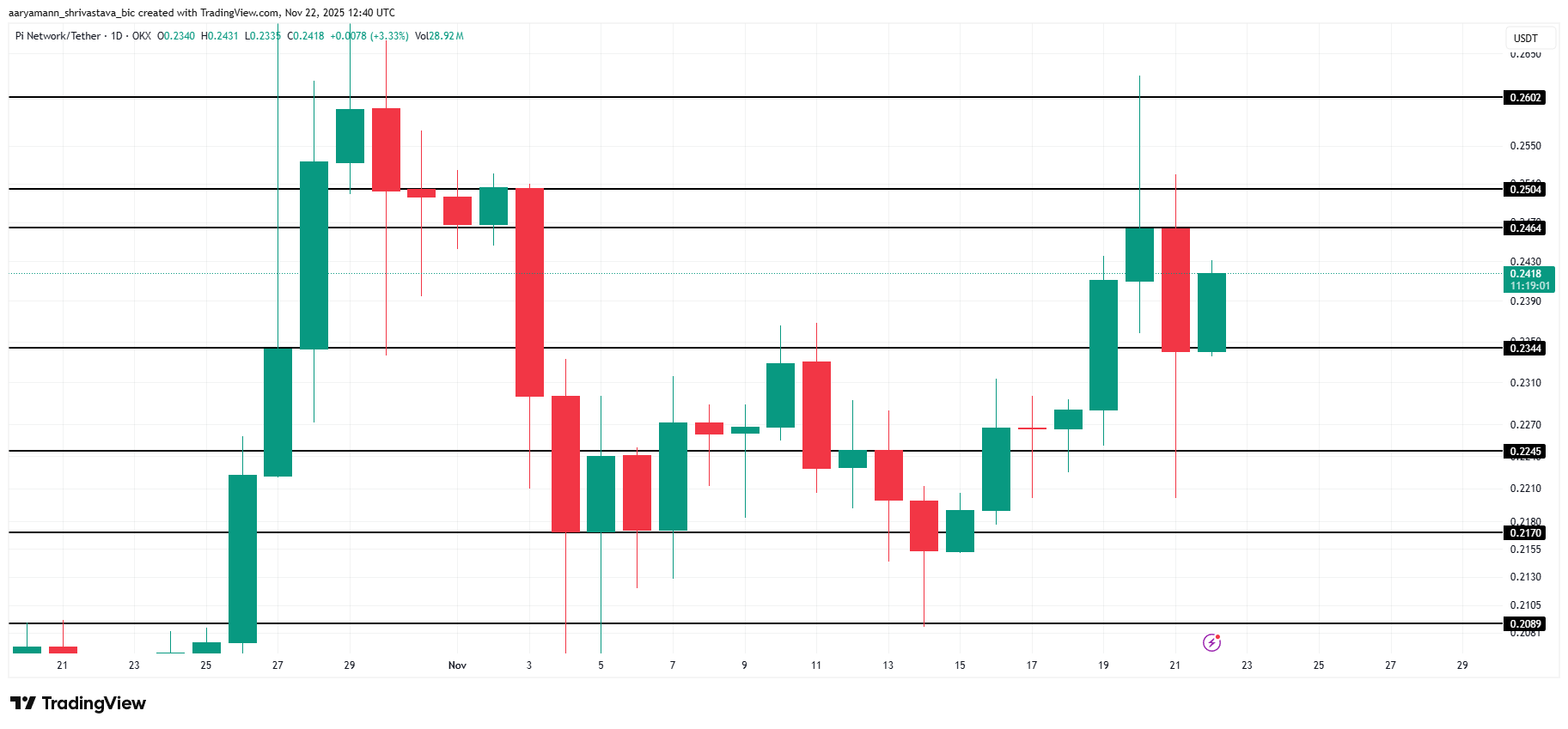

Pi Coin is trading at $0.241, sitting just below the $0.246 resistance level. The altcoin’s 5% drop yesterday reflects short-term bearish pressure. This has eased but not disappeared entirely. Price action suggests a cautious environment as traders wait for stronger signals.

If buying strength continues to fade, Pi Coin could slip below the $0.234 support or remain range-bound between $0.234 and $0.246.

Consolidation appears likely unless inflows strengthen again, which historically has taken time once CMF retreats.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

However, if capital inflows rise again, Pi Coin may break above the $0.246 resistance.

A successful move could lift the price to $0.250 and potentially to $0.260. This would invalidate the bearish outlook and restore short-term bullish momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Emerging Economies Face a Fine Line: Lowering Rates Amid Export Declines and Dollar Fluctuations

- Asia FX markets remain range-bound as traders balance expectations of December central bank rate cuts against pending U.S. economic data and divergent regional fundamentals. - Brazilian firm BR Advisory Partners (BRBI11) demonstrates resilience in high-rate environments through 13.9% dividend yield, despite 4.3% Q3 revenue decline and improved 45.8% efficiency ratio. - India's October merchandise exports fell 11.8% YoY, driven by -10.4% petroleum product and -10.2% core sector declines, raising concerns

Metaverse Technology Addresses Madagascar’s Real-Life Challenges Through Ambitious Collaboration

- AZTEQ Metaverse partners with Madagascar’s Presidency of the Reformation to deploy ARQ energy systems, metaverse platforms, and blockchain tokenization, aiming to transform infrastructure, economy, and education by 2026. - The initiative prioritizes energy and water infrastructure pilots, leveraging modular ARQ systems to modernize grids and reduce fuel imports, while creating thousands of jobs. - AZTEQ’s blockchain tokenization aims to democratize investment in agriculture and tourism, aligning with Mad

Penguintech (PENGU) Experiences Unexpected 30% Share Price Decline in November 2025: Investor Confidence, Short-Term Volatility, and Uncertainty from Regulations and Earnings

- PENGU's 30% stock price drop in late November 2025 sparks investor scrutiny amid regulatory inquiry confusion and earnings uncertainty. - Regulatory ambiguity linked to Pentagon investigations and misinterpreted PNW earnings exacerbates market volatility and liquidity risks. - Institutional sell-offs and algorithmic trading amplify downward pressure on PENGU's niche market stock. - Investors advised to avoid overexposure until regulatory outcomes and clear earnings data resolve current ambiguity.

DOGE drops by 0.22% as Government Efficiency Agency Faces Dissolution

- The Trump-era DOGE agency, dissolved 8 months early in Nov 2025, aimed to cut $2 trillion in federal spending but struggled with coordination and lacked legislative framework. - Despite Elon Musk's involvement and $335M in reported savings, DOGE's erratic operations and internal disputes led to its absorption into the Office of Personnel Management. - Legal challenges persist as former USAID staff seek transparency, while supporters argue its efficiency principles remain active despite the abrupt shutdow