Cardano News Update: ZKP’s Open Presale Approach Disrupts Traditional Blockchain Speculation

- Investors are shifting from HBAR and ADA to ZKP, a 2025-focused blockchain project with transparent presale and real-world utility. - ZKP's $120M pre-launch funding and daily on-chain auctions contrast with HBAR's 36% decline and ADA's weak DeFi traction. - The project's Proof Pods hardware and "built-first" strategy differentiate it from legacy projects with delayed upgrades. - ZKP's fair allocation model and institutional partnerships position it as a paradigm shift in crypto project launches. - Analys

Investors are quickly moving away from established blockchain platforms such as

Despite its focus on enterprise solutions, HBAR has underperformed in 2025. After reaching a high of $0.091 in March, its value dropped to $0.058 by November, even as it slowly added new corporate partners.

ZKP, on the other hand, is setting new standards. Its token distribution format—a daily on-chain

ZKP’s infrastructure is already up and running, featuring Proof Pods—physical hardware that performs privacy-focused AI tasks and earns tokens based on output. This seamless blend of hardware and software sets ZKP apart from projects like HBAR and ADA,

The project’s readiness for launch has also ignited discussions about the evolution of token sales. While traditional models often depend on speculative values and exclusive allocations, ZKP’s approach ensures that all components—Proof Pods, on-chain dashboards, and token distribution—go live simultaneously from day one.

As the crypto sector moves toward greater transparency and utility, ZKP’s strategy is gaining momentum. The project is being recognized as a game-changer in blockchain launches. For those seeking concrete progress instead of lengthy development timelines, ZKP’s model offers an appealing alternative to conventional approaches.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: BitMine's Ethereum Acquisition Echoes MicroStrategy's Bitcoin Strategy, Targets $3,600 Surge

- Ethereum fluctuates between $2,600–$3,000 as analysts monitor $2,800 support level for recovery signals. - BitMine Immersion Technologies accumulates 3% of Ethereum supply (3.63M ETH, $11.2B value), mirroring MicroStrategy's Bitcoin strategy. - Spot ETF inflows ($230.9M) and institutional demand, coupled with Apparent Demand metric hitting 26-month highs, suggest potential $3,600 rally if $2,800 support holds. - BitMine's $7.4B market cap and 51.5 current ratio highlight its unique financial position, wi

Bitcoin Updates: The Cryptocurrency’s Eco-Friendly Transformation—How Artificial Intelligence, Cloud Technology, and Renewable Energy Drive Responsible Expansion

- Crypto market shifts toward sustainability via AI, cloud, and blockchain, with Alibaba and Bybit leading green tech integration. - Bitcoin miners like CleanSpark leverage renewable energy and low-cost remote locations, while BI DeFi's $180M XRP inflows highlight institutional eco-friendly interest. - CoinShares pivots to diversified crypto ETFs amid regulatory scrutiny, mirroring industry trends toward high-margin sustainable products. - Crypto donations exceed $3M for Hong Kong fire relief, showcasing a

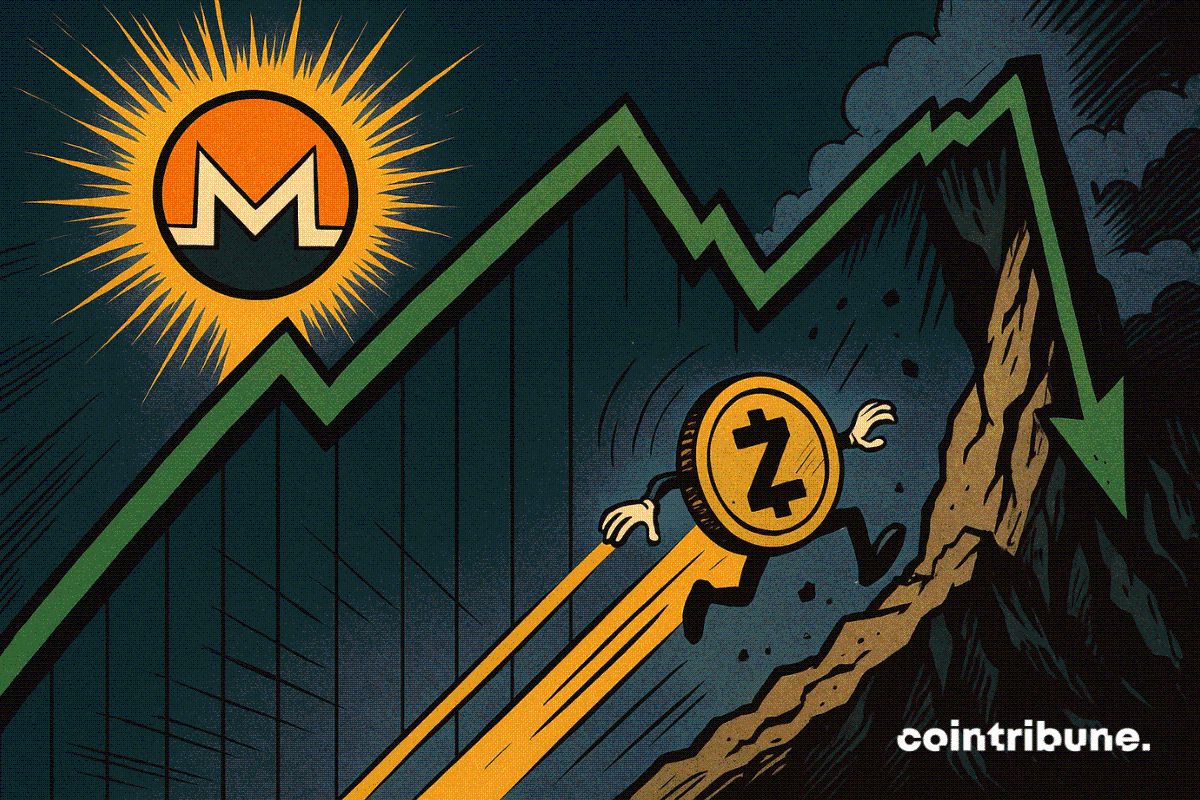

Monero Gains, Zcash Struggles In Privacy Coin Shake-up

Is Pump.fun (PUMP) Poised for a Bullish Move? This Fractal Setup Suggest So!