As Sports Wagering Surges, NCAA Strengthens Prohibition to Protect Fair Play

- NCAA reverses pro sports betting rule amid gambling scandals, maintaining a ban on collegiate athletes and staff wagering. - High-profile arrests (e.g., NBA coach Billups) and NCAA investigations into betting violations prompted the decision. - Rule rescission succeeded due to <75% support threshold, with 2/3 Division I schools opposing the change. - Major leagues like MLB and NBA also restrict prop bets, reflecting shared concerns over integrity risks in gambling-adjacent sports. - Critics argue blanket

The National Collegiate Athletic Association (NCAA) has reversed a proposed rule that would have allowed college athletes and athletic department employees to wager on professional sports, a move prompted by a recent wave of gambling scandals affecting both college and pro sports. This decision, made following a procedural vote among Division I schools, upholds the existing prohibition on gambling for anyone involved in NCAA sports, highlighting increasing worries about preserving fair competition

This action comes in the wake of several high-profile arrests and investigations that have brought negative attention to sports betting. In late October, NBA coach Chauncey Billups and Miami Heat guard Terry Rozier were among those detained in federal crackdowns on suspected gambling operations. The NCAA also recently declared six men’s basketball players ineligible for violating betting rules and confirmed that former Temple University guard Hysier Miller had placed wagers on Owls games, including bets against his own team. These incidents, along with ongoing federal investigations, led the NCAA to stop the rule change, which was originally set to begin on Nov. 1.

The NCAA’s stance is consistent with broader measures taken by professional leagues to protect the integrity of their competitions. Major League Baseball, for example,

In recent years, the NCAA has stepped up its enforcement of sports betting violations, with at least a dozen new cases currently under investigation. The organization’s actions also reflect mounting pressure from conference officials, such as Southeastern Conference Commissioner Greg Sankey, who

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Switzerland Postpones Crypto Tax Data Exchange to Meet Technological and International Requirements

- Switzerland delays crypto tax data sharing until 2027, aligning with global regulatory reevaluations amid evolving tech and market dynamics. - SGS acquires Australia's Information Quality to boost digital revenue, reflecting Swiss firms' expansion into tech-driven compliance solutions. - Canada's Alberta oil sands policy shift highlights governments prioritizing economic growth over strict climate regulations, mirroring Switzerland's approach. - BridgeBio's precision medicine and Aires' EMF solutions dem

Switzerland's Focus on Privacy Conflicts with International Efforts for Crypto Taxation

- Switzerland delays crypto tax data sharing with international partners until 2027, contrasting with global regulatory efforts to close offshore loopholes. - The U.S. advances implementation of the OECD's CARF framework, aiming to automate reporting on foreign crypto accounts by 2029. - CARF requires foreign exchanges to report U.S. account details, mirroring traditional tax standards and targeting crypto tax evasion. - Switzerland's privacy-focused stance highlights tensions between financial confidentia

Zcash News Update: Reliance Shifts Entirely to Zcash, Citing Privacy and Regulatory Alignment

- Reliance Global Group, a Nasdaq-listed fintech firm, shifted its entire crypto portfolio to Zcash (ZEC), divesting Bitcoin , Ethereum , and other major coins. - The strategic pivot, announced November 25, prioritizes Zcash's privacy-focused zk-SNARKs technology for institutional compliance and selective data disclosure. - Zcash's 1,200% 90-day price surge and Grayscale's ETF filing highlight growing institutional interest in privacy-centric assets. - The move reflects broader crypto industry trends towar

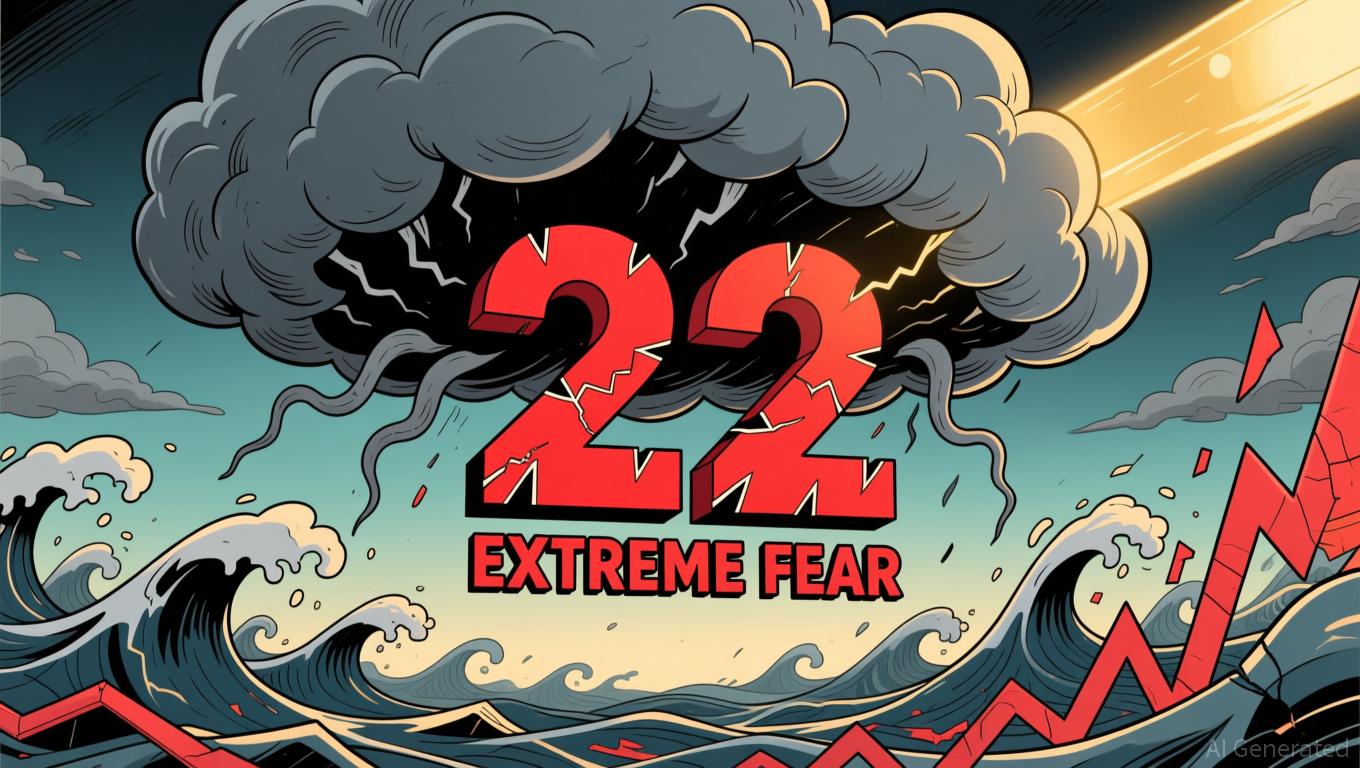

Bitcoin News Update: Bitcoin Fear Index Drops to 22 While Investors Look for Signs of Market Rebound

- Bitcoin Fear & Greed Index rose to 22 from 20, indicating slight easing of extreme fear but persistent bearish sentiment. - Bitcoin stabilized near $87,000 after hitting $80,553, yet remains below key resistance levels amid $3.5B ETF outflows. - Structural factors like leverage and liquidations drive selloffs, with ETF redemptions correlating to 3.4% price drops per $1B outflow. - Analysts note oversold technical indicators and waning retail capitulation as potential inflection points for near-term rebou