Ethereum News Today: Ethereum Faces $3,000 Test as Institutional Optimism Clashes with Bearish Forces

- Ethereum stabilizes near $3,100 Fibonacci support as RSI and Stochastic Oscillator signal potential bullish reversal after sharp correction. - Institutional buyers accumulate 3.5% of ETH supply through long-term staking, contrasting ETF outflows and creating structural demand. - Technical analysts highlight completed Elliott Wave B pattern, suggesting $3,592 resistance test if bulls defend $3,000 threshold successfully. - Risks persist below key moving averages, with breakdown to $2,850-$2,380 possible a

Ethereum’s latest price movements have reignited hope among traders, with technical signals and institutional involvement hinting at a possible bullish turnaround despite persistent market swings. Following a steep drop that sent the cryptocurrency below $3,000 earlier in the week,

This stabilization is backed by blockchain data indicating a slowdown in bearish pressure. Ethereum’s Relative Strength Index (RSI) has bounced back from oversold levels, and the Stochastic Oscillator has also recovered from extreme lows, suggesting a possible change in market sentiment

Analysts are also noting the completion of a corrective B wave in Elliott Wave analysis, a formation that has historically preceded strong upward moves. Technical experts suggest that Ethereum’s current consolidation near $3,100 may mark the conclusion of an extended bearish phase and the beginning of a new rally. “A stable B wave can provide a foundation for a bullish move,” one analyst on X commented, adding that a successful bounce could see ETH challenge the $3,592 resistance level in the near future

Nevertheless, certain risks persist. Ethereum’s price remains under important moving averages, and a drop below $3,000 could revive selling pressure, potentially driving the price down to $2,850 or even $2,380

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Balancer DAO Starts Discussing $8M Recovery Plan After $110M Exploit Cut TVL by Two-Thirds

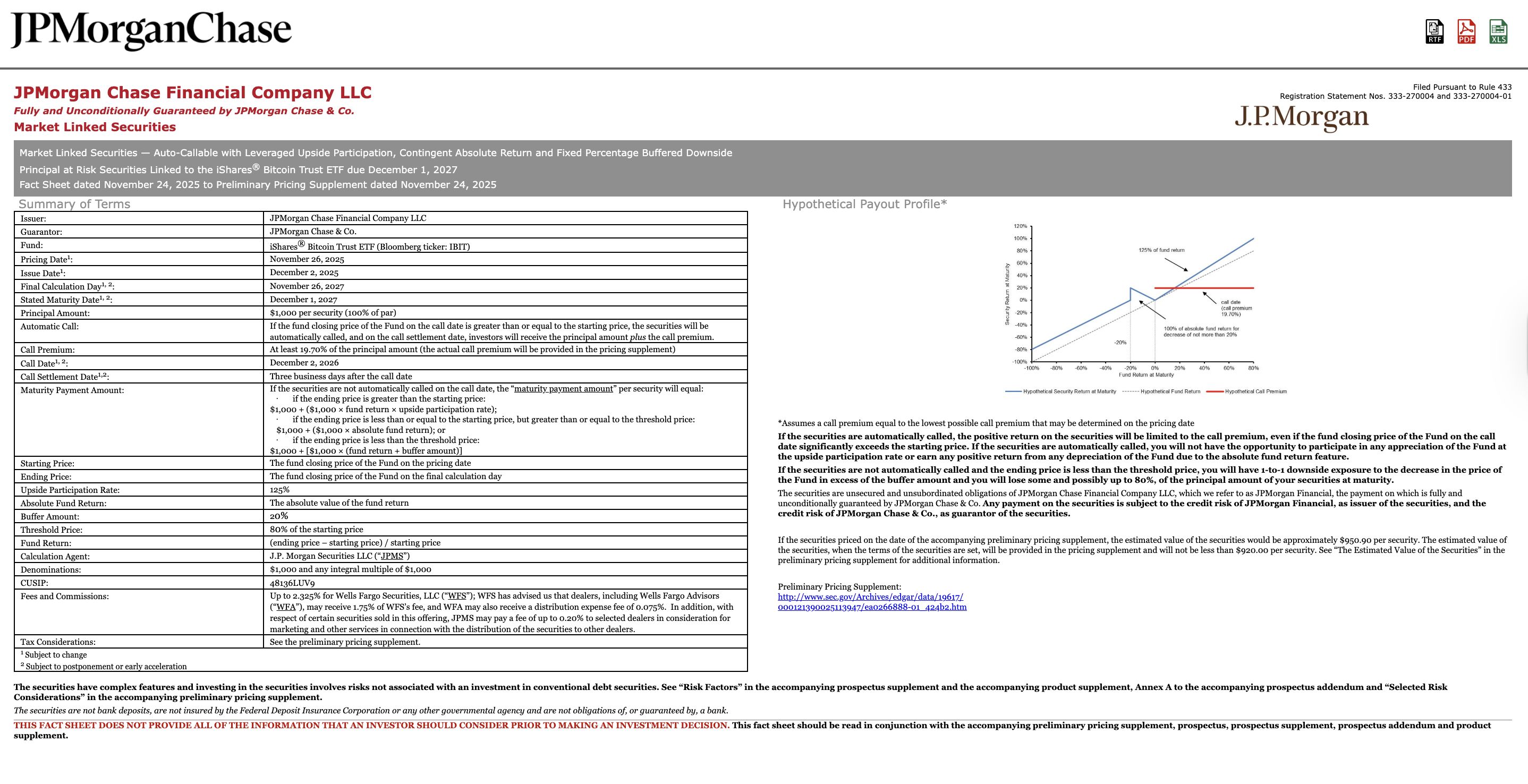

Bitcoiners accuse JPMorgan of rigging the game against Strategy, DATs

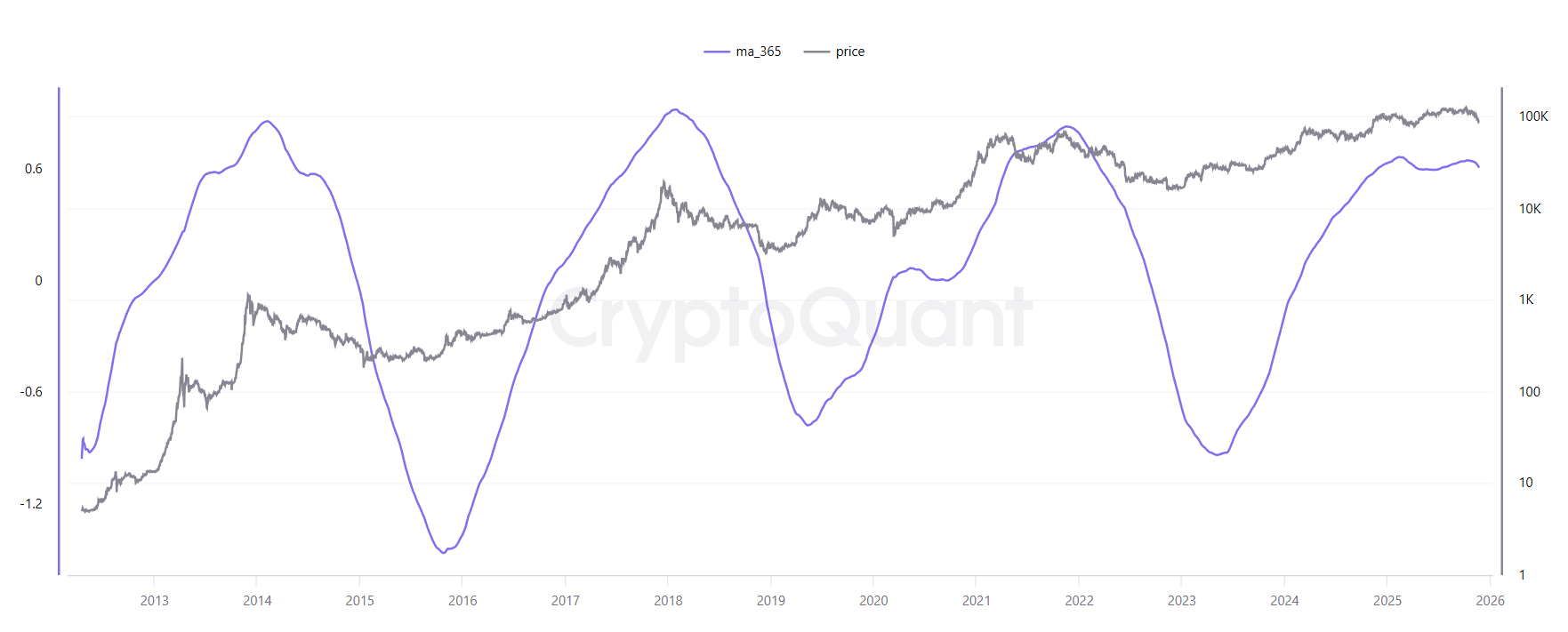

Bitcoin Downtrend Driven by Early Whale Selling, Says Ki Young Ju

Alchemy Pay Enables Fiat Purchases of Canton Coin, Opening $CC to 173 Countries