Ethereum Updates: Automated Bear Market: $2 Billion in Crypto Liquidations Reveal the Dangers of Leverage

- Cryptocurrency markets faced $2B in 24-hour liquidations, with Ethereum and Bitcoin suffering largest losses as leveraged longs dominated exits. - Macroeconomic pressures including surging Japanese yields and algorithmic trading triggered cascading sell-offs, pushing ETH below $2,900 for first time in months. - High-profile traders like "Anti-CZ Whale" and Machi lost millions as leveraged positions collapsed, exposing systemic risks in crypto's interconnected markets. - Market turmoil highlighted crypto-

The crypto market faced a turbulent 24 hours, with almost $2 billion in trader positions wiped out, and

Wider macroeconomic factors intensified the ETH downturn.

The market crash also played out alongside algorithm-driven selling.

Ethereum’s price movement highlighted the extent of the sell-off.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Balancer DAO Starts Discussing $8M Recovery Plan After $110M Exploit Cut TVL by Two-Thirds

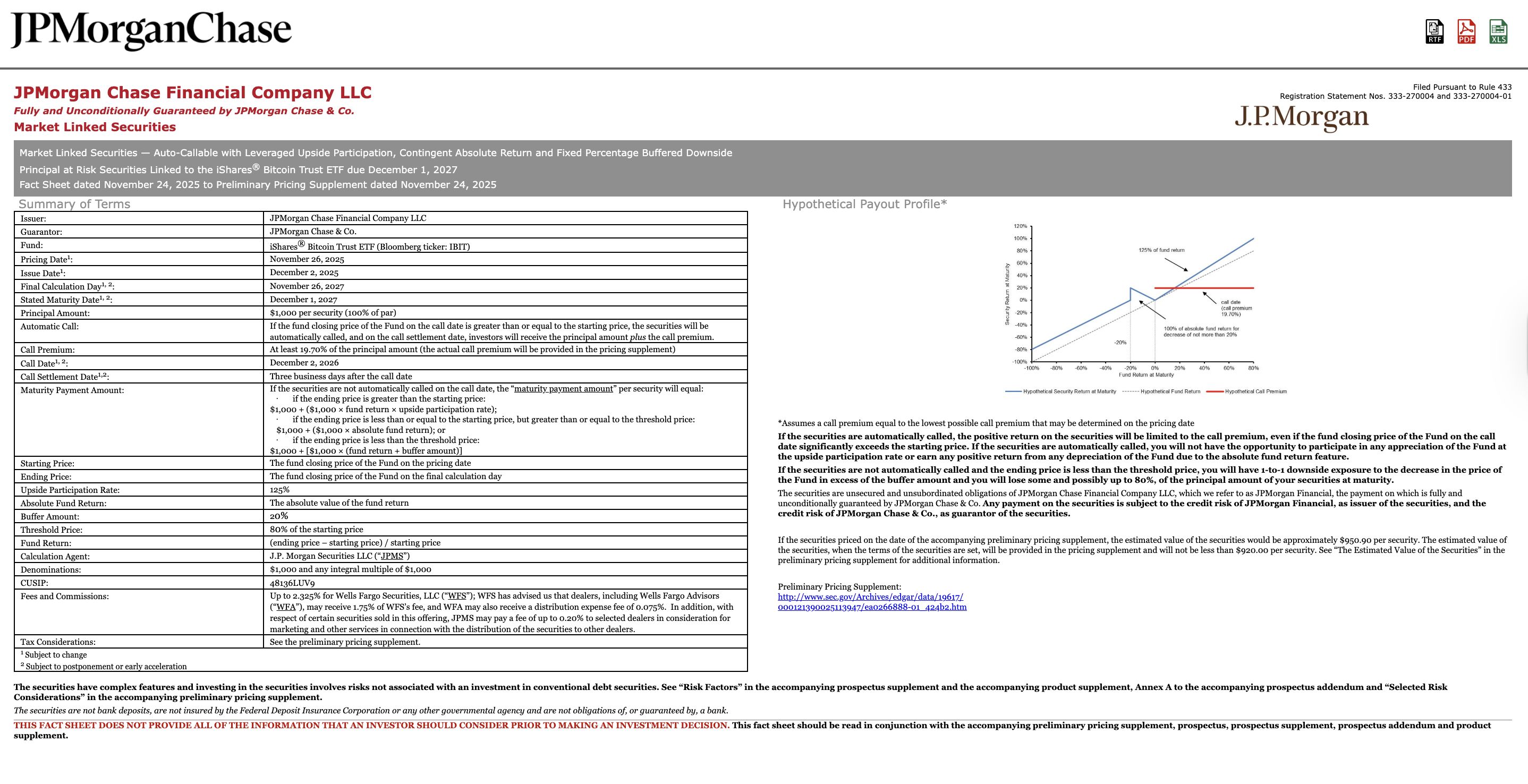

Bitcoiners accuse JPMorgan of rigging the game against Strategy, DATs

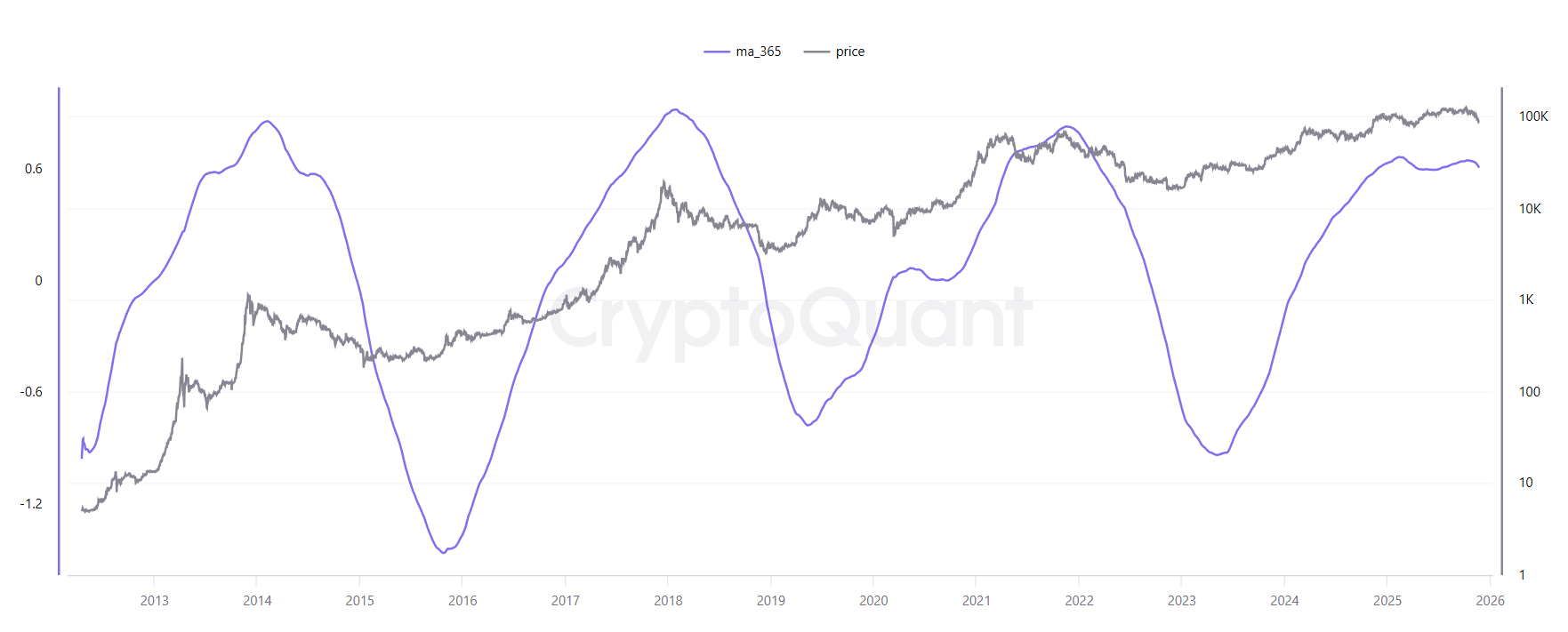

Bitcoin Downtrend Driven by Early Whale Selling, Says Ki Young Ju

Alchemy Pay Enables Fiat Purchases of Canton Coin, Opening $CC to 173 Countries