Date: Sat, Nov 22, 2025 | 10:15 AM GMT

The cryptocurrency market continues to face heavy selling pressure as both Bitcoin (BTC) and Ethereum (ETH) plunged over 23% and 29% in the past 30 days. The correction triggered a sharp selloff in major memecoins, and Pepe (PEPE) has taken a heavy hit as sentiment remains weak.

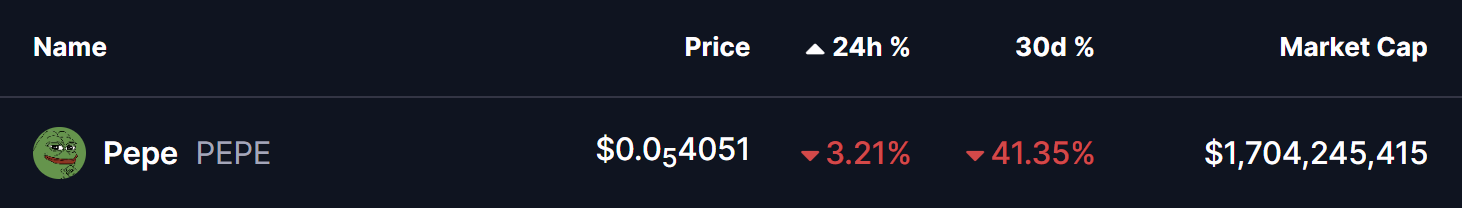

PEPE has dropped nearly 41% after confirming a significant breakdown, pushing it into a decisive support region that could determine its next major price direction.

Source: Coinmarketcap

Source: Coinmarketcap

Head and Shoulders Breakdown Signals Trend Shift

On the weekly timeframe, PEPE had been forming a classic head and shoulders pattern — widely recognized as one of the strongest bearish reversal structures. The left shoulder, head, and right shoulder formation became clear, with the peak around $0.00001632 in May marking the top of the cycle. Once the right shoulder attempt failed to break higher, momentum began fading rapidly.

The neckline of the structure was located near $0.0000059, a level that served as a multi-week base. The chart confirms that PEPE broke below this neckline with strong bearish volume, officially triggering a downside breakdown. After losing this critical area, the price slid further, reaching the key weekly support range between $0.00000389 and $0.0000042 — the zone now holding the line between stabilization and deeper capitulation.

Pepe (PEPE) Weekly Chart/Coinsprobe (Source: Tradingview)

Pepe (PEPE) Weekly Chart/Coinsprobe (Source: Tradingview)

This zone represents the final major historical support visible on the weekly chart, making it extremely significant for buyers to defend.

What Comes Next for PEPE?

The market now awaits the reaction within this support band. A temporary relief bounce is possible if buyers step in aggressively and attempt a retest move toward the breakdown zone around $0.0000059. Such a move from the current price would represent an upside of nearly 48%, potentially pausing the ongoing downtrend.

However, if the current support fails and PEPE prints a weekly close below $0.00000389, bearish continuation becomes the dominant scenario. Breaking below this level would remove structural support from the chart and could trigger a cascading selloff, deepening the decline.

For now, the retest zone and weekly candle close hold the key to PEPE’s directional clarity.