Global authorities suspend the growth of Biometric Blockchain due to worries about data privacy

- Worldcoin (WLD) fell 14% amid regulatory crackdowns, token unlocks, and market weakness, outperforming crypto's 9% decline. - Colombia, Philippines, and Thailand ordered operations halted and biometric data deleted over privacy concerns. - 37M WLD tokens ($25M) unlocked recently, worsening sell pressure as price consolidates near $0.63 resistance. - Analysts predict $0.75–$0.85 by 2025 if regulations clarify, but warn of potential drops to $0.26 amid unresolved compliance risks. - Project's viability hin

Worldcoin (WLD) experienced a steep 14% drop in a single day as global regulatory pressures mounted, token unlocks increased, and the broader market weakened, dealing a notable blow to the biometric-identity blockchain initiative. This rapid decline, which surpassed the overall crypto market’s 9% fall, came after a series of regulatory measures targeting the project’s data handling and business model. Authorities in Colombia, the Philippines, and Thailand all issued cease-and-desist orders,

These regulatory interventions have added to existing structural challenges. In recent weeks, more than 37 million

Forecasts for WLD’s price are varied, reflecting the clash between short-term negative factors and the potential for future growth.

The project’s future will depend on how well it can address regulatory concerns and prove real-world value for its token. For now, investors should keep an eye on token unlock timelines, regulatory updates, and on-chain adoption as key indicators. As one expert put it, “Worldcoin’s future depends less on speculation and more on its ability to scale compliant onboarding and turn verified users into real economic activity.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Switzerland Postpones Crypto Tax Data Exchange to Meet Technological and International Requirements

- Switzerland delays crypto tax data sharing until 2027, aligning with global regulatory reevaluations amid evolving tech and market dynamics. - SGS acquires Australia's Information Quality to boost digital revenue, reflecting Swiss firms' expansion into tech-driven compliance solutions. - Canada's Alberta oil sands policy shift highlights governments prioritizing economic growth over strict climate regulations, mirroring Switzerland's approach. - BridgeBio's precision medicine and Aires' EMF solutions dem

Switzerland's Focus on Privacy Conflicts with International Efforts for Crypto Taxation

- Switzerland delays crypto tax data sharing with international partners until 2027, contrasting with global regulatory efforts to close offshore loopholes. - The U.S. advances implementation of the OECD's CARF framework, aiming to automate reporting on foreign crypto accounts by 2029. - CARF requires foreign exchanges to report U.S. account details, mirroring traditional tax standards and targeting crypto tax evasion. - Switzerland's privacy-focused stance highlights tensions between financial confidentia

Zcash News Update: Reliance Shifts Entirely to Zcash, Citing Privacy and Regulatory Alignment

- Reliance Global Group, a Nasdaq-listed fintech firm, shifted its entire crypto portfolio to Zcash (ZEC), divesting Bitcoin , Ethereum , and other major coins. - The strategic pivot, announced November 25, prioritizes Zcash's privacy-focused zk-SNARKs technology for institutional compliance and selective data disclosure. - Zcash's 1,200% 90-day price surge and Grayscale's ETF filing highlight growing institutional interest in privacy-centric assets. - The move reflects broader crypto industry trends towar

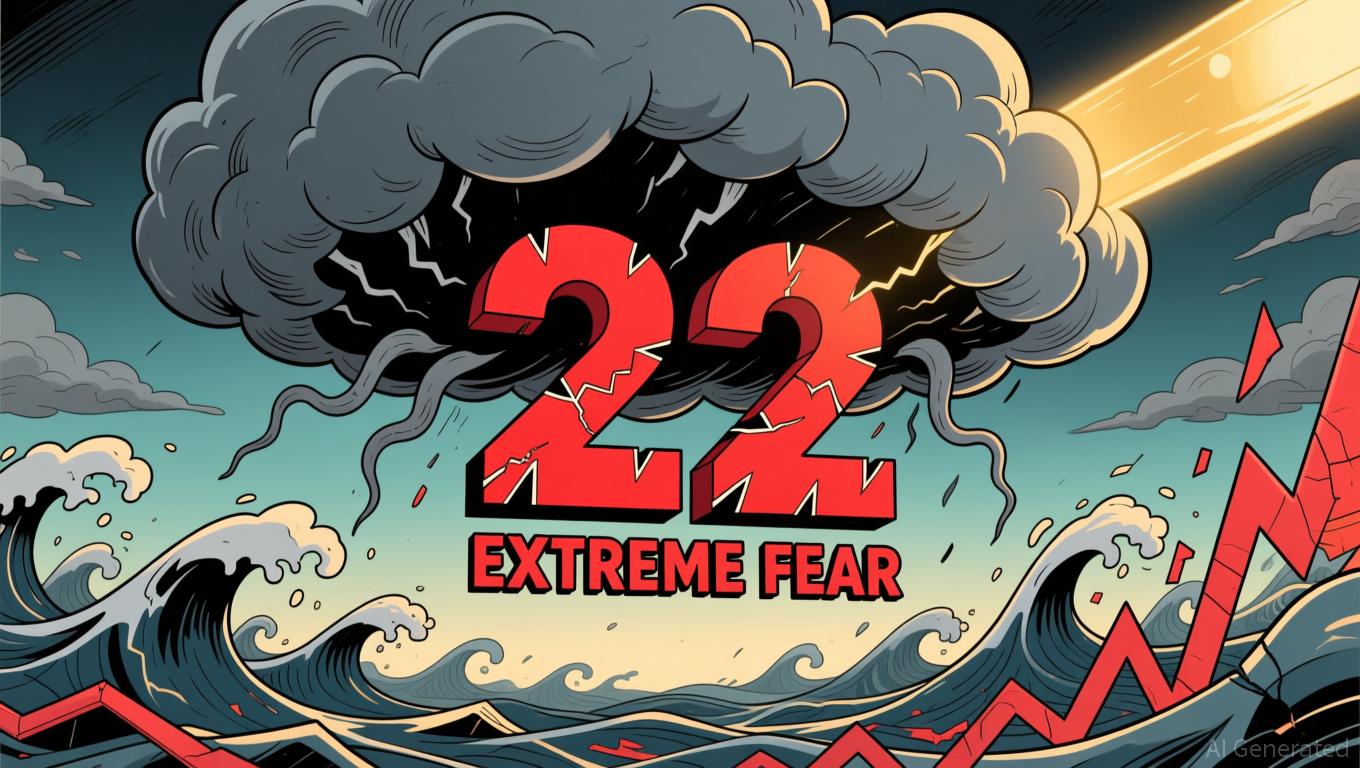

Bitcoin News Update: Bitcoin Fear Index Drops to 22 While Investors Look for Signs of Market Rebound

- Bitcoin Fear & Greed Index rose to 22 from 20, indicating slight easing of extreme fear but persistent bearish sentiment. - Bitcoin stabilized near $87,000 after hitting $80,553, yet remains below key resistance levels amid $3.5B ETF outflows. - Structural factors like leverage and liquidations drive selloffs, with ETF redemptions correlating to 3.4% price drops per $1B outflow. - Analysts note oversold technical indicators and waning retail capitulation as potential inflection points for near-term rebou