Adherence to regulations and rapid transaction speeds are driving the widespread adoption of cryptocurrency in mainstream business.

- OwlTing Group's "Invisible Rails" strategy enables rapid deployment of compliant crypto gateways via global licensing across Asia and Latin America. - Opera's MiniPay expands Latin American reach by integrating USD₮ stablecoins with local payment systems like PIX and Mercado Pago. - Grayscale rebrands XRP Trust as GXRP ETF, reflecting growing institutional demand for regulated crypto exposure in global markets. - Industry analysis highlights blockchain's convergence with AI data infrastructure, emphasizi

OxaPay White-Label: Launch Your Own Crypto Gateway in Under 24 Hours

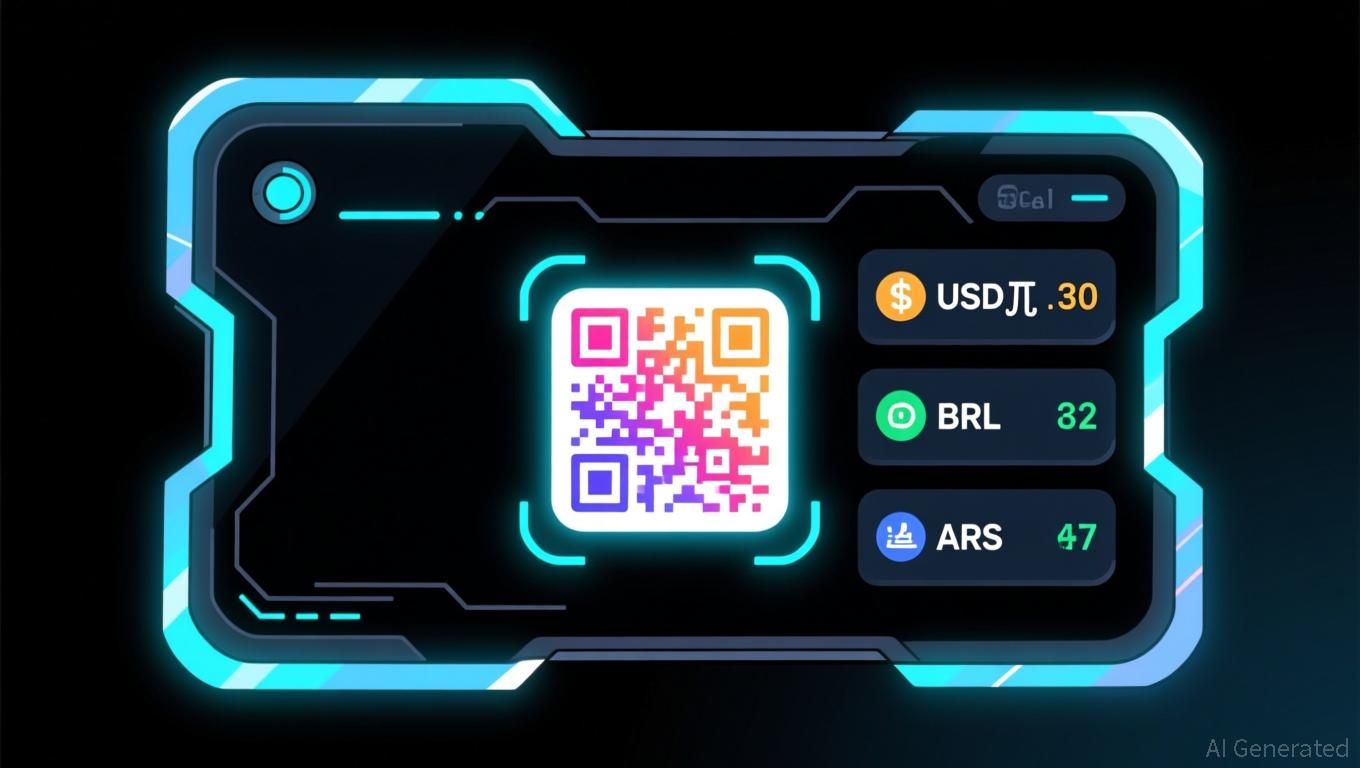

The adoption of custom-branded cryptocurrency gateways is gaining momentum as businesses implement compliant and scalable platforms to connect digital currencies with everyday transactions. A standout example is OwlTing Group's (NASDAQ: OWLS) "Invisible Rails" initiative, which

This surge mirrors larger trends in the $209 billion web data infrastructure sector, where companies including Bright Data and Oxylabs are

Darren Wang of OwlTing remarked that "success in this industry will belong to those who excel at navigating regulations, not those who ignore them," a view shared by MiniPay’s Murray Spark, who

As the industry progresses, the relationship between AI-driven data demands, stablecoin integration, and regulatory oversight will shape how crypto becomes part of the global economic landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ARK Supports Nvidia's Dominance in AI Despite Concerns of a Market Bubble

- ARK Invest re-allocates $17M to Nvidia , betting on AI-driven growth amid crypto-linked equity purchases during a market slump. - Nvidia reports $57B revenue, exceeding forecasts by $2.1B, with $500B Blackwell/Rubin order backlog and 73.6% gross margin. - $15B Nvidia-Microsoft Anthropic deal intensifies generative AI competition, while analysts raise $250-$272 price targets for AI infrastructure leadership. - Market anxieties persist over AI sustainability: 61% Q3 revenue from four clients, AI "bubble" f

Treasury Targets Crypto: Sanctions Reveal Worldwide Network of Illegal Finance

- U.S. Treasury sanctions Canadian Olympian Ryan Wedding for leading a global drug network, designating 9 individuals/entities and cryptocurrency addresses linked to Bitcoin/Ethereum. - Actions target cross-border illicit finance, including Indian firms aiding Iran's oil trade and UK crypto networks laundering funds for Russian oligarchs/military suppliers. - Crackdown aligns with national security priorities, blocking crypto mining near nuclear sites and blacklisting Chinese AI firms tied to Huawei, while

PENGU Price Forecast: Managing Immediate Market Fluctuations and Key Drivers in the Altcoin Landscape After 2025

- Pudgy Penguins (PENGU) faced 2025 price volatility, surging 450% in July but dropping 28.5% by October, with critical support at $0.023. - Cboe's PENGU ETF filing could attract institutional capital if approved, while rejection risks exacerbating market instability. - Pudgy Party game and DreamWorks partnership aim to boost utility and brand visibility, though token value remains unproven. - Regulatory pressures (GENIUS Act, MiCA) and macroeconomic factors compound risks, urging hedging via stop-loss ord

Bitcoin Updates: Ark Invest Increases Crypto Portfolio by $39.6M During Market Downturn, Shows Confidence in Future Growth

- U.S. crypto stocks fell 1.45%-4.48% pre-market on Nov 21, mirroring Bitcoin's $91,600 drop and $3.79B ETF outflows. - Ark Invest defied the selloff by adding $39.6M to Bullish, Circle , and Bitmine shares, betting on long-term crypto value. - MicroStrategy's $1.5B Bitcoin accumulation contrasts with its 60% stock decline amid dilution concerns and leveraged liquidations. - Bitmine defends crypto's 12-36 month recovery timeline, citing Ethereum upgrades and asset tokenization potential. - AI/HPC miners su