Crypto and Tech Stocks Surge as Nvidia Shatters Earnings Expectations, Boosting Market Confidence

Quick Breakdown:

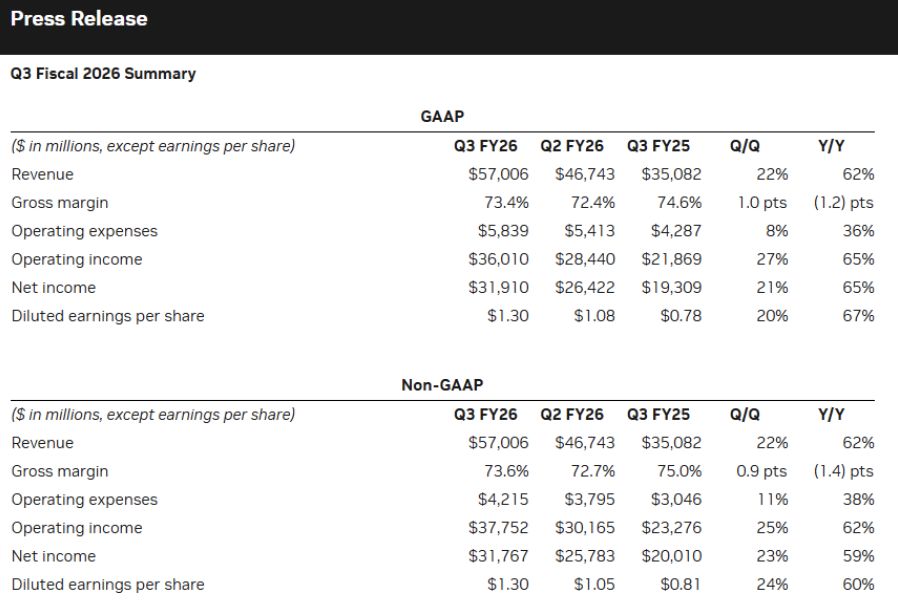

- Nvidia shattered third-quarter expectations with $57 billion in revenue, fueling market confidence and easing fears of an AI bubble.

- The strong earnings triggered a broad market rally, with Bitcoin rebounding to $91,500 and major tech stocks like Apple, Microsoft, and Meta also posting gains.

- Despite a China sales roadblock due to export controls, Nvidia’s dominance is attracting new domestic customers, such as Bitcoin miner IREN, which is pivoting to AI infrastructure and becoming a large-scale buyer of Nvidia’s GPU hardware.

Nvidia’s record earnings seal market confidence and spur crypto gains

Nvidia’s third-quarter results have become a catalyst for renewed optimism across crypto and tech markets. With revenue hitting an all-time high of $57 billion, well above Wall Street’s $54.7 billion projection, investors see robust demand for artificial intelligence (AI) technologies. This surge has alleviated recent fears of an impending AI bubble, signalling strong market health and continued industry growth.

Source

: Nvidia

Source

: Nvidia

Nvidia’s profit of $31.9 billion, representing a 65% increase from last year, underscores the company’s dominance in the AI chip market. Furthermore, its optimistic forecast of $65 billion in revenue for the upcoming quarter reinforces confidence in AI’s sustained expansion. The positive earnings report was a key factor behind the immediate rally of tech and crypto stocks, with Nvidia’s shares jumping over 5% in after-hours trading.

Broader market impact: crypto assets and major tech companies rise

The earnings report has triggered a broader market rally. Bitcoin, which had recently dipped below $89,000 amid a global market rout, rebounded to approximately $91,500, buoyed by Nvidia’s strong results and growing sector optimism. Despite a weekly decline of over 10%, Bitcoin’s recovery highlights renewed investor interest and confidence in crypto’s resilience. Similarly, Ethereum has climbed back above $3,000 after falling to $2,873 earlier in the week.

Major tech giants like Apple, Microsoft, Alphabet, Amazon, and Meta also experienced gains following Nvidia’s earnings, reflecting increased risk appetite among investors. The rally in both traditional tech and crypto sectors signals a potential shift toward more bullish sentiment amid improving fundamentals and optimistic outlooks for AI-driven growth.

Nvidia posted massive earnings, confirming its AI chip dominance, yet faces a substantial sales roadblock in the critical China market due to U.S. export controls. Concurrently, Bitcoin miner IREN, after achieving record revenue, is pivoting aggressively to AI infrastructure by becoming a “Preferred Partner” of Nvidia and planning a $200 million investment to expand its GPU fleet. This convergence suggests a key dynamic: the crypto mining industry is transforming into a large, new domestic customer for Nvidia’s AI hardware, offering a strong, diversified revenue stream to offset geopolitical risks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve Hawks Speak Out, Asset Price Crash Risk May Become New Obstacle to Rate Cuts

JPMorgan warns that if Strategy is removed from MSCI, it could trigger billions of dollars in outflows. The adjustment in the crypto market is mainly driven by retail investors selling ETFs. Federal Reserve officials remain cautious about rate cuts. The President of Argentina has been accused of being involved in a cryptocurrency scam. U.S. stocks and the cryptocurrency market have both declined simultaneously. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Citibank and SWIFT complete pilot program for fiat-to-crypto PvP settlement.

Pantera Partner: In the Era of Privacy Revival, These Technologies Are Changing the Game

A new reality is taking shape: privacy protection is the key to driving blockchain toward mainstream adoption, and the demand for privacy is accelerating at cultural, institutional, and technological levels.

Exclusive Interview with Bitget CMO Ignacio: Good Code Eliminates Friction, Good Branding Eliminates Doubt

A software engineer's brand philosophy.