BREAKING NEWS: Critical US Nonfarm Payrolls and Unemployment Data Released, Delayed Due to Government Shutdown! Here's Bitcoin's (BTC) Initial Reacti

The longer-than-expected US federal government shutdown has led to the cancellation of the October employment report, a key indicator for interest rate decisions. It was also announced that the November employment report, previously scheduled for December 5th, will now be released on December 16th.

The Bureau of Labor Statistics (BLS), part of the U.S. Department of Labor, announced that it would not release October employment data for the first time in its history, increasing uncertainty in market forecasts for investors.

This has lowered the market's estimate of a December interest rate cut to around 30% from 100% a month ago.

According to CME FedWatch, the probability of a December rate cut has fallen to 31.8%, while the probability of leaving rates unchanged is priced in at 68.2%.

While October employment data was not released, the September employment report was published today.

The data, normally released on the first Friday of each month, was postponed until today due to the government shutdown.

The data released for September is as follows:

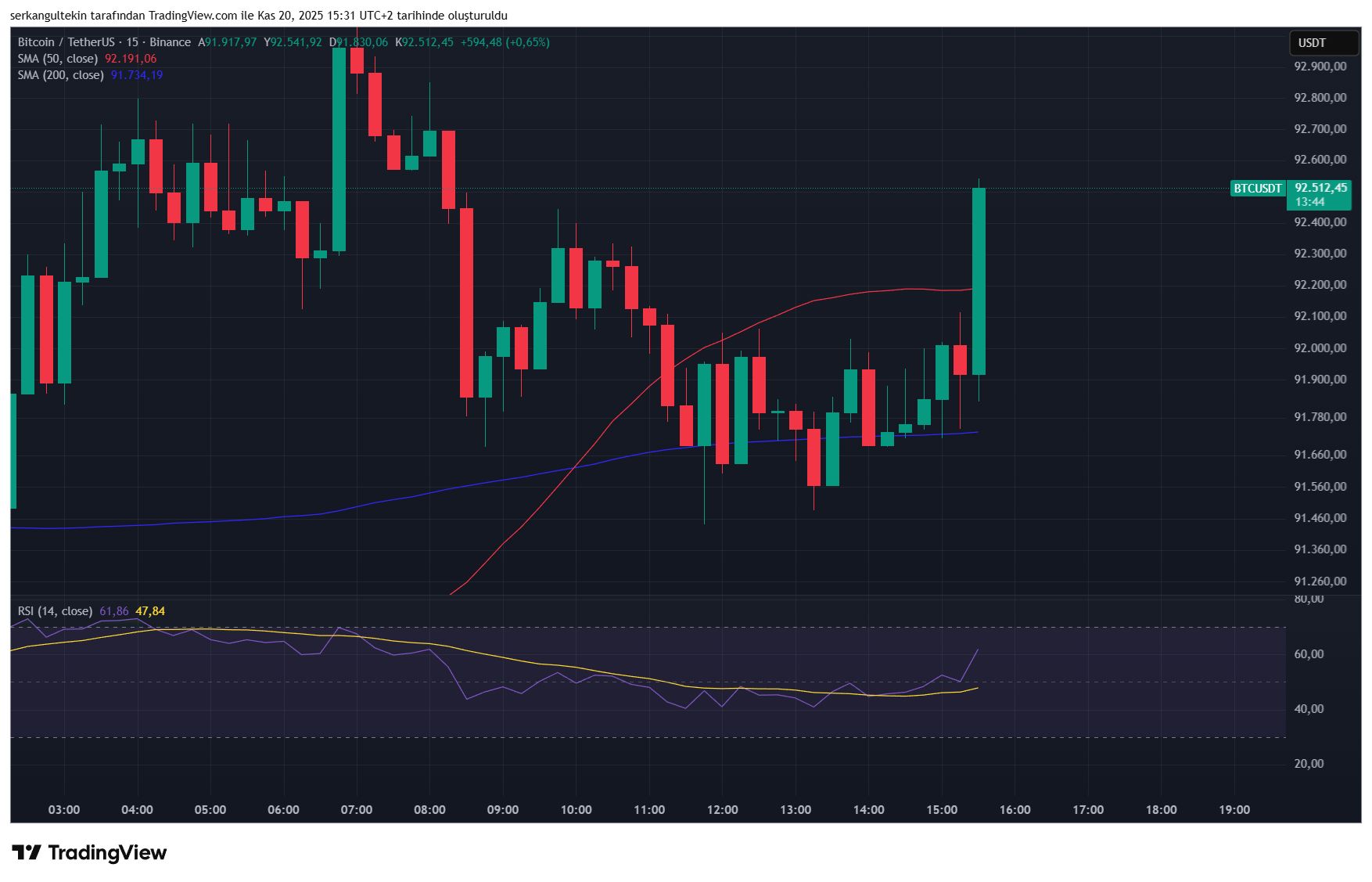

Nonfarm Payrolls Data: 119k Announced vs. 53k Expected vs. 22k Previous

Unemployment data: Announced 4.4% – Expected 4.3% – Previous 4.3%

Bitcoin's reaction after the incoming data was as follows:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Bitcoin's Sharp Drop Ignites Debate—Is This a Bear Market or a Fundamental Change?

- Bitcoin fell below $90,000, sparking debates over a prolonged bear market or rebound potential amid critical support levels. - ETF outflows ($492M in Bitcoin ETFs) and a $19B October deleveraging event highlight waning investor confidence and systemic selling pressure. - Technical indicators (RSI at 28, Fear & Greed Index at 15) and backwardation in futures signal extreme fear but potential oversold conditions. - Analysts split between structural maturity (Frontier Investments) and long-term bearish tren

Standard Chartered Confirms Bitcoin Bottom And Expects A Strong December Rally

BlackRock Bitcoin Purchase of $62.23M Signals Crypto Confidence

Aifinyo AG Steps Up Its Bitcoin Exposure With Another Strategic Buy