AI’s $219 Billion Energy Sector Boom Fueled by Automation That Reduces Workforce

- AI-driven automation in energy management is displacing workers as the $219.3B market grows via predictive analytics and smart grid integration. - SoundHound AI accelerates agentic AI expansion with $269M cash reserves while C3.ai faces $116.8M losses and leadership instability. - Regulators struggle to balance AI's efficiency gains with labor displacement risks as blockchain and compliance tools adopt AI solutions. - The PwC developer's layoff exemplifies how AI's cost-cutting potential outpaces its abi

The story of a 26-year-old AI engineer who lost his job at PwC in 2025 highlights a significant transformation in the technology industry, where the very innovations meant to boost efficiency are now being used to reduce expenses. His involvement in developing AI agents to optimize workflows has helped create an environment where automation is increasingly replacing human roles. This contradiction brings to light a central dilemma in the AI era: the technologies that drive productivity are also fundamentally altering job markets, especially in sectors such as energy management and enterprise software.

The worldwide Energy Management Systems (EMS) industry,

Regulators are also racing to keep up with the swift integration of AI. In the energy industry,

The experience of the PwC developer reflects a wider pattern in the industry: AI’s ability to lower costs is outstripping its potential to generate new jobs. Although the markets for energy management and enterprise AI are set for significant growth, the social impact of these changes remains a pressing concern. As companies like SoundHound and C3.ai compete for leadership, workers must adjust to a landscape where automation is on the rise and regulations struggle to keep pace with innovation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Naver's Cryptocurrency Merger Approaches Completion Despite Regulatory Hurdles and Valuation Issues

- Naver Financial acquires Dunamu via equity swap, making Upbit a wholly owned subsidiary to expand digital finance and crypto markets. - Dunamu's chairman becomes largest shareholder (28%), while Naver's stake dilutes to 17%, raising valuation and governance concerns. - Regulatory scrutiny focuses on antitrust risks as Upbit holds 50.6% market share, amid intensified competition from Bithumb and U.S. crypto firms. - Naver plans a won-backed stablecoin integrated into Naver Pay and explores Saudi partnersh

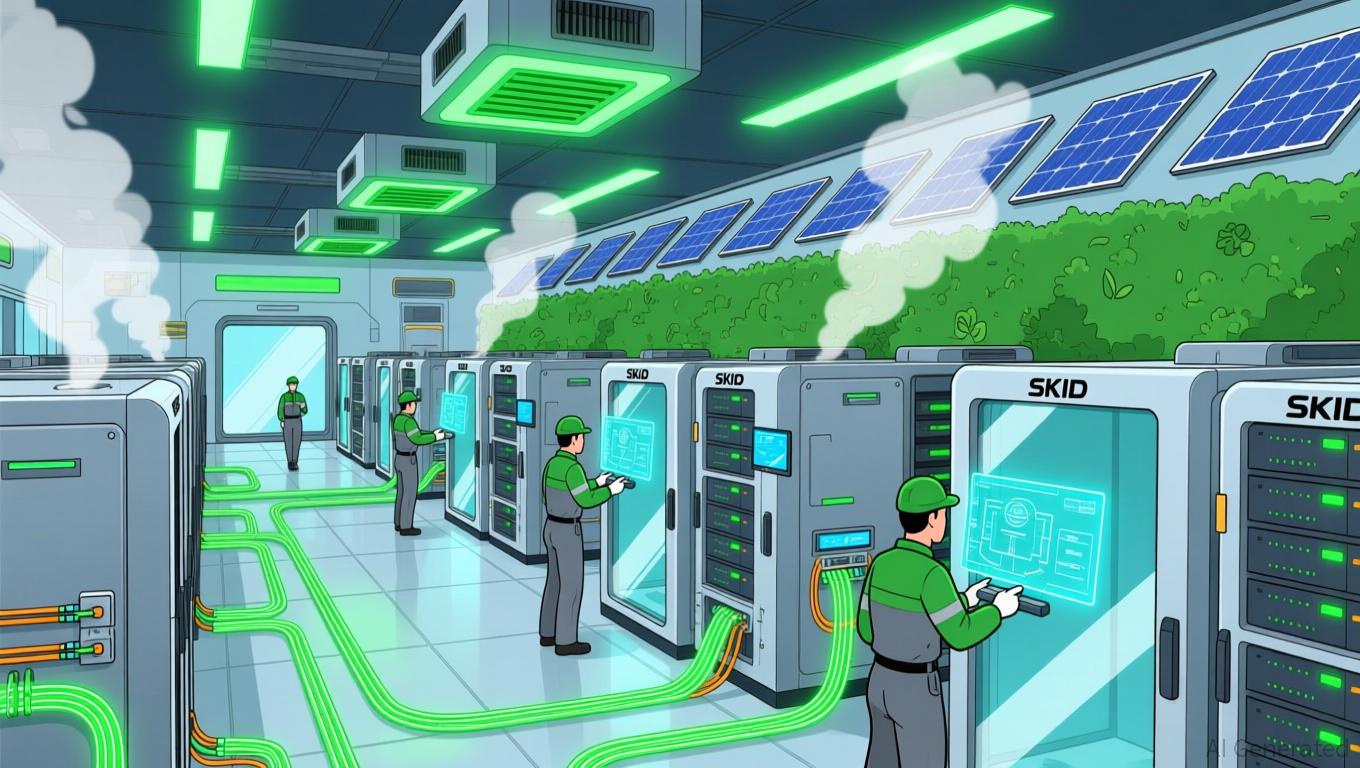

Modular Data Centers Address the Challenge of Balancing AI Performance and Environmental Responsibility

- Siemens and Delta partner to launch modular data center solutions, aiming to cut deployment time by 50%, costs by 20%, and emissions by 27%. - Standardized SKIDs and eHouses integrate power, UPS , batteries, and thermal management for rapid on-site installation. - BIM and digital twins optimize design and monitoring, targeting AI-driven EMEA/APAC markets with scalable, sustainable infrastructure. - Modular designs reduce concrete waste and enable compact power enclosures, aligning with global decarboniza

Ethereum Updates: Unknown Wallet Drains $15M in ETH While London Launches Crypto ETPs

- A mystery Ethereum wallet withdrew $15.5M worth ETH from Binance, coinciding with London's new crypto ETP listings. - 21Shares launched Ethereum/Bitcoin ETPs on LSE, offering institutional exposure to staking rewards and crypto holdings. - The withdrawal timing suggests potential capital deployment into newly approved ETPs requiring custodied crypto assets. - UK regulators approved these products, signaling growing institutional adoption of crypto-backed securities with traditional infrastructure.

Bitcoin News Update: Bitcoin Remains Steady While Altcoins Plunge Amid Market Sell-Off

- Bitcoin stabilizes near $93,555 amid market turmoil while altcoins hit multi-month lows due to $801M in 24-hour liquidations. - A 13-year dormant Satoshi-era wallet triggering 2% price drop and fear index hitting 14/100 heightens bearish concerns. - Cboe's perpetual-style crypto futures and global stimulus packages may reshape liquidity as Bitcoin tests $100,000 threshold. - Galaxy Digital notes algorithmic deleveraging rather than systemic weakness, with $3B in DeFi borrows signaling structural shifts.