Nearly $115 Million Longs Liquidated As Bitcoin Drops to 7-Month Low, $70,000 Incoming?

Over $112 million in Bitcoin longs vanished as BTC plunged below $90,000 ahead of the FOMC minutes. Analysts warn the sell-off may extend toward $70,000 amid fading rate-cut expectations and accelerating ETF outflows.

In the past 60 minutes, over $112 million longs have been liquidated as traders de-risk in anticipation of the FOMC minutes.

Bitcoin slipped below the $90,000 psychological levels, blowing millions in long positions out of the water.

$115 Million Longs Wiped Out Amid FOMC Minutes Jitters

Data on Coinglass shows that over $112 million in long positions have been liquidated over the past hour. These positions were flushed out as the Bitcoin price dipped below the $90,000 psychological level, testing a seven-month low.

Bitcoin (BTC) Price Performance. Source: TradingView

Bitcoin (BTC) Price Performance. Source: TradingView

Meanwhile, the drop was not limited to the Bitcoin, as crypto stocks also registered losses, following the pioneer crypto’s fall to a 7-month low.

CRYPTO STOCKS FALL AS BITCOIN NEAR SEVEN-MONTH LOW🔸 COINBASE GLOBAL DOWN 4.9% 🔸 BITFARMS FALLS 7.5%🔸 STRATEGY SLIPS 10.3%🔸 RIOT PLATFORMS FALLS 3.7%🔸 HUT 8 MINING DOWN 3.3%🔸 MARA HOLDINGS DROPS 6.6%

— *Walter Bloomberg (@DeItaone)

It comes ahead of the October FOMC minutes, which is barely an hour out, suggesting investors are de-risking.

Beyond crypto and related stocks, indices were also down, with the Nasdaq and S&P 500 turning negative.

S&P 500 AND NASDAQ TURN NEGATIVE; S&P 500 DOWN 0.2%, NASDAQ DOWN 0.2%

— *Walter Bloomberg (@DeItaone)

This drop comes barely an hour before the October FOMC minutes release, with sentiment already reflected on social media.

Amid the anticipation, US President Trump said Fed chair Jerome Powell is “grossly incompetent,” citing too high interest rates.

Meanwhile, the Bureau of Labor Statistics has also revealed that it will not publish the October Jobs report. This gap likely steps from the recently concluded US government shutdown, which saw authorities run basically blind.

“After the September jobs report (out Thursday), there won’t be another jobs report until after the Dec. 9-10 FOMC meeting BLS: The October jobs report is cancelled. The November report won’t land until December 16. Sept JOLTS is also cancelled. October JOLTS will be published December 9,” wrote Nick Timiraos.

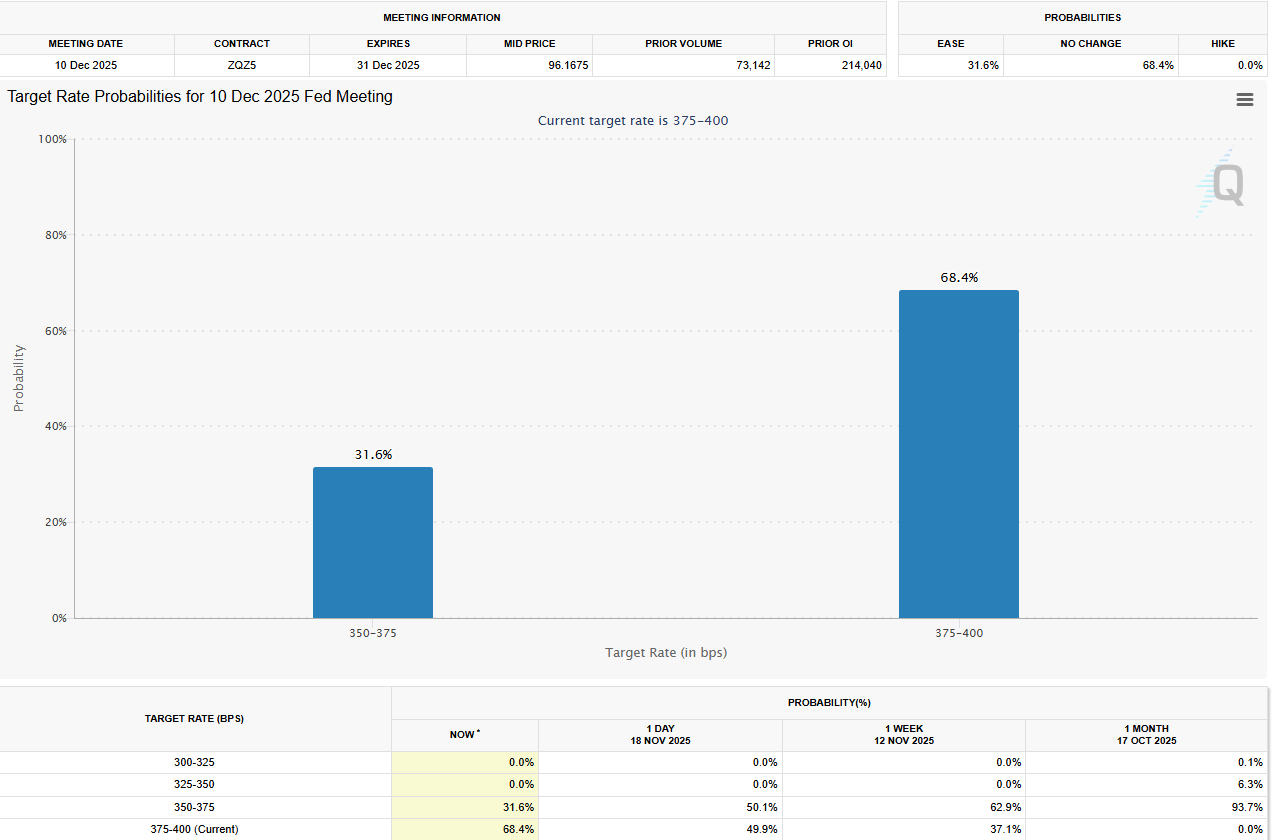

Based on this gap in the October Jobs report, December Fed rate cut bets have dwindled, with nearly 70% anticipating policymakers will hold interest rates steady.

Interest Rate Cut Probabilities. Source:

CME FedWatch Tool

Interest Rate Cut Probabilities. Source:

CME FedWatch Tool

Some analysts also ascribe the prevailing bearish sentiment to FUD (fear, uncertainty, and doubt), as institutional players signal a lack of conviction for BTC.

This is seen with ETF outflows from the likes of BlackRock, which the asset manager posting record negative flows of on Tuesday.

“BlackRock Dumps Record $523M in Bitcoin as BTC Slips Further in Bear Market. They sold $523M in Bitcoin, the largest single-day outflow IBIT has EVER recorded. Wall Street entered, profited, and exited. Bitcoiners got played hard,” analyst Jacob King remarked.

Even as the Bitcoin price continues to drop, some analysts say the downside potential remains very much alive, potentially as low as $70,000 in the near term, or worse.

Below $98,650, the next key Bitcoin $BTC levels are:• $75,740• $56,160• $52,820

— Ali (@ali_charts)

As of this writing, the Bitcoin price was trading for $88,977, down by almost 5% in the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Ethereum Transforms into Digital Bonds, Soaring Above $3,000 Driven by Institutional Interest

- Ethereum surged past $3,000 in late 2025 driven by institutional demand, ETF approvals, and technical upgrades like the Fusaka upgrade. - BlackRock's staked Ethereum ETF attracted $13.1B inflows since 2024, reclassifying staked ETH as "digital bonds" for institutional investors. - Over 69 corporations now hold 4.1M ETH in treasuries, but ETF outflows highlight ongoing market differentiation from Bitcoin . - Fusaka's focus on layer-1 scalability aims to redirect economic activity to Ethereum's base layer

Bitcoin News Today: Bitcoin Faces Bearish Turning Point with Death Cross and $75K Teal Band Indicator

- Bitcoin fell below $90,000, triggering bearish signals like the "death cross" and a $75,700 teal band target. - Analysts split between short-term volatility recovery hopes and warnings of prolonged bearish momentum amid Fed rate uncertainty. - On-chain whale accumulation contrasts with $4B in liquidations and RSI hitting 2022 FTX-level lows, signaling fragile market conditions. - Macroeconomic risks from liquidity crunches and synchronized equity declines amplify Bitcoin's role as a global liquidity baro

Zcash News Today: Zcash's Shielded Momentum: $150 Million Institutional Investment in Quantum-Proof Privacy

- Zcash (ZEC) surged 13% in 24 hours despite $1B crypto liquidations, driven by institutional buys and quantum-resistant privacy tech. - Cypherpunk Technologies added $18M ZEC, holding 1.43% of supply, as Zcash’s 140% monthly gain outperforms Bitcoin and Ethereum . - Analysts link Zcash’s rise to shielded pools and institutional demand, while broader crypto markets face $1.35T losses since October.

Bitcoin News Update: Yen’s Decline Tests Bitcoin’s Risk Appetite Link as Fiscal Pressures Mount

- Japanese yen's 10-month low against the dollar sparks debate on Bitcoin's risk-on correlation amid divergent monetary policies. - Japan's ¥14 trillion fiscal package aims to boost liquidity but raises concerns over 240% debt-to-GDP ratio and rising bond yields. - Swiss franc emerges as new risk barometer as yen's carry trade faces strain from higher yields and potential capital outflows. - Bitcoin struggles to hold $92,000 support amid weak institutional demand and ETF inflows, with November bond auction