TRUMP Price Holds Above $7, Even As Epstein Files Release Approved

OFFICIAL TRUMP trades at $7.06 as political pressure and weakening indicators raise breakdown risks, with $6.89 serving as the last major support.

OFFICIAL TRUMP has shown little movement in recent days, with price action flattening as uncertainty grows. The lack of volatility reflects cautious sentiment among holders, who are watching external developments closely.

That pressure is set to intensify after the US Senate approved the release of Epstein files, a decision likely to influence TRUMP’s short-term direction.

OFFICIAL TRUMP Could Bear The Brunt

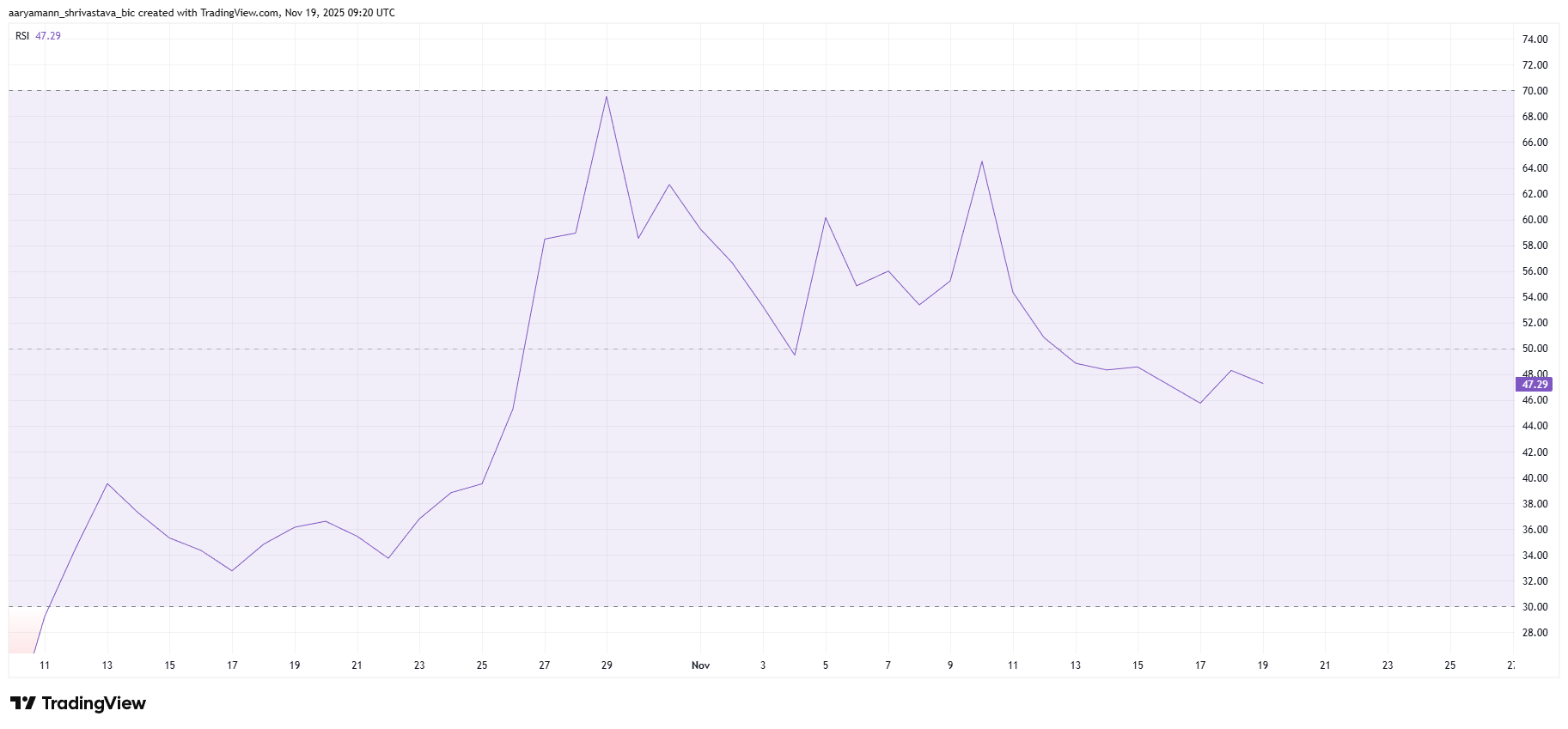

Market sentiment is weakening as the Relative Strength Index slips below the neutral 50.0 level, signaling growing bearish momentum. A continued drop into the negative zone would confirm increasing downside pressure. With Bitcoin now trading near $90,000, overall market confidence has already eroded, creating a challenging backdrop for risk-sensitive tokens like TRUMP.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

TRUMP RSI. Source:

TRUMP RSI. Source:

TRUMP faces additional headwinds owing to the Epstein files discourse. The Senate approved a House-passed bill requiring the Justice Department to release documents related to Jeffrey Epstein. Donald Trump has opposed the release previously, and past images of him with Epstein may spark renewed speculation. This combination heightens uncertainty and could weigh heavily on the TRUMP price as investors reassess risk.

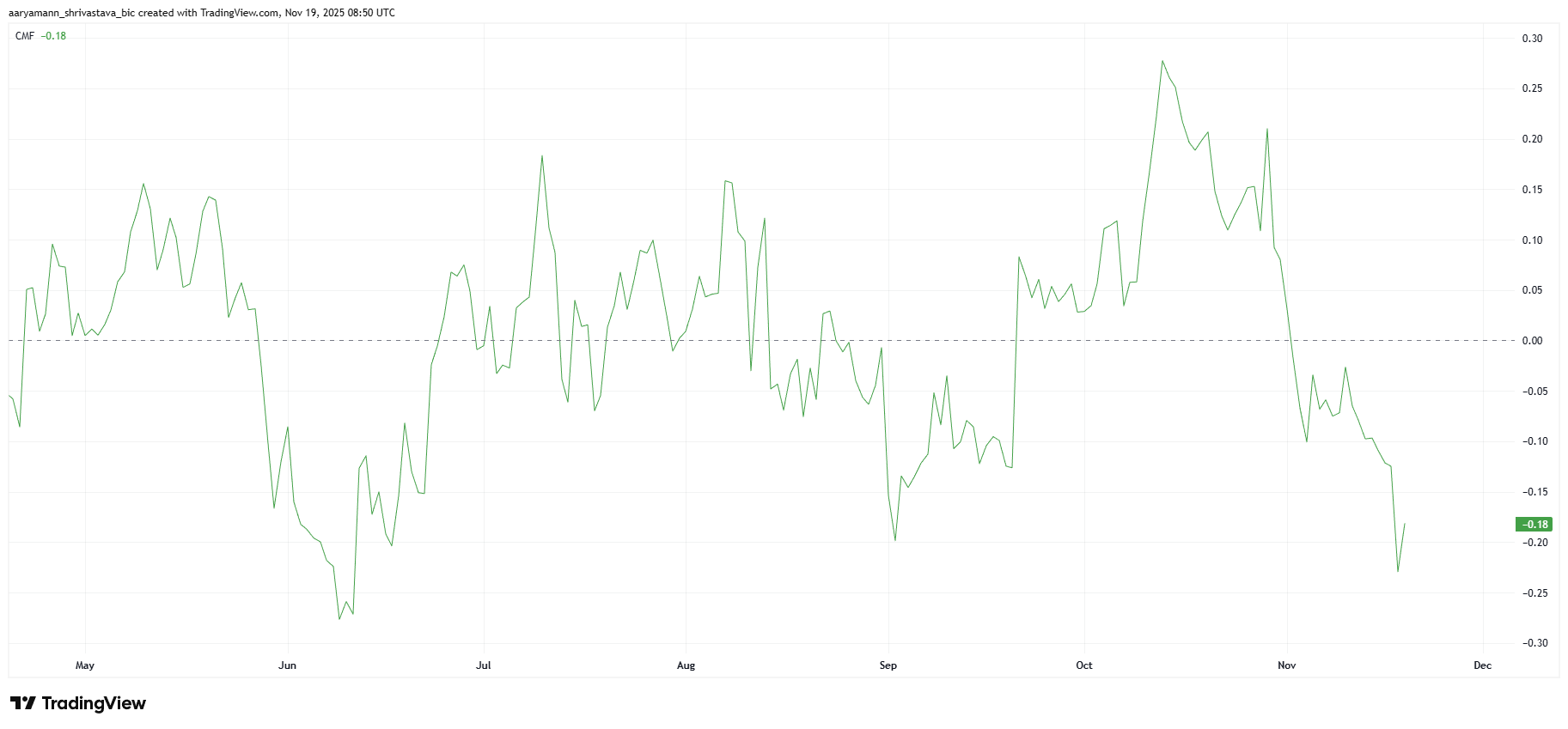

Macro momentum indicators confirm a deteriorating outlook. The Chaikin Money Flow has dropped to a five-month low, signaling aggressive capital outflows from TRUMP. The indicator weakened sharply over the past several days, revealing that investors are pulling liquidity and reducing exposure as concerns grow.

Heavy withdrawals indicate fading conviction among holders who fear further controversy and market instability. Sustained negative CMF readings typically point toward prolonged weakness, especially when paired with falling momentum indicators.

TRUMP CMF. Source:

TRUMP CMF. Source:

TRUMP Price Is Holding Above Crucial Support

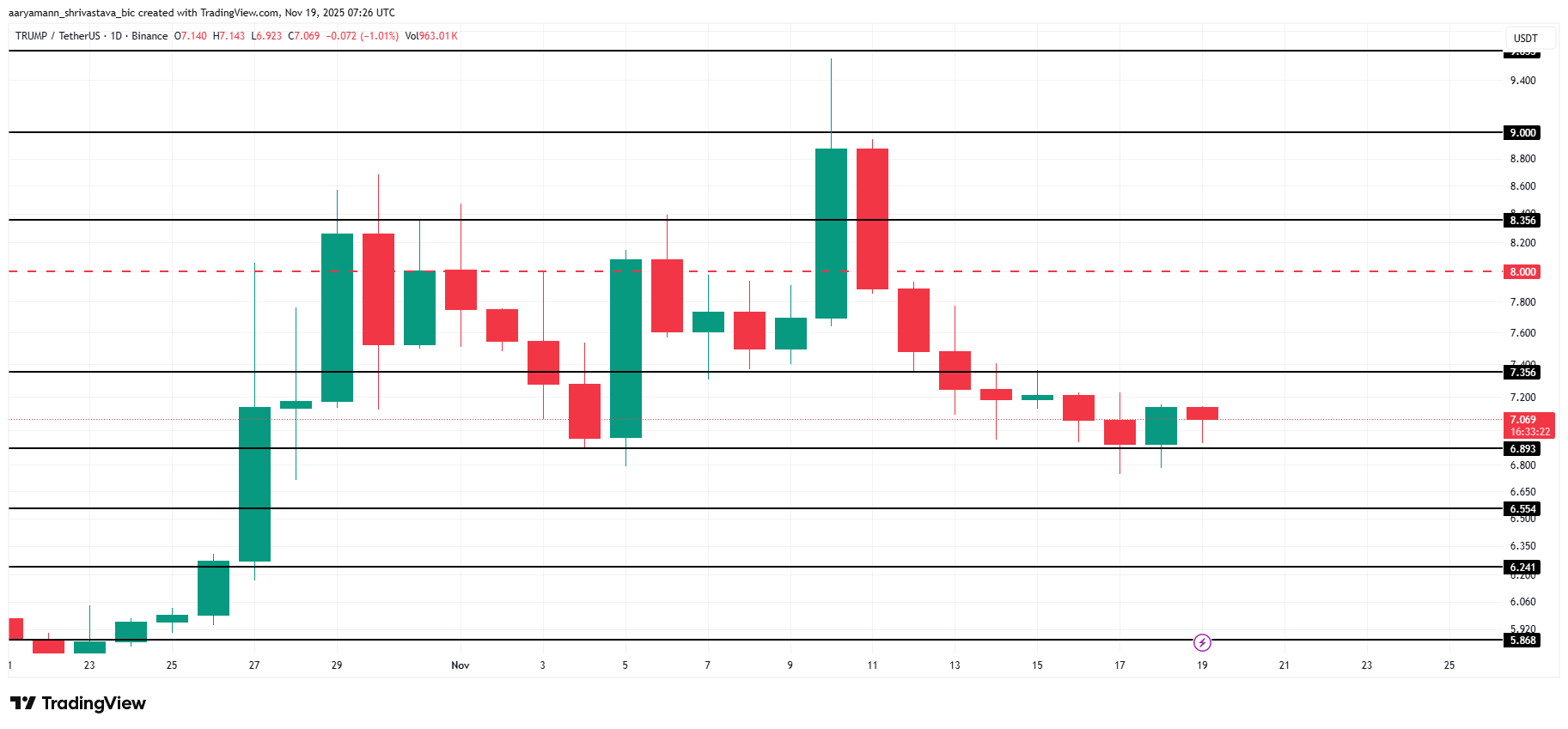

TRUMP trades at $7.06, holding just above the $6.89 support level that has stabilized the price for three weeks. The coin’s inability to generate upward traction increases the likelihood of a breakdown. Continued pressure could push TRUMP below this zone as sentiment worsens.

A drop under $6.89 would expose the price to deeper losses, potentially sending it toward $6.55 or $6.24. If fear surrounding the Epstein files intensifies, TRUMP could break below $6.00 for the first time in months and reach $5.86. Bearish sentiment and political uncertainty may accelerate this move.

TRUMP Price Analysis. Source:

TRUMP Price Analysis. Source:

However, if Donald Trump avoids controversy after the approval of the files’ release, OFFICIAL TRUMP may find room to recover. A bounce from $6.89 could lift the price to $7.35. A break above that level would open the path toward $8.00. This would invalidate the bearish thesis and restore short-term confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TrustLinq Converts Cryptocurrency into Spendable Cash for Daily Life

- TrustLinq, a Swiss-regulated firm, launched a crypto-to-fiat platform enabling global payments in 70+ currencies without traditional banking infrastructure. - The platform addresses crypto adoption gaps by converting digital assets to fiat for rent, payroll, and international transfers, bypassing recipient crypto requirements. - Operating under Swiss AML regulations with non-custodial security, it targets individuals and businesses seeking crypto integration for practical financial operations. - Debit ca

Solana News Update: Pump.fun Transfers $436M—Strategic Treasury Move or Exit Strategy?

- Pump.fun denied allegations of cashing out $436.5M USDC , calling transfers routine treasury management amid a $19B crypto market crash. - Critics question timing as revenue dropped 53% to $27. 3M , with funds traced to June's institutional PUMP token sale at $0.004 each. - The team defended moves as reinvestment for ecosystem expansion, citing acquisitions and 12% PUMP buybacks since October. - Social media silence and a 72% PUMP price drop fueled exit speculation, despite $855M stablecoin liquidity rep

Ethereum Updates Today: BlackRock's Bold Move with Staked ETH ETF—Will It Influence Ethereum's Future?

- Ethereum faces bearish technical signals, with price below key averages and a rising wedge pattern suggesting further declines toward $2,050 if support breaks. - BlackRock's proposed staked ETH ETF aims to offer 3% annualized yields with low fees, potentially disrupting DATs by combining institutional custody and transparent staking structures. - Market dynamics show $1.9B in ETF outflows and whale activity shifting ETH to cold storage, while macro factors like sticky U.S. yields weigh on risk assets. -

China: Electricity Too Cheap Revives the Bitcoin Mining Industry