Fed's Discussion on Lowering Rates: Balancing Job Market Concerns and Inflation Risks Amid Limited Data

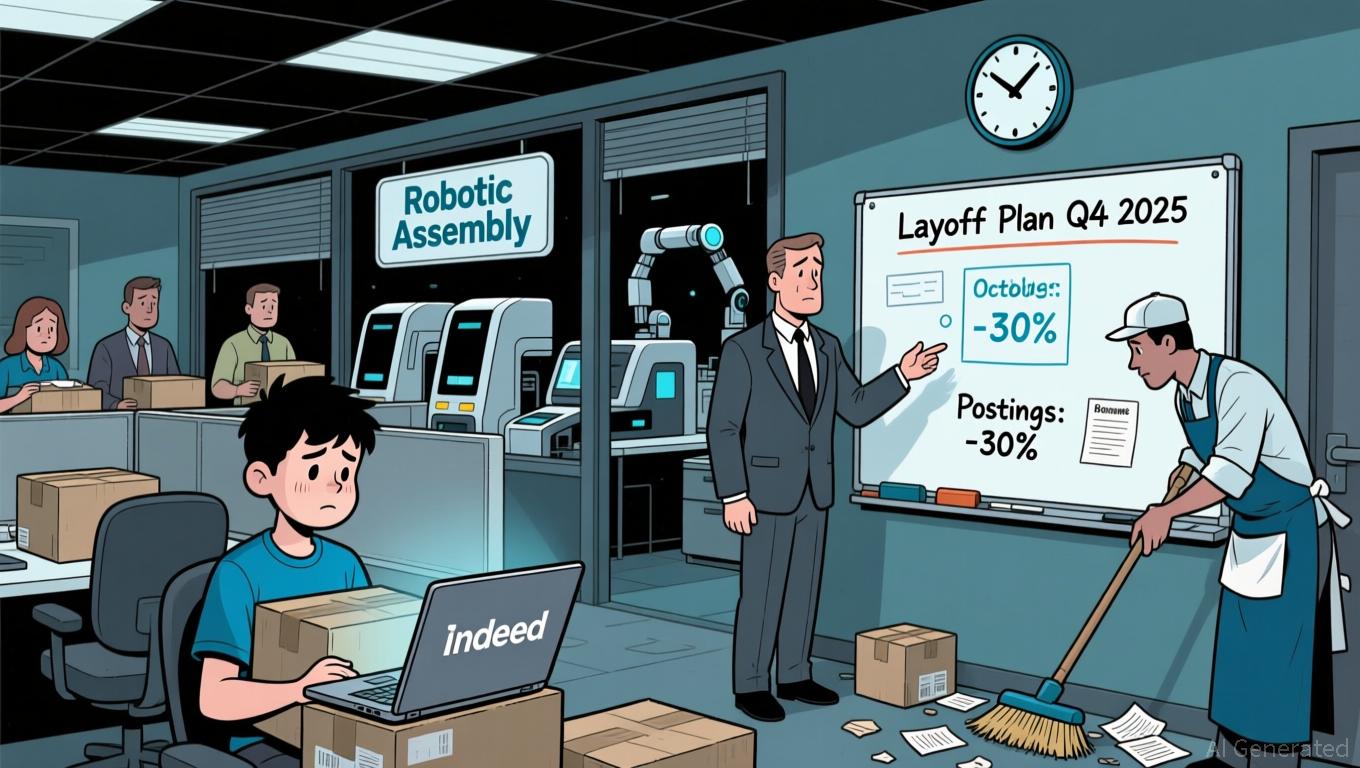

- Fed's December rate cut odds dropped to 52% as data gaps and labor market slowdown fuel investor uncertainty. - Governor Waller advocates 25-basis-point cut citing weak job growth and AI-driven hiring challenges, contrasting inflation-focused officials. - Key metrics like delayed September payrolls and October meeting minutes will shape final decision amid policy debate. - Global central banks and Trump's Fed chair selection add political risks to monetary policy neutrality. - Gold prices fell 3.4% as re

Uncertainty has increased regarding whether the Federal Reserve will lower rates in December, as the market

Waller

The Fed’s decision is further complicated by limited data.

The Fed’s dual mandate is facing new obstacles.

Investors are also wary of the Fed’s political environment.

The outcome of the Fed’s December meeting will likely

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates: Unknown Wallet Drains $15M in ETH While London Launches Crypto ETPs

- A mystery Ethereum wallet withdrew $15.5M worth ETH from Binance, coinciding with London's new crypto ETP listings. - 21Shares launched Ethereum/Bitcoin ETPs on LSE, offering institutional exposure to staking rewards and crypto holdings. - The withdrawal timing suggests potential capital deployment into newly approved ETPs requiring custodied crypto assets. - UK regulators approved these products, signaling growing institutional adoption of crypto-backed securities with traditional infrastructure.

Bitcoin News Update: Bitcoin Remains Steady While Altcoins Plunge Amid Market Sell-Off

- Bitcoin stabilizes near $93,555 amid market turmoil while altcoins hit multi-month lows due to $801M in 24-hour liquidations. - A 13-year dormant Satoshi-era wallet triggering 2% price drop and fear index hitting 14/100 heightens bearish concerns. - Cboe's perpetual-style crypto futures and global stimulus packages may reshape liquidity as Bitcoin tests $100,000 threshold. - Galaxy Digital notes algorithmic deleveraging rather than systemic weakness, with $3B in DeFi borrows signaling structural shifts.

COAI Token Fraud: Warning Signs in Cryptocurrency Ventures and Ways for Investors to Safeguard Themselves in 2025

- COAI token's 88% price drop in 2025 caused $116.8M losses, highlighting DeFi risks. - Technical flaws and regulatory gaps exposed systemic DeFi vulnerabilities through COAI's collapse. - 87.9% token concentration among ten wallets enabled manipulation and panic selling. - Experts urge due diligence, AI tools, and diversification to mitigate crypto risks. - The collapse underscores the need for transparency and unified global crypto regulations.

COAI's Latest Price Decline: Market Drivers and Prospects for Investment Rebound

- ChainOpera AI (COAI) fell 88% year-to-date amid AI/crypto sector governance issues and CLARITY Act regulatory uncertainty. - Technical analysis shows oversold RSI and whale accumulation, suggesting short-term rebound potential with key resistance at $5.40-$7.33. - Analysts highlight 121% upside to $9.09 if COAI breaks resistance, but warn of further decline below $3.97 to $2.15 due to sector volatility. - Long-term recovery depends on CLARITY Act compliance clarity and AI-blockchain innovation progress,