Bitcoin News Today: Bitcoin’s Bull Run Falters as Institutional Interest and Market Liquidity Wane

- Bitcoin breaks below 365-day moving average, signaling bearish market structure and extreme technical weakness. - Institutional demand collapses as treasury firms cut BTC purchases, while spot ETFs see $373M outflows in one day. - Bull Score Index hits 20/100 historical lows, with $90K-$92K support and $102.6K resistance now critical price levels. - Market debates if this marks the end of the 4-year bull cycle, amid Fed uncertainty and vanishing liquidity sources.

Bitcoin has entered its most negative phase since the 2023 bull run began, having fallen below its 365-day moving average—a crucial technical threshold it had maintained during all previous corrections in this cycle.

Technical signals suggest a bleak outlook. CryptoQuant’s Bull Score Index has plunged to 20 out of 100, a level that typically signals intense bearishness, fueled by declining spot demand, negative price trends, and stagnant growth in stablecoin liquidity

On top of technical weakness, demand-side challenges are mounting.

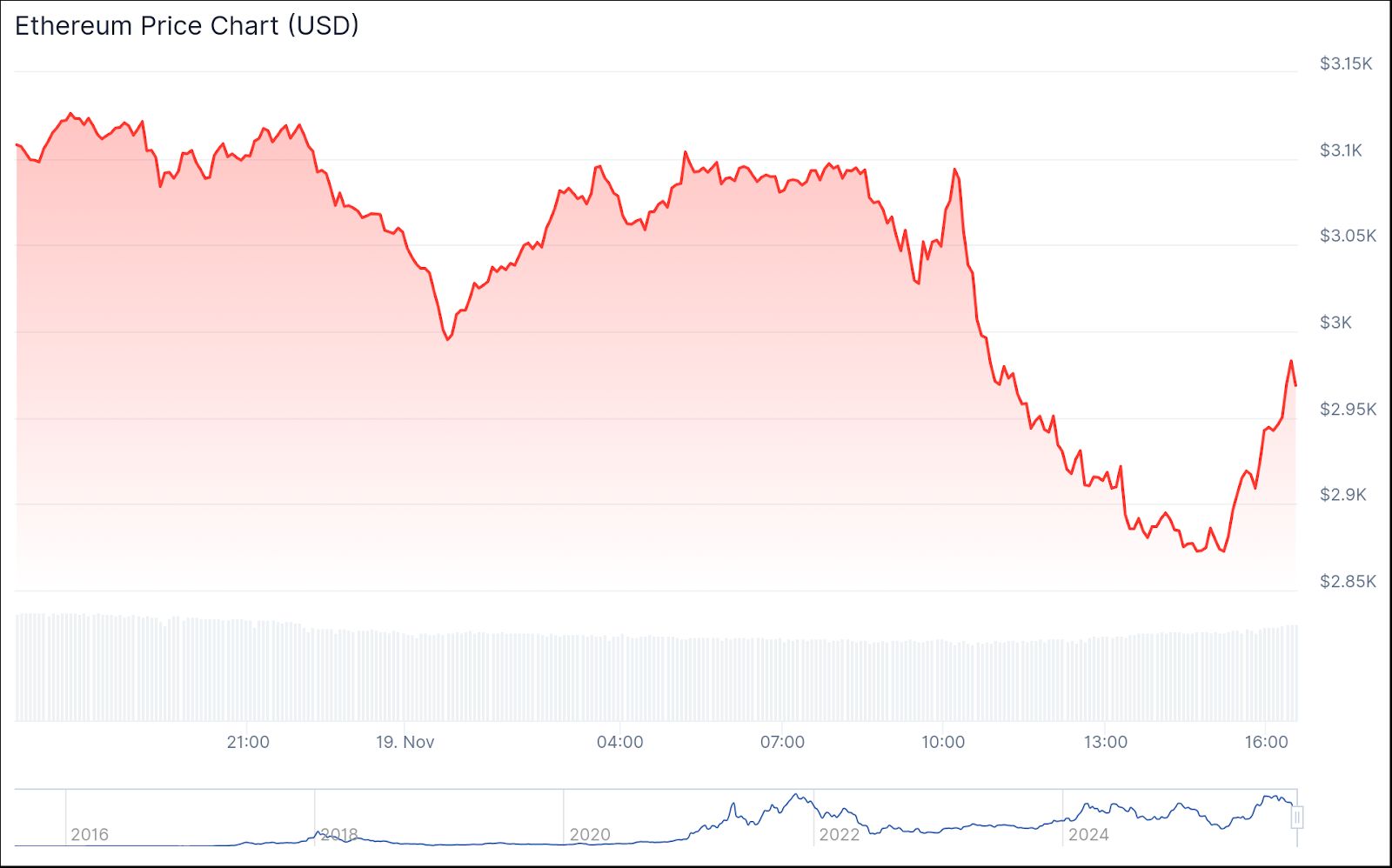

Bearish sentiment is not limited to Bitcoin.

There is ongoing debate among market participants about whether this signals the conclusion of the current four-year bull run or simply a delayed continuation into 2026. Historically, Bitcoin’s cycles have coincided with halving events, but

Bitcoin’s recent breakdown highlights the vulnerability of a market still contending with macroeconomic challenges and structural changes. With major technical supports breached and sources of demand fading, the road to recovery appears uncertain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Ecosystem Growth: 11,000+ Banks Join XRPL Network

Quick Take Summary is AI generated, newsroom reviewed. Over 11,000 banks are now connected to the XRP Ledger (XRPL). BXE Token launches as the largest decentralized media program on XRPL. A 10,000,000 BXE token burn is scheduled for December 1st. XRP adoption continues to grow, bridging traditional finance and blockchain.References XRP is gearing up for MASSIVE adoption — with 11,000+ banks now connected to the ecosystem! The XRP Ledger is leveling up fast, with the largest decentralized media program laun

NVIDIA’s positive AI feedback loop eases concerns of a bubble, powering a $57 billion quarter

- NVIDIA reported $57B Q3 revenue, 62% YoY growth, surpassing $54.9B Wall Street estimates driven by AI/data center demand. - Data center revenue hit $51.2B (66% YoY), fueled by Blackwell GPUs and cloud infrastructure, with $500B in advanced chip bookings through 2026. - CEO Huang declared AI "virtuous cycle" with exponential compute demand, while Q4 guidance of $65B revenue (+/-2%) exceeded $61.66B consensus. - Stock rose 4.1% post-earnings, with institutional ownership at 65.27% and $4.53T market cap ref

Cancer Diagnosis Helps Keep Jack Abramoff Out of Prison for 'AML Bitcoin' Fraud Scheme

BlackRock Registers Staked Ethereum Trust