Bitcoin Preemptively "Surrenders," Market Quietly Awaits Nvidia's Earnings Report

Behind the synchronized sharp downturn in the US stock and cryptocurrency markets, investor concerns about the "AI Bubble" and uncertainty about the Fed's monetary policy are forming a dual "shockwave."

Original Title: "Bitcoin Surrenders Early, Market Awaits NVIDIA's 'Performance'"

Original Author: Bootly, BitpushNews via Bitpush

Ahead of NVIDIA's earnings report announcement, global risk assets have already reacted: sentiment has shifted from panic to "stampede" panic.

On Tuesday, the Dow Jones Index fell by 499 points, a 1.07% drop; the S&P 500 saw a four-day decline, marking its longest losing streak since August; the Nasdaq, since hitting a historic high in October, has now cumulatively dropped by over 6%, wiping out approximately $2.6 trillion in market value.

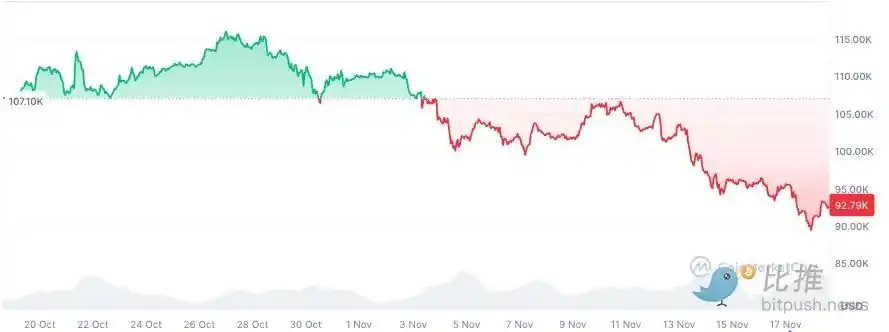

The cryptocurrency market, seen as a risk-on asset barometer, underwent a "bloodbath": Bitcoin dropped below $90,000 in the short term for the first time in seven months; Ethereum fell below the $3,000 integer mark.

Behind the synchronized sharp decline in the U.S. stock and cryptocurrency markets, investors are experiencing a dual "shock" of panic over the "AI bubble" and uncertainty about the Federal Reserve's monetary policy.

Prior to NVIDIA's Earnings Report, AI Bubble Discussion Reaches a Peak

This time, the stock market's decline is closely related to the AI topic.

Earlier today, NVIDIA and Microsoft announced plans to invest up to tens of billions of dollars in Anthropic, aimed at the next round of computing power competition. This was supposed to be a bullish piece of news symbolizing future industry growth momentum but it barely uplifted the market.

Over the past half year, the investment of major tech companies in AI infrastructure has shown exponential growth—data center construction, energy expansion, GPU procurement, all in the hundreds of billions of dollars. NVIDIA's market cap had once soared to $5 trillion, and the weight of AI companies in the S&P 500 is rapidly approaching one-third.

This has also made the voices in the market warning that the "bubble is accelerating" become more piercing.

During an interview with the BBC, Sundar Pichai, CEO of Alphabet, Google's parent company, pointed out that the current AI frenzy has an "irrational element." He cautioned, "If the AI bubble bursts, no company can stand alone, including us."

Wharton School Professor Jeremy Siegel stated this week in a Bloomberg TV interview: "AI is revolutionary, but that doesn't mean valuations can detach from fundamentals."

This statement somewhat epitomizes investors' current conflicting emotions: they are unwaveringly bullish on AI's future, but they also worry that the past year's surge may have priced in too much of the future growth.

Therefore, ahead of NVIDIA's earnings report, some funds have chosen to retreat first, reassessing the risk-reward ratio of the AI sector.

Carson Group's Global Macro Strategist Sonu Varghese pointed out in his analysis report: "The tech sector has been surging throughout the year, so it's not surprising to see volatility. The tech stock volatility is further exacerbated by concentrated risks—both in index composition and investor holdings. Despite the significant gains, investors heavily allocated to AI-related stocks are always on thin ice, as any pullback could trigger a chain reaction. What's more severe is that when stock prices start to fall, a large number of investors simultaneously seeking risk diversification may, in turn, intensify market turmoil."

Macroeconomic Variables: Missing Data About to Be Replenished, but Rate Outlook Remains the Greatest Uncertainty

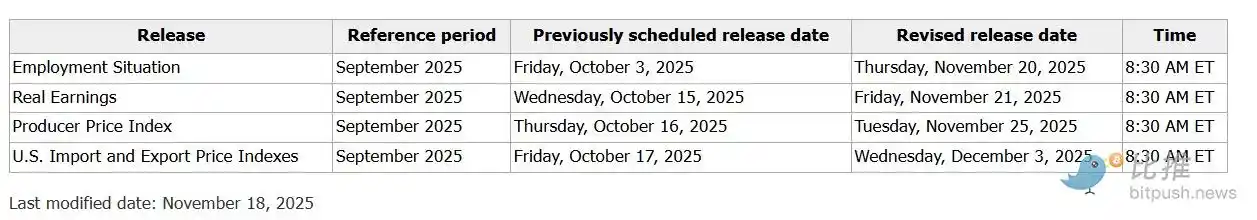

Previously missing key economic data due to the government shutdown is rapidly being restored. The U.S. Department of Labor has confirmed that it will replenish all missing weekly initial jobless claims data by this Thursday and will retroactively release September PPI and Import-Export Price Indices on November 25 and December 3, respectively.

However, the market's core anxiety lies not in the "data's absence" but in: what interest rate path will the data point to after replenishment?

According to the CME FedWatch tool (as of November 19): the probability of a 25-basis-point rate cut by the Fed in December is 48.9%, with the probability of no change at 51.1%.

In other words, the market's expectations for a recent rate cut are almost evenly split, making rate expectations particularly sensitive and fragile.

Tech stocks and cryptocurrencies belong to asset categories that rely on high valuations and strong growth expectations, making them extremely sensitive to interest rate changes. If the upcoming data reinforces the narrative of "inflation remaining sticky" or "labor market resilience exceeding expectations," leading to a further delay in rate cut expectations, then the pressure of liquidity tightening will continue to loom over risk assets.

Industry Insiders: Is It a 'Deep Pullback' or a 'Perfect Bottom'?

Over the past few years, the correlation between Bitcoin and U.S. tech stocks, especially the Nasdaq 100 Index, has continued to strengthen. The latest data shows that the 30-day correlation between Bitcoin and the Nasdaq has reached around 0.80, hitting a new high since 2022.

Industry insiders generally believe that Bitcoin's performance is increasingly resembling a "leveraged tech stock," surging in a bull market, being sold off in sync during risk-off sentiment spikes, and experiencing amplified declines.

· Faced with Bitcoin's pullback, opinions among crypto industry professionals are divided:

· Long-term Profit Taking: Analysts such as Gerry O'Shea from Hashdex Asset Management believe that Bitcoin's struggle is partly due to long-term holders taking profits, capitalizing on significant gains in recent years.

Technical Warning: Alex Kuptsikevich, Chief Market Analyst at FxPro, pointed out that Bitcoin breaking below the 50-week moving average confirms the rupture of the two-year bull market trend. His scenario predicts that Bitcoin may further decline to the 200-week moving average (around the $60,000 to $70,000 range).

· 'Extreme Fear' Signal: The sentiment index from CoinMarketCap indicates that current crypto investors are in a state of 'extreme fear.' However, Haider Rafique, Managing Partner at OKX Global, believes that the market's performance in the coming days will determine whether this is just a 'sharp, temporary pullback' or will evolve into 'a deeper reset.'

· Optimists Call for Entry: Optimists like Ryan Rasmussen from Bitwise Asset Management still maintain a positive outlook, viewing the market's 'fear' extremes as the 'perfect opportunity' for investors to build existing positions or enter the market. Geoffrey Kendrick, Director of Digital Asset Research at Standard Chartered, stated in a recent research report that the current Bitcoin pullback is a healthy adjustment within the cycle, and if it can hold around the $100,000 region, Bitcoin will establish a new structural support.

In summary, the current market is in a typical 'wait-and-see' phase. It is advised for investors to control their positions, avoid chasing highs or panic selling, and expect short-term or sustained weak consolidation in tech stocks and crypto assets. The market is waiting for new anchor points, including fundamental data, policy signals, and AI narrative validation. Until then, risk assets will undergo a more restrained consolidation phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: "Crypto ETFs See $3 Billion Outflow While Energy Storage Surges in Contrasting Markets"

- U.S. Bitcoin ETFs lost $903M in net outflows on Nov 20, with IBIT and GBTC leading the exodus. - Ethereum ETFs faced $262M in eight-day outflows as institutional investors locked in year-end profits. - Bitcoin dropped 9% to $83,884 amid technical breakdowns and miner economics, despite major holders continuing accumulation. - Smaller crypto ETFs like Solana and XRP saw inflows, contrasting with Canadian Solar's $1.858G storage contract and 167.7% stock surge. - Divergent market trends highlight crypto vo

Ethereum Updates Today: Major Ethereum Investor Makes $1.34B Move Amid Crypto Market Slump

- Chordate board proposes voluntary liquidation and delisting due to insufficient capital, with process starting December 2025. - Ethereum whale '66kETHBorrow' accumulates $134M in ETH amid market selloff, signaling long-term bullish conviction. - Crypto markets face $3,000 ETH support test as $170M+ liquidations highlight fragility, contrasting whale's accumulation strategy. - Canaan Inc. reports $1.3B mining revenue and BTC/ETH treasury growth, showcasing resilience amid industry downturn.

Bitcoin Updates: The 2026 Transformation in Crypto—Infrastructure Surpasses Speculation

- Crypto market anticipates 2026 growth driven by infrastructure upgrades and structured tokenomics, contrasting volatile meme coins like PEPE and BONK . - Bitcoin Munari (BTCM) advances with Solana integration and $0.01 presale model, targeting 2027 Layer-1 launch with EVM compatibility and privacy tools. - Bullish's Q3 2025 resilience during market crashes highlights its AMM liquidity advantages, while tokenization services gain traction amid institutional demand growth. - Institutional-grade infrastruct

Bitcoin News Update: Bitcoin ETFs See $1.9B Outflow While Competing Altcoins Draw $420M in Just 16 Days

- U.S. Bitcoin ETFs saw $1.9B in 4-day outflows as prices fell below $90,000 amid macroeconomic uncertainty. - BlackRock's IBIT lost $1.43B in 5 days, reflecting institutional risk aversion ahead of potential Fed policy shifts. - Altcoin ETFs attracted $420M in 16 days, with XRP and Solana funds gaining traction through staking yields and regulatory clarity. - Analysts warn sustained outflows could push Bitcoin toward $85,000, highlighting diverging investor priorities between blue-chip and emerging crypto