BlackRock’s IBIT bleeds $523M in its biggest one-day outflow

Key Takeaways

- Investors pulled $523 million out of BlackRock's IBIT on Tuesday.

- This move is part of a broader trend, as institutional investors continue to adjust their portfolios amid volatile crypto market conditions.

BlackRock’s Bitcoin ETF (IBIT) posted $523 million in net withdrawals on November 18, its largest single-day outflow since launch. The fund has recorded large redemptions for five straight days.

The sales reflect broader institutional adjustments amid volatile market conditions. BlackRock’s Bitcoin ETF has been moving assets to exchanges as clients seek to reduce their crypto exposure.

US-listed spot Bitcoin ETFs have experienced consecutive days of outflows due to institutional rebalancing. Major asset managers, including BlackRock, are seeing client-driven Bitcoin sales as investors adjust their portfolios during current market volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Harvard's $443 Million Investment Confirms Growing Institutional Interest in Cryptocurrency

- BlackRock launches Ethereum ETF in Delaware, expanding crypto offerings amid rising institutional demand. - Harvard's $443M IBIT investment marks 21% of its equity portfolio, signaling rare institutional crypto endorsement. - SEC's regulatory shifts normalize crypto ETFs, removing 2026 examination priority and enabling diversified index launches. - Market volatility sees $257M IBIT outflow as Bitcoin dips 25%, yet long-term institutional allocation persists. - Crypto's transition to strategic asset class

Buffett's Unexpected Investment in Tech Drives Alphabet's AI Boom

- Berkshire Hathaway's $4.3B Alphabet investment drove a 5% stock surge, marking Buffett's rare tech bet. - Alphabet's Gemini 3 AI model improves complex query accuracy and integrates into search/cloud products. - Analysts praise Gemini 3 as a "state-of-the-art" advancement closing AI performance gaps with rivals. - The model's commercial deployment and Buffett's backing position Alphabet as a key AI industry player.

Panera’s ‘Paper Cuts’ Takeaway: Prioritizing Quality Over Reducing Expenses

- Panera Bread’s CEO Paul Carbone launched the "Panera RISE" strategy to boost sales and restore customer trust by reversing cost-cutting measures like replacing romaine with iceberg lettuce. - Key initiatives include reintroducing premium ingredients, expanding menu options, and enhancing service to achieve $7 billion in systemwide sales by 2028. - JAB Holding and franchisees are funding the turnaround, while the IPO of Panera Brands remains delayed to prioritize customer satisfaction over short-term gain

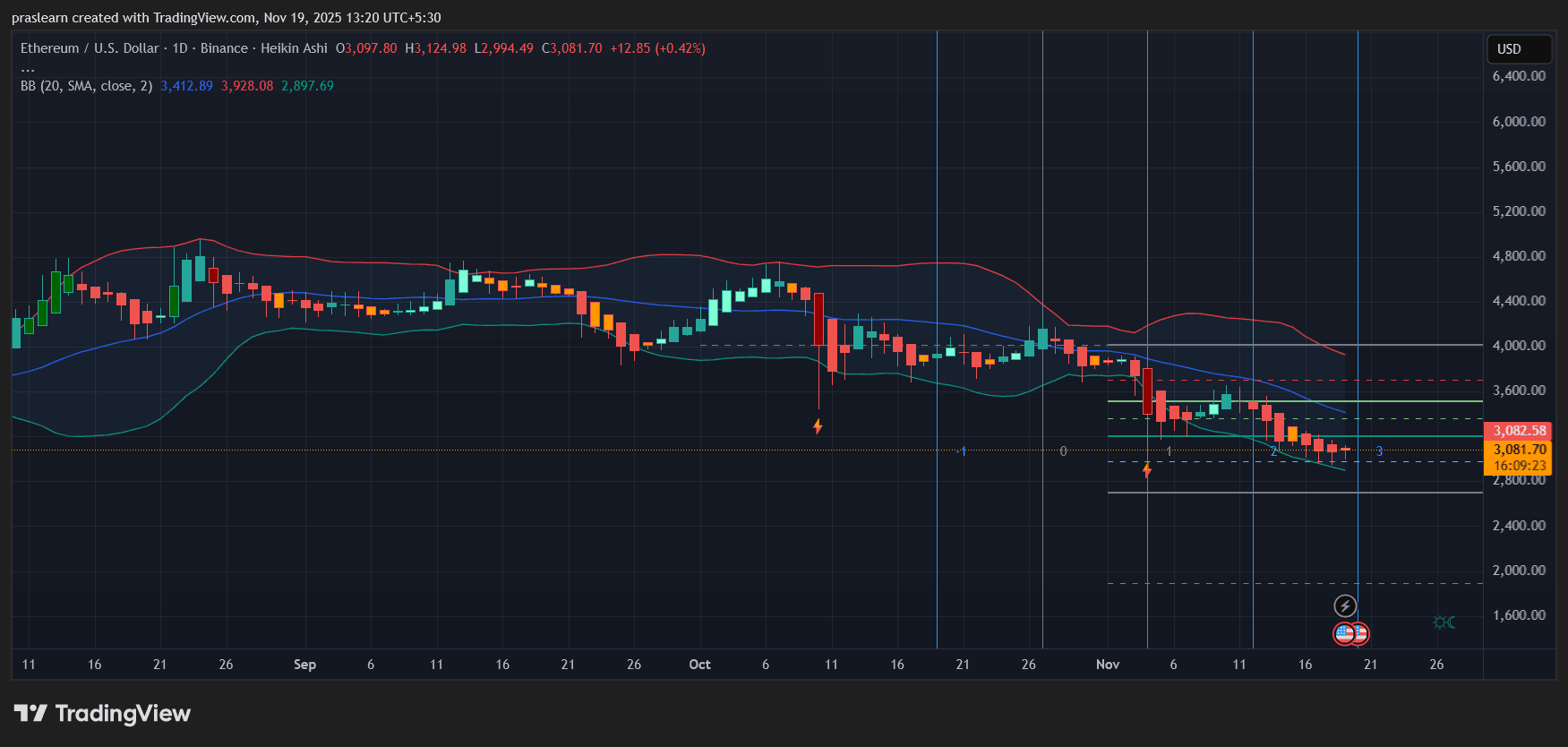

Fed Uncertainty Keeps ETH Stuck in a Tight Downtrend