Markets Sink as Liquidity Tighten as Crypto Dips in Major Economic Data

The atmosphere in the world markets has changed drastically to caution. Liquidity is contracting in the hope of major economic releases, such as the upcoming earnings report of NVIDIA and the late U.S. Non-Farm Payrolls information. The S and P 500 fell below the 50-day moving average, which indicated a weak equities. Gold was also floating down in line with crypto, which was a sign of a general backlash of risk assets.

The crypto markets have not been an exception. Bitcoin has lost its support of $93,000 and is trading at an approximate of 91,000. Ethereum has fallen under $3,000. Crypto Fear and Greed Index is at 11 which is extreme fear. This kind of reading is normally an indication of an increased volatility and reluctance by investors, particularly before any important indication of policy.

NVIDIA Earnings and Payroll

Shareholders are gearing up to NVIDIA earnings in November 19. The hopes are still high, and analysts predict that the growth of revenues will be enormous due to the demand of artificial intelligence. The threat of trade tension and weaker semiconductor demand is however a threat. An unhappy report may initiate additional liquidation of asset classes.

U.S. payroll report is delayed by a government shutdown not that long ago. Analysts project that the number of job additions will decline greatly in October. This, had it been established, would be a pointer to a declining labor market and the triggering of recession anxieties. Federal Reserve sentiment is closely monitored by the market players because there are now below 50 percent expectations of interest rate cut in December.

Cryptocurrency Exchange Dumps

Cryptocurrency markets were still falling after Bitcoin lost momentum in the recent past. Altcoins have come after BTC which is currently at about 30 per cent of its peak. Not everything is going down though. Horizen, Monero and Dash are some privacy-oriented tokens that have increased in the recent sessions. These assets are enjoying reinvigoration of new regulatory discussion on privacy in digital finance.

Bitcoin hegemony stands at 59.3, which indicates that the flagship asset continues to take the direction of the market. The institutional players are still purchasing Bitcoin when the wider market value has shrunk. MicroStrategy has recently purchased more than 8,000 BTC, and now its possession is close to 650,000. This degree of institutional confidence gives some ground in a volatile environment.

Uniswap Governance

In the conditions of market turbulence, there is a high level of governance activity in decentralized finance. Uniswap is also in the process of implementing its fee switch proposal, which would also add a protocol fee on multiple pools. The plan contains an incineration system of UNI tokens. It is projected that voting will start November 19. The news has caused the price of UNI to increase by 50 percent over the past few days.

Liquidity incentives throughout DeFi can be reconstituted with the introduction of protocol fees. It is an indication of a transition towards building up the token value and retaining decentralized governance.

Outlook in Market: More Risk or Reprieve?

The market is in a critical crossroad with a wider macro pressure and extreme sentiment. The levels of Bitcoin will become the key support levels that will define the next stage of consolidation or further correction. November is an historically good month in crypto, and now there are warnings.

Some industries are promising as it is the case in the privacy and governance innovation, but the trend is still connected to macroeconomic trends. With liquidity disappearing and risk persisting, both volatility and opportunity are equally being prepared.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP Drops to $2.20 as ETF Investments Face Off Against Major Whale Sell-Offs and Derivatives Market Liquidations

- XRP fell below $2.20 despite $164M ETF inflows, showing institutional demand-price disconnection amid whale selling and derivatives liquidations. - Whale activity sold 200M XRP post-ETF launch, while RLUSD's 30-day volume surged to $3.5B, contrasting with broader crypto outflows. - Technical analysis highlights $2.20 support and $2.26 resistance, with JPMorgan forecasting $14B in XRP ETF inflows due to cross-border payment adoption. - XRP's 0.50% ETF exposure lags Bitcoin/Ethereum's 6.54%/5.5%, but deriv

Bitcoin News Update: Medium-Sized Investors Help Steady Bitcoin During ETF Outflows and Broader Economic Challenges

- Bitcoin (BTC-USD) rose above $90,000 for the first time in nearly a week, but remains down 19% month-to-date amid macroeconomic headwinds and ETF outflows. - Mid-sized holders (10–1,000 BTC) accumulated 365,000 BTC, stabilizing prices as institutional liquidity re-entered via a rare $238M ETF inflow. - Technical indicators suggest a fragile rebound, with BTC below its 365-day moving average and CryptoQuant's Bull Score Index at 20/100, signaling prolonged bearish sentiment. - Analysts highlight conflicti

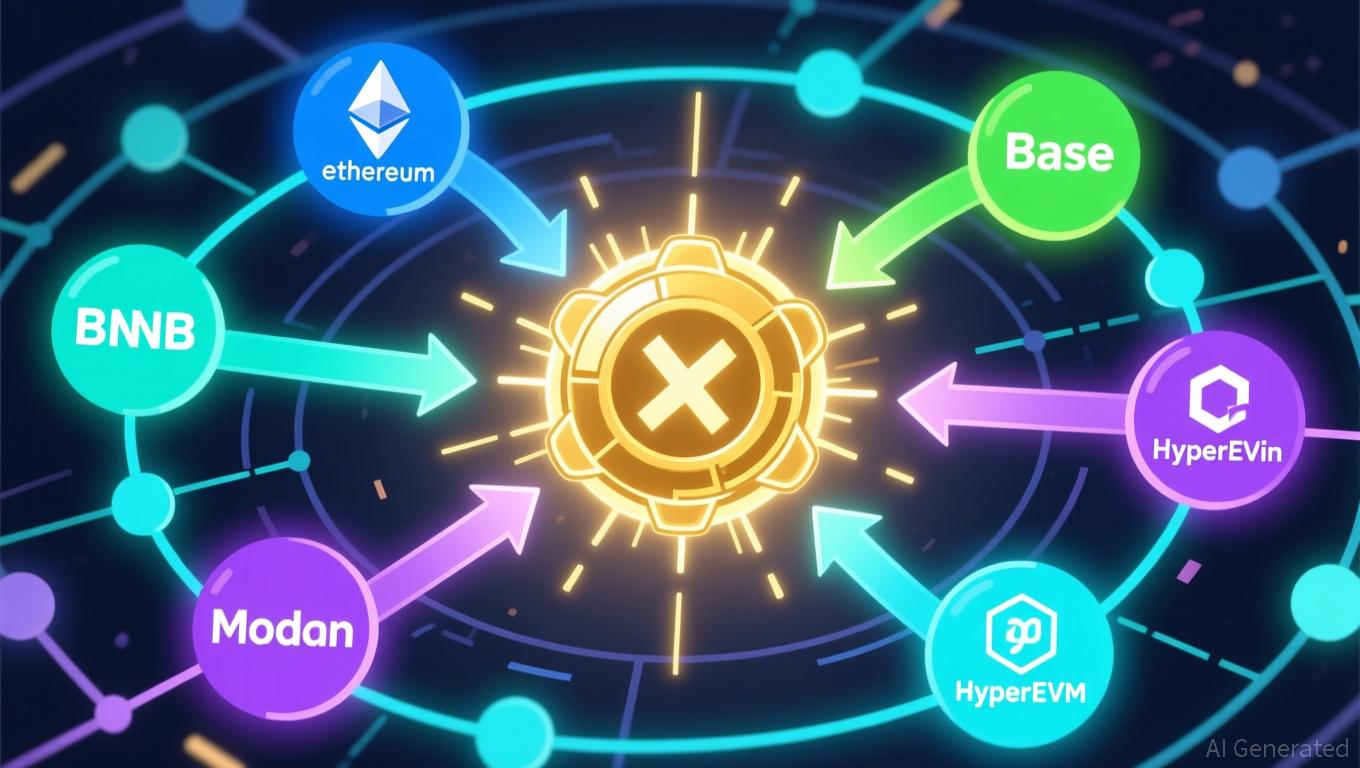

Avail’s Nexus Mainnet Brings Liquidity Together to Address Blockchain Fragmentation

- Avail launches Nexus Mainnet, a cross-chain execution layer unifying liquidity across Ethereum , BNB Chain, and other major blockchains. - The platform uses intent-based routing and multi-source liquidity aggregation to address blockchain fragmentation and inefficiencies. - Developers gain SDKs/APIs for cross-chain integration, while users benefit from simplified transactions and reduced reliance on traditional bridges. - AVAIL token coordinates the network, with future Infinity Blocks roadmap aiming to

Bitcoin News Update: Bitcoin's Plunge Signals Trump's Diminishing Influence, as Crypto Connections Weaken Amid MAGA's Downturn

- Nobel laureate Paul Krugman links Bitcoin's $1 trillion crash to Trump's waning political influence and crypto-linked wealth decline. - Trump family's crypto assets lost $1 billion in value, with Eric Trump's ABTC shares down 50% and memecoins losing 90% of peak value. - Despite losses, complex financial structures like Alt5 Sigma holdings buffer the family, while Krugman ties crypto turmoil to fractured MAGA support. - Trump's pro-crypto policies face scrutiny as Bitcoin's $40k drop undermines his econo