November 18 Key Market Information Discrepancy, A Must-See! | Alpha Morning Report

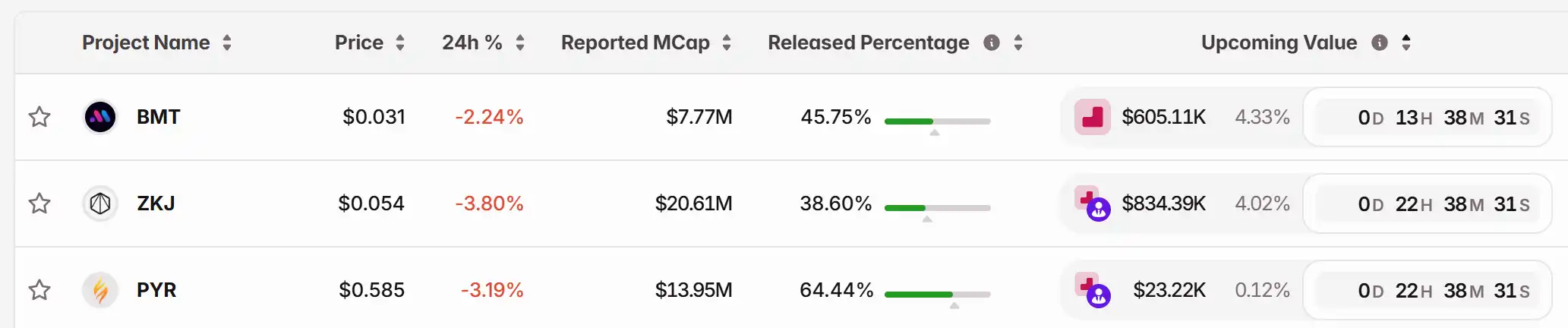

1. Top News: Bitcoin Drops Below $92,000, Ethereum briefly falls below $3,000 2. Token Unlocking: $SMT, $ZKJ, $PYR

Top News

1.Bitcoin Falls Below $92,000, Ethereum Briefly Drops Below $3,000

2.Mainstream Crypto Treasury (DAT) Companies mNAV All Fall Below 1, Strategy Falls to 0.937, Bitmine Falls to 0.83

3.Sentient Airdrop Qualification Registration Now Live

4.Vitalik Criticizes SBF, Says FTX Is Completely Deviating from Ethereum's Core Values

5.Over $800 Million Liquidated in the Past 24 Hours, with Over 154,000 Liquidated

Articles & Threads

1.《Stop Blindly Chasing Airdrops: Six Key Metrics to Identify Truly High-Potential Projects》

Crypto airdrops may seem like "free money," but experienced airdrop hunters know that not every airdrop is worth the gas and effort. Over the past 5-7 years, I've participated in dozens of airdrops, some of which turned into five-figure gains, while others ended up yielding nothing. The key difference lies in whether a thorough evaluation was conducted. In this report, I will attempt to provide a framework for evaluating airdrop potential.

2.《Whales Accelerate Bitcoin Sell-Off, but Is It Yet a Signal of Panic?》

Bitcoin broke below the key $100,000 mark last week, and the selling behavior of "whales" (large holders of cryptocurrency) and other long-term holders has been a significant driver of the recent price weakness. Most blockchain analytics firms define "whales" as individuals or institutions holding 1,000 BTC or more. While the identities of many "whales" remain unknown, blockchain data can still provide clues to their activities.

Market Data

Daily Marketwide Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Franklin's Solana ETF—Will It Surge Past $142 or Fall Short?

- Franklin Templeton files Form 8-A for Solana ETF, nearing NYSE Arca listing after regulatory clearance. - The 0.19% fee ETF offers physical SOL exposure, joining Bitcoin/Ethereum crypto products to meet rising institutional altcoin demand. - Market analysis highlights $142 price resistance for SOL, with ETF inflows potentially driving a $150 breakout or triggering a pullback below $118. - 2025 regulatory shifts enabled rapid commodity-based crypto ETF approvals, spurring innovation like staking-enabled f

Bitcoin Updates: Stocks Connected to Bitcoin Surge as Metaplanet Secures $130M Loan for BTC Acquisition

- Tokyo-listed Metaplanet borrowed $130M against 30,823 BTC collateral amid market downturn, signaling institutional crypto confidence. - The firm aims to expand BTC holdings to 210,000 by 2027 using debt, mirroring MicroStrategy's treasury strategy despite volatility risks. - Shares rose ¥366 as investors back Bitcoin-centric model, though regulators scrutinize such structures amid Asian market concerns.

UK's FCA Pilots Crypto Disclosure Templates to Establish International Standards for Transparency

- UK's FCA approves Eunice to test standardized crypto disclosure templates in its regulatory sandbox, involving major exchanges like Coinbase and Kraken. - The initiative aims to enhance transparency through real-world trials, reflecting FCA's industry-led regulatory approach and 2026 crypto rule roadmap. - Templates developed via 2023 consultation address institutional adoption needs, with potential global influence as EU and US draft their own frameworks. - Challenges include adapting disclosures to cry

Token Cat’s Crypto Strategy: Will Limited Funds Drive International Growth?

- Token Cat appoints Sav Persico as COO to accelerate its crypto and asset management transformation, leveraging his 30+ years in blockchain infrastructure and enterprise operations. - Persico will build a Bitcoin/Ethereum-focused asset framework, develop risk-controlled strategies, and expand blockchain-business synergies as part of the strategic pivot. - A $1B cross-border partnership with Ouyi Industrial aims to integrate automotive expertise with global trade networks, boosting digital efficiency and i