Date: Mon, Nov 17, 2025 | 06:00 PM GMT

The broader crypto market continues to struggle with persistent volatility as Ethereum (ETH) extends its month-long decline of over 21%. This weakness has spilled across major tokens, including Pump.fun (PUMP), which is now exhibiting a clear bearish breakdown on the charts.

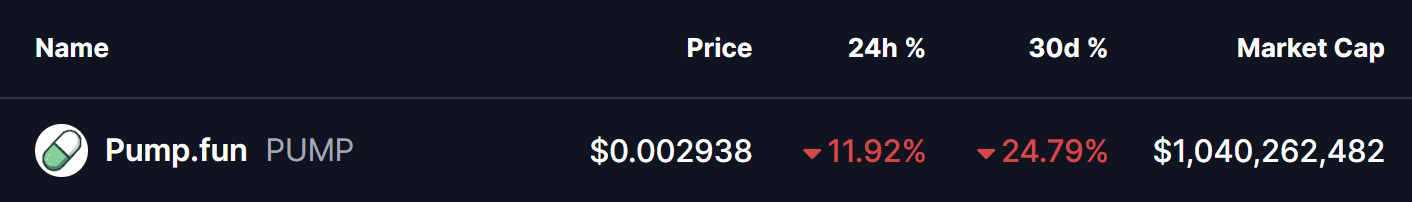

PUMP has dropped more than 11% today, extending its monthly decline to 24% and the latest technical development suggests that the token may be preparing for deeper downside movement.

Source: Coinmarketcap

Source: Coinmarketcap

Head and Shoulders Breakdown

On the daily timeframe, PUMP had been forming a classic head and shoulders pattern — one of the most reliable bearish reversal structures in technical analysis. After failing to push higher from the right shoulder, which peaked around $0.005484 in early November, the token began losing momentum.

From there, PUMP slid toward the neckline support zone near $0.0035. This level had acted as a strong structural base for weeks, but the chart shows that PUMP eventually broke below it, confirming a bearish breakdown. The drop accelerated selling pressure, sending the price down toward the $0.00235 region.

Pump.fun (PUMP) Daily Chart/Coinsprobe (Source: Tradingview)

Pump.fun (PUMP) Daily Chart/Coinsprobe (Source: Tradingview)

This shift marks a significant change in market structure, indicating that any remaining bullish momentum has faded and sellers now have stronger control.

What’s Next for PUMP?

With the breakdown confirmed, traders will be focusing on how PUMP behaves around the neckline — now turned into resistance. If the token attempts a retest but fails to reclaim this zone, the bearish outlook will strengthen further, opening the path toward the next key support levels near $0.002616 and $0.002265.

A continuation move below these ranges could even push PUMP toward new all-time lows in line with the breakdown target projected from the head and shoulders pattern.

However, if buyers manage to reclaim the neckline zone, a short-lived relief bounce could occur. Even then, the broader structure remains bearish, and caution is warranted until the token successfully builds higher lows and reclaims key resistances.