Strategy Adds $836M in Bitcoin

Michael Saylor has done it again. Strategy , the company formerly known as MicroStrategy, has added another massive block of bitcoin to its treasury, buying 8,178 BTC for roughly 836 million dollars between November 10 and November 16. The average price came in at 102,171 dollars per coin. With this move, Strategy now holds an astonishing 649,870 BTC , worth more than 61 billion dollars at current market prices. That’s over three percent of the total bitcoin supply that will ever exist. It’s another reminder that Saylor isn’t simply bullish on bitcoin; he is architecting one of the largest and most aggressive acquisition strategies in modern corporate history.

A Capital Machine Designed for One Purpose

What makes this buy especially interesting is the machinery behind it. The latest accumulation didn’t come from operational cash flow or debt. It was funded almost entirely through proceeds from the company’s perpetual preferred stock programs, including STRK, STRF, STRC, and the newer euro-denominated STRE issuance.

Strategy has effectively built a multi-layered funnel that turns capital markets into a continuous bitcoin acquisition engine. Each preferred instrument offers different dividend structures, conversion terms, and risk profiles, letting the company tap into investor appetite across the spectrum. This isn’t improvisation; it’s a long-term financial structure engineered purely to acquire more bitcoin through every market cycle.

Strategy’s Bitcoin Position Is Now in a League of Its Own

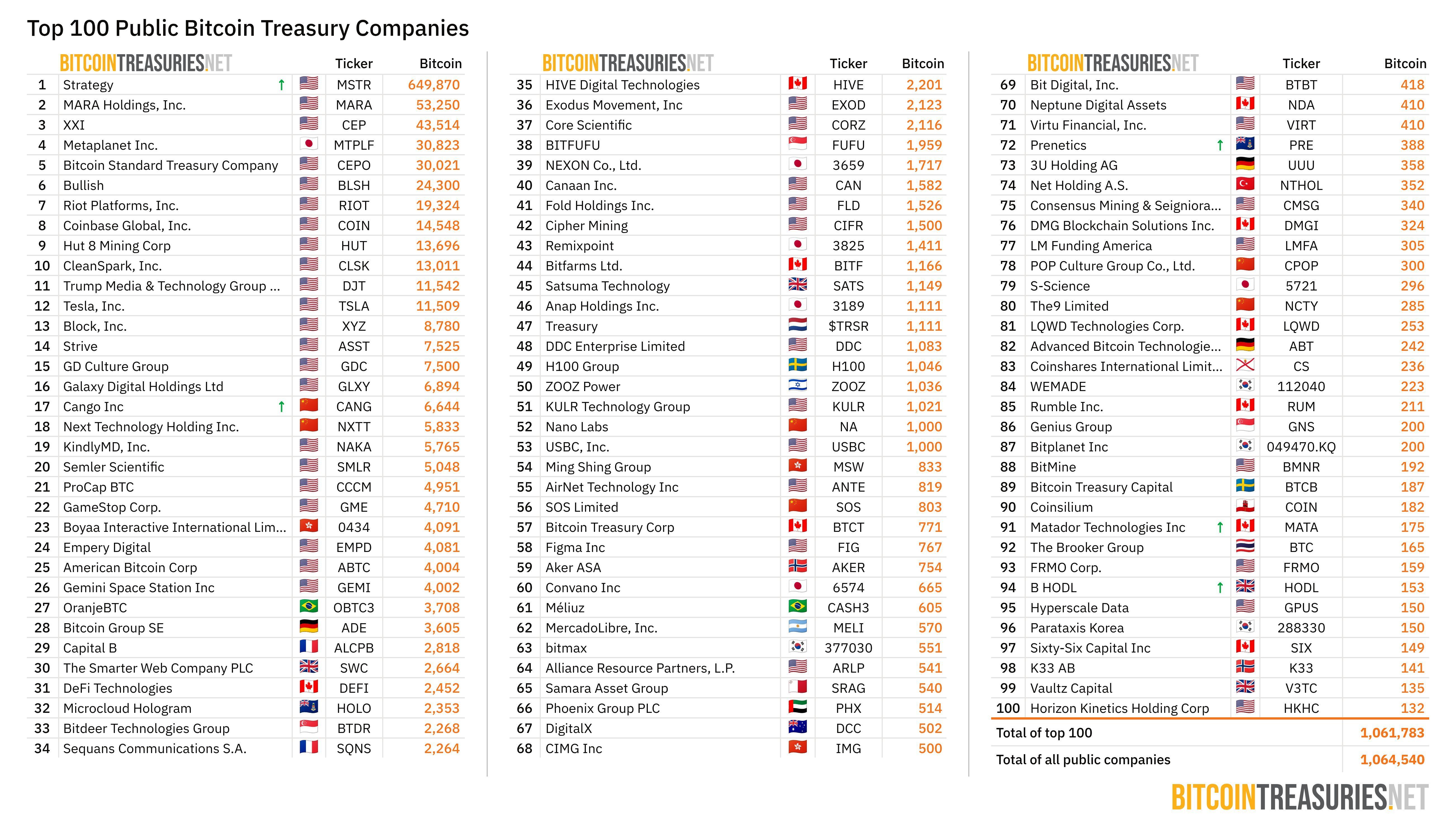

With nearly 650,000 BTC on the books, Strategy towers above every other public company with a bitcoin treasury strategy. It has outpaced not only bitcoin miners and crypto-native firms but also major financial institutions experimenting with digital assets.

For context, Marathon, Tether-backed Twenty One, Metaplanet, and Cantor Fitzgerald-backed Bitcoin Standard Treasury Company sit far behind Saylor’s mountain of holdings. Even if you combine the next several companies in line, they still don’t match Strategy’s total. The scale of this operation matters because the more bitcoin Strategy absorbs, the more long-term supply becomes effectively inaccessible to the open market.

Why the Stock Isn’t Matching the Momentum

Despite the enormous bitcoin haul, Strategy’s stock price has not reflected the same enthusiasm. The company’s market-cap-to-NAV ratio has contracted sharply, its shares remain well below summer peaks, and the stock is down more than 30 percent year-to-date. This disconnect has fueled speculation that Strategy may be forced to liquidate assets if bitcoin weakens further.

Analysts at Bernstein call those fears misplaced. They point out that Strategy’s leverage remains conservative. Its eight billion dollars of debt is small compared to its sixty-plus billion dollars in bitcoin, and its capital programs continue to draw strong institutional demand. According to them, the structure Saylor has built is too robust and too liquid to be pressured into selling bitcoin during a market pullback.

Michael Saylor Says the Rumors Are Nonsense

Last week, rumors circulated online claiming Strategy sold more than 47,000 BTC. Saylor was quick to swat down the speculation, saying the movements detected on-chain were standard custodial rotations rather than sales. He told CNBC that the company is buying aggressively and that more disclosures were coming. The filings this week backed him up. In public and in practice, Michael Saylor stance hasn’t wavered: the company hasn’t sold a single bitcoin, and it doesn’t intend to.

Why This Accumulation Matters for Bitcoin’s Future

With every purchase like this, Strategy is effectively locking away a chunk of the finite bitcoin supply for the long haul. That supply squeeze becomes more pronounced as more institutional players adopt similar strategies.

Even in a year when crypto markets have corrected and sentiment has cooled, Michael Saylor buying continues at full speed. His approach is built to withstand severe downturns. He has said repeatedly that the company’s capital structure can survive a ninety percent bitcoin correction lasting several years. That level of endurance matters because it signals that bitcoin is not simply an investment for Strategy—it’s the company’s operating thesis.

Final Take

What this really comes down to is conviction. Saylor isn’t reacting to headlines, fear, or short-term market noise. He is executing a long-term plan that continues to absorb enormous amounts of bitcoin regardless of price conditions. Each acquisition pushes Strategy further ahead of every other corporate holder and tightens bitcoin’s available supply that much more. The message he keeps sending is simple: they’re not selling, not slowing down, and not changing course.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Unveils ‘Kohaku,’ Ethereum’s Most Significant Privacy Upgrade Yet

Aave Integrates With 12,000 Banks in New App Offering 5% Base Savings Rate

Hong Kong's drive to become a leading crypto center accelerates as AMINA secures institutional approval

- AMINA Bank AG, a Swiss crypto-focused bank, became the first international institution to secure a Hong Kong SFC license for institutional-grade crypto trading and custody services. - The license enables trading in 13 major cryptocurrencies and complies with SFC standards through SOC 1/2 Type 2-certified security frameworks, addressing prior market gaps in regulated offerings. - Hong Kong's crypto market saw 233% trading volume growth in H1 2025, with AMINA planning to expand into tokenized assets and st

Why is Internet Computer (ICP) experiencing significant growth in late 2025: Advancements in Blockchain Infrastructure and Increased Institutional Adoption Propel Expansion

- Internet Computer (ICP) surged 385% in late 2025, with $237B TVL driven by strategic blockchain-AI integration and institutional adoption. - Caffeine AI platform enables natural language dApp development, lowering barriers through reverse-gas token economics and cross-chain interoperability. - Partnerships with Microsoft Azure and Google Cloud address enterprise needs like data sovereignty, while Hong Kong regulatory support boosts institutional confidence. - ICP's 20–40% AI cost reduction and hybrid inf