Firo (FIRO) Hits a 3-Year High — What Risks and Opportunities Are Emerging?

FIRO’s rally highlights its maturing tech and strong sector momentum, but heavy whale supply and regulatory risks challenge its stability.

Firo (FIRO), a privacy coin with Bitcoin-like tokenomics, surged more than 300% in November and returned to its 3-year high. With a market cap still below $100 million, many investors expect its rally to extend further.

However, this explosive growth also comes with hidden risks tied to on-chain data and market volatility. This article examines FIRO’s opportunities and challenges in light of recent developments.

What Opportunities Come With FIRO’s Rally in November?

Firo, previously known as Zcoin, launched in 2016 and became a pioneer in privacy-focused cryptocurrencies. Its nine-year lifespan demonstrates resilience across multiple market cycles, which serves as an initial advantage attracting investors.

“Old names can shine again, but only the ones that kept building deserve to. And I genuinely believe this Dino Coin wave will pull fresh liquidity into the market, reviving momentum and setting the stage for the next Altcoin Season,” investor Tanaka predicted.

Firo was the first coin to deploy Zero-Knowledge (ZK) proofs on mainnet, even before Zcash (ZEC). This technology offers users a superior layer of privacy protection.

ZEC’s recent rally pushed many privacy-themed altcoins upward. As a result, the privacy coin sector became one of the best-performing categories, recording an average gain of 320%, according to Artemis.

As a result, many investors compare FIRO’s trajectory with that of ZEC. They believe FIRO still has room to accelerate and break out of its low-cap status.

“Buying FIRO at $5.3 is like buying ZEC at $5.3,” investor 𝐙𝐞𝐫𝐞𝐛𝐮𝐬 predicted.

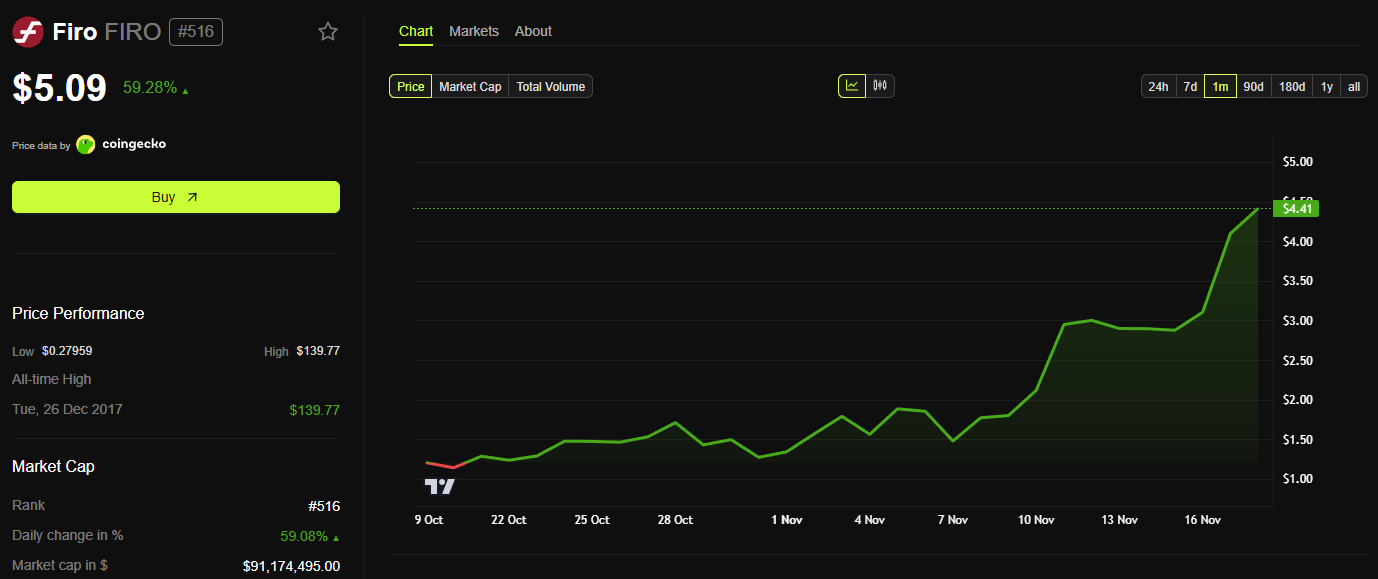

FIRO Price Performance. Source:

FIRO Price Performance. Source:

FIRO Price Performance. Source:

FIRO Price Performance. Source:

BeInCrypto data shows FIRO has surpassed the $5 mark, reaching its highest price since August 2022. The altcoin has ranked as the #1 trending asset on CoinGecko and remained in the top 3 for an entire week.

The biggest highlight at the moment is the upcoming hard fork. Expected to arrive in just two days at block 1,205,100 (November 19, 2025), Firo will upgrade to version 0.14.15.0. The standout feature is the ability to transfer Spark names — digital domains within the Firo ecosystem.

🚨The next hard fork is just around the corner, estimated in about 2 days at block 1,205,100. 🎉This upgrade introduces:✅Spark Name Transfers✅Lower GPU VRAM requirements for miningSpark Names creates privacy-preserving decentralized digital identities where people can pay…

— Firo $FIRO (@firoorg) November 16, 2025

Previously, Spark names were only used for wallet identification. They will now become freely tradable assets, creating an internal “domain economy.” According to Firo’s official blog, this upgrade increases liquidity and encourages community participation. The hard fork is expected to boost demand for FIRO.

What About the Risks?

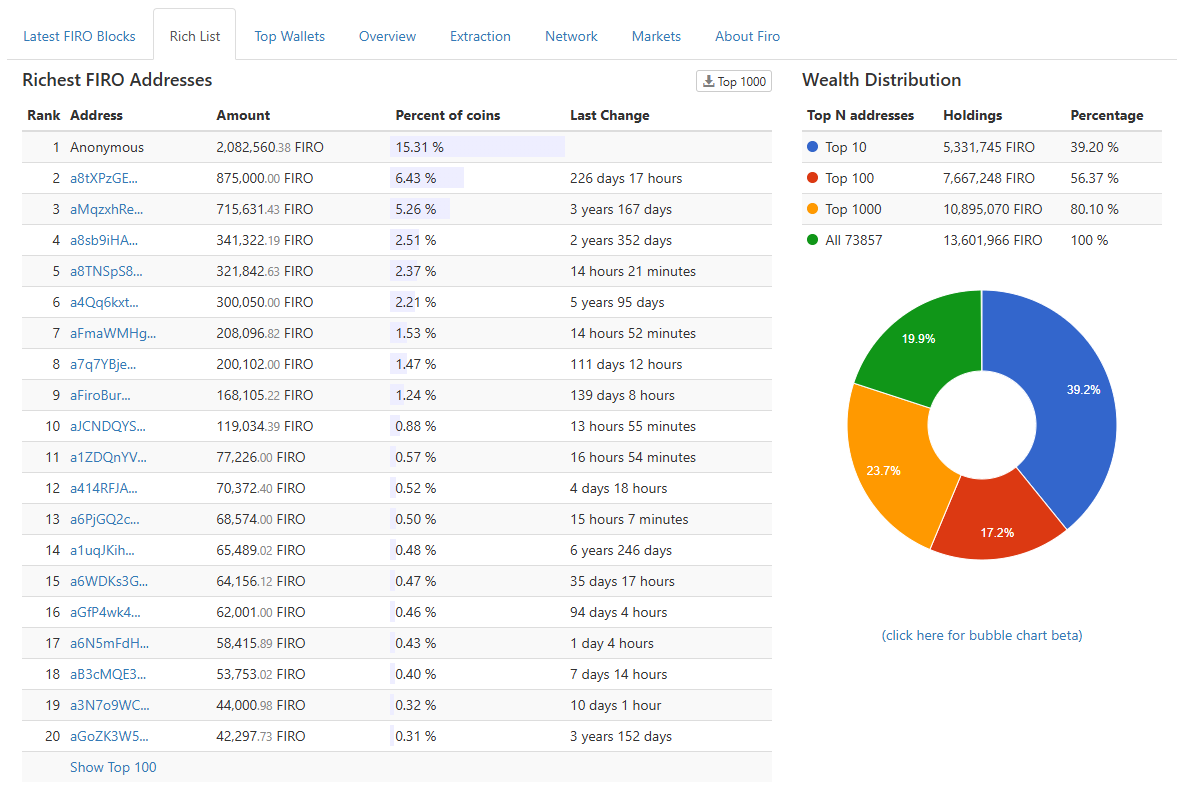

Opportunities come with risks. On-chain data shows the top 10 richest wallets control more than 39% of FIRO’s total supply — an alarmingly concentrated distribution.

Richest FIRO Addresses. Source:

Richest FIRO Addresses. Source:

Richest FIRO Addresses. Source:

Richest FIRO Addresses. Source:

These wallets have remained dormant for years and accumulated FIRO at low prices between 2018 and 2024. With the current price above $5, these holders are nearing break-even or sitting on profits. This situation could trigger large-scale selling if they decide to realize gains.

Privacy coins have historically exhibited strong volatility due to regulatory pressure from governments. FIRO faces the same vulnerability.

Additionally, FIRO and other privacy coins depend heavily on ZEC’s trend. Meanwhile, many analysts warn that ZEC may be forming a new bubble pattern.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Grayscale Seeks Dogecoin ETF Approval: Meme Coin Gains Institutional Traction

- Grayscale files S-1 to convert Dogecoin Trust into spot ETF, seeking SEC approval by Nov 24, 2025. - This follows 2025 crypto ETF success and could drive $500M in inflows, leveraging Coinbase custody and Nasdaq listing. - Bloomberg analyst notes SEC's 20-day review window, suggesting potential rapid approval if no regulatory pushback occurs. - Dogecoin's volatility and regulatory scrutiny pose risks, but institutional adoption and social media momentum may drive growth.

Bitcoin News Update: Bitcoin Faces $83,000 Test as Whale Activity Drives Optimistic Predictions

- Bitcoin whale activity surged, with large holders transferring over 102,900 transactions above $100K and 29K above $1M, signaling a shift from selling to accumulation, per Santiment. - Analysts highlight $83K as a critical Fibonacci level, suggesting a successful defense could reignite Bitcoin's upward trajectory after stabilizing above $92K. - Derivatives markets show neutral funding rates and $83B daily volumes, indicating active participation despite drawdowns, while whale outflows suggest structured

Ethereum News Update: BlackRock's ETH Sell-Off Triggers Downward Trend as $2B Exits ETFs

- Ethereum ETFs face $2B outflows as BlackRock deposits $175.93M ETH into Coinbase Prime, signaling strategic offloading. - Death Cross pattern and oversold RSI highlight technical fragility, with price needing $3,200 to avoid $2,500 retest. - Institutional selling and macroeconomic uncertainty drive $73B ETP outflows since October, deepening bearish sentiment. - Analysts warn BlackRock's absence from crypto purchases since mid-2025 risks prolonged capitulation below $2,800 support.

Chainlink’s cross-chain advancements enhance liquidity, with LINK aiming to surpass the $14 mark

- Chainlink (LINK) partners with TAO Ventures and Project Rubicon to boost liquidity via CCIP, targeting a $14 price breakout. - The collaboration tokenizes Bittensor subnets into ERC-20 assets, enabling cross-chain DeFi access and staking rewards without selling assets. - Technical indicators (MACD convergence, ADX 37) suggest upward momentum, with analysts projecting $15–$20 price targets if $14 resistance breaks. - Institutional and retail interest grows as Chainlink's interoperability role strengthens,