XRP Price Is One Step From a Breakdown — Or a Cycle Bottom?

The XRP price sits on one level that decides everything. Momentum has weakened, but a major support band and a fresh yearly low in NUPL suggest a bottom may be forming. If buyers defend $2.154, XRP can attempt a rebound. If not, the chart opens to $2.065 and deeper levels.

The XRP price is down almost 9% this week, showing clear weakness after failing to hold its recent rebound. Sellers remain in control for now, but one support level continues to hold.

Whether this level survives decides if XRP forms a cycle bottom or slides into a deeper correction.

Weakness Shows Up In Momentum, But Support Still Holds

The first sign of pressure comes from momentum. Between October 13 and November 10, the XRP price made a lower high while the Relative Strength Index (RSI) made a higher high. RSI tracks buying pressure, and this pattern is called a hidden bearish divergence. It shows buying strength was rising, but not enough to push the price up.

That explains the week’s decline.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

XRP Flashes Bearish Divergence:

TradingView

XRP Flashes Bearish Divergence:

TradingView

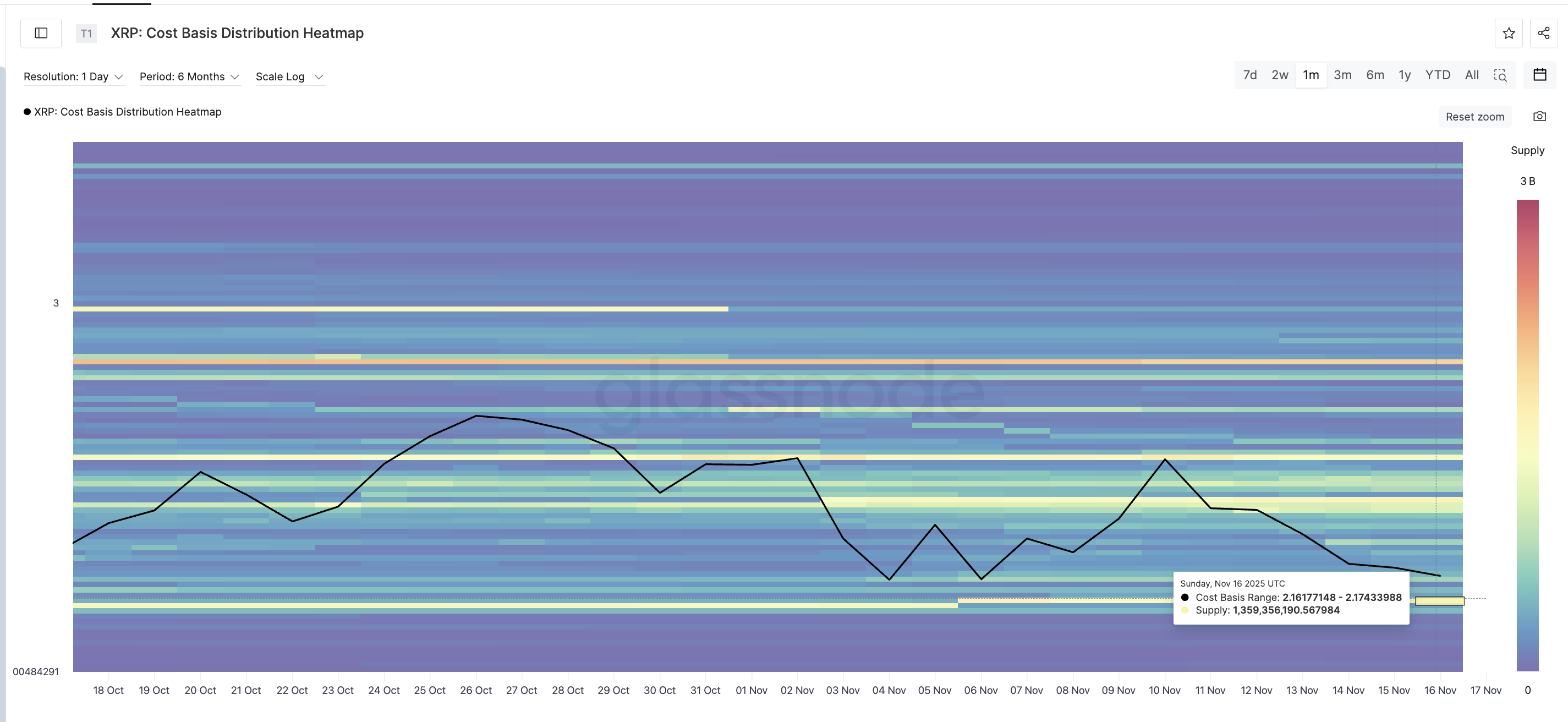

Even with that weakness, the $2.154 zone still holds. This is not just a chart level. The cost-basis heatmap confirms it. Between $2.161 and $2.174, XRP has a huge supply cluster of 1.359 billion tokens.

That makes this band the strongest support in the near term. The $2.154 level on the chart sits immediately under this cluster and could be the only thing standing between a bounce and a breakdown.

Support Cluster Could Limit Downside:

Glassnode

Support Cluster Could Limit Downside:

Glassnode

If this band holds, the divergence can be considered “played out,” opening the door for a recovery attempt.

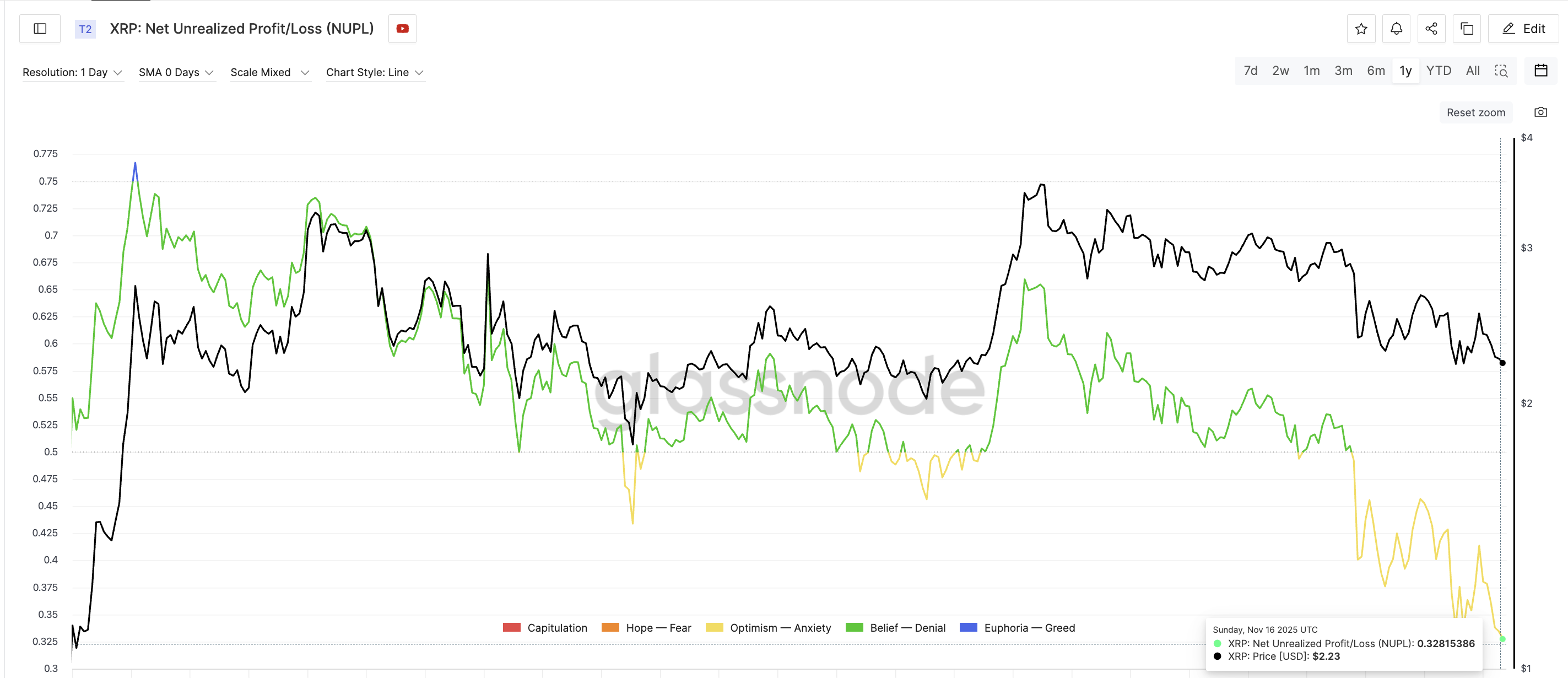

Sentiment Shows A Bottom May Be Forming

The second signal is psychological. XRP’s Net Unrealized Profit and Loss (NUPL) fell to 0.32 on November 16, its lowest reading in a year. NUPL measures investor sentiment—whether wallets hold paper profit or loss.

The last time NUPL hit a yearly low (0.43 on April 8), the XRP price rallied from $1.80 to $3.54 by July 22. That was a 96% rise.

XRP Flashes A Bottoming Signal:

Glassnode

XRP Flashes A Bottoming Signal:

Glassnode

This time, the NUPL is even lower, which means sentiment has reset more deeply. If the $2.154 support holds, the same type of bottoming behavior could form here, too.

XRP Price Levels To Watch Next

If the XRP price loses $2.154, the support zone breaks. In that case, there is little strong demand until $2.065, and falling under $2.06 opens a path toward even lower levels.

If buyers defend support instead, the first upside test sits at $2.394, a level with several prior rejections. A move above $2.394 starts a real rebound attempt.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

If momentum improves further, XRP can push toward $2.696, and breaking that level brings a much stronger recovery into view.

For now, everything comes down to one question: Can the $2.154 support band survive long enough for sentiment to flip? If yes, the XRP price may be forming the same kind of bottom that drove its last major rally.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Unexpected Bitcoin Price Fluctuation: Was It Due to a System Error or a Natural Market Adjustment?

- Bitcoin's 2025 volatility combines technical glitches (e.g., Binance's stablecoin de-pegging) and macroeconomic/regulatory factors like ETF outflows and geopolitical tensions. - Binance's October 10 technical disruptions exposed liquidity vulnerabilities, with $283M compensation for forced liquidations and transfer delays. - Institutional investors adapt via strategies like Strategy's preferred-share Bitcoin accumulation and Hyperscale Data's dollar-cost averaging to mitigate price swings. - ETF liquidit

The Magnificent 7's Hold on 37% of the S&P: Market Bubble or the New Standard?

- NYU professors Galloway and Damodaran warn of a "bubble" in the Magnificent 7 tech stocks, which control 37% of the S&P 500's value. - They highlight unsustainable AI-driven valuations, with Nvidia's $1T revenue projection requiring 80% perpetual gross margins deemed unrealistic. - Market volatility grows as S&P 500 faces its longest losing streak since 2025, while alternative assets like trading cards gain traction amid investor caution. - AI optimists counter that robust cash flows and cross-industry i

Bitcoin News Update: $3 Billion Withdrawn from ETFs as Investors Exit, Altcoin Inflows Indicate Changing Preferences

- Bitcoin faces selloff as 65,200 BTC ($5.8B) transferred to exchanges, with prices below $103,227 realized cost basis. - Bitcoin ETFs see $3B in outflows over three weeks, led by Grayscale and BlackRock , as investors shift to cash and altcoin ETFs. - Altcoin ETFs attract $500M in inflows, contrasting Bitcoin's 13% average loss, while Ethereum ETFs lose $1.2B amid weak derivatives markets. - Technical indicators show fragile Bitcoin at $95,000 with RSI at 34, risking further declines if support below $94,

LCPC AI's blockchain solution transforms the opaque nature of AI into a transparent and trustworthy system

- LCPC AI launches Ethereum-based blockchain platform merging AI with decentralized infrastructure to address digital trust gaps. - Platform's "on-chain intelligence engine" ensures transparent AI model training and decision-making via blockchain traceability. - Citigroup reports $2.24 EPS beat and $22.09B revenue growth, attracting institutional investors amid macroeconomic risks. - LCPC's Global Alliance Program expands while Citigroup faces regulatory scrutiny, highlighting fintech's disruptive converge