XRP Dip Buyers Are Active — So Why Is the Price Still Falling?

The XRP price has corrected despite short-term buying rising this month. Long-term holders are selling far more aggressively, and money flow has turned negative, leaving the token stuck under key resistance levels. Until buyers reclaim $2.38, XRP remains vulnerable to further downside.

XRP price is down almost 8% in the past week, and even though the last 24 hours have been flat, the absence of red cannot be mistaken for strength.

The chart and on-chain data indicate that XRP is under real pressure, despite one group of investors continuing to buy the dip.

Short-Term Holders Keep Buying — But One Group Doesn’t Agree

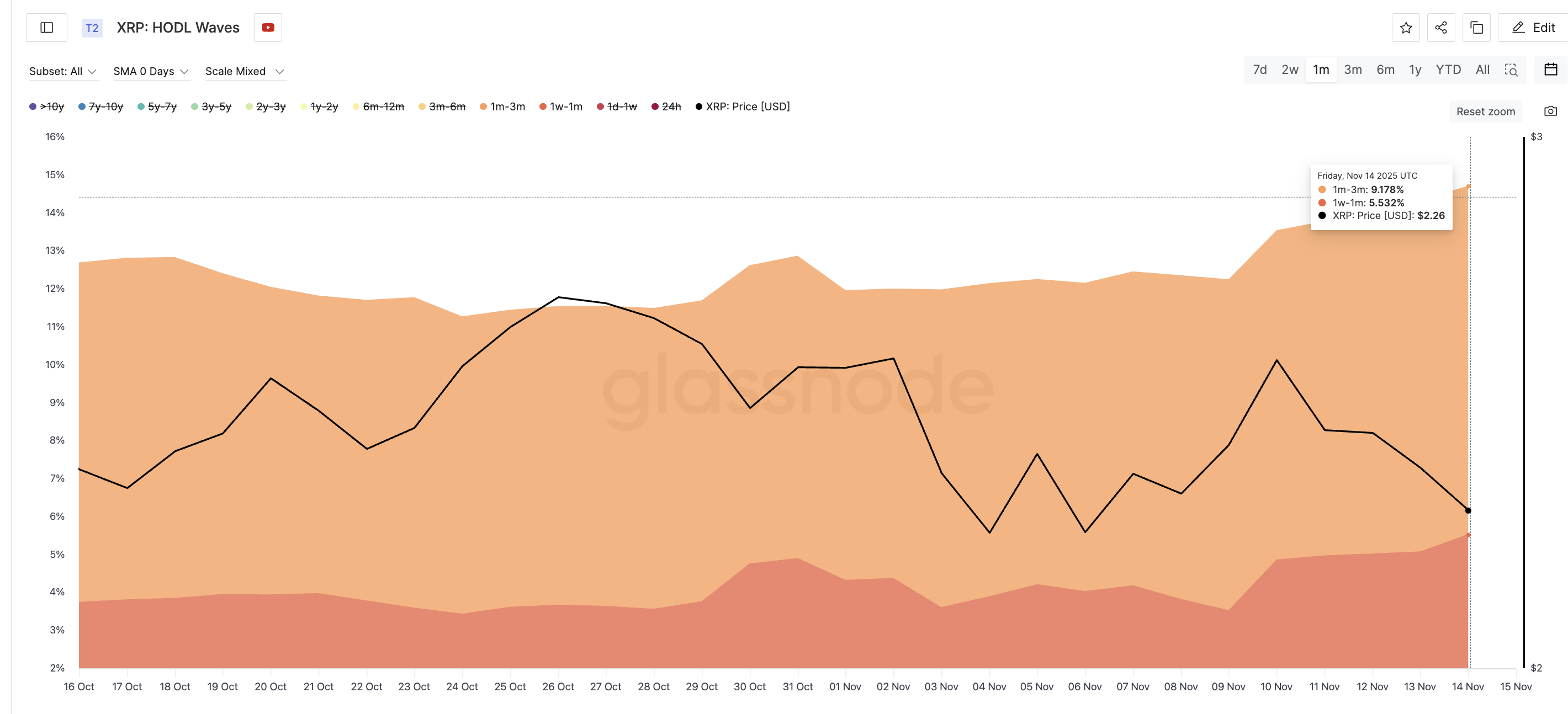

HODL Waves — a metric that shows how much supply each holding-duration group controls — reveals that two short-term cohorts have been steadily accumulating XRP through the month.

On October 16, wallets holding XRP for 1–3 months controlled 8.94% of supply. As of November 14, they hold 9.17%.

Another short-term cohort, the 1-week to 1-month group, has increased from 3.74% to 5.53% of the supply in the same period.

Dip Buying Remains Active:

Glassnode

Dip Buying Remains Active:

Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Despite the XRP price dropping 7.8% over the past 30 days, these groups are accumulating, likely positioning for short-term bounces.

But this buying doesn’t seem strong enough to lift the price for one key reason.

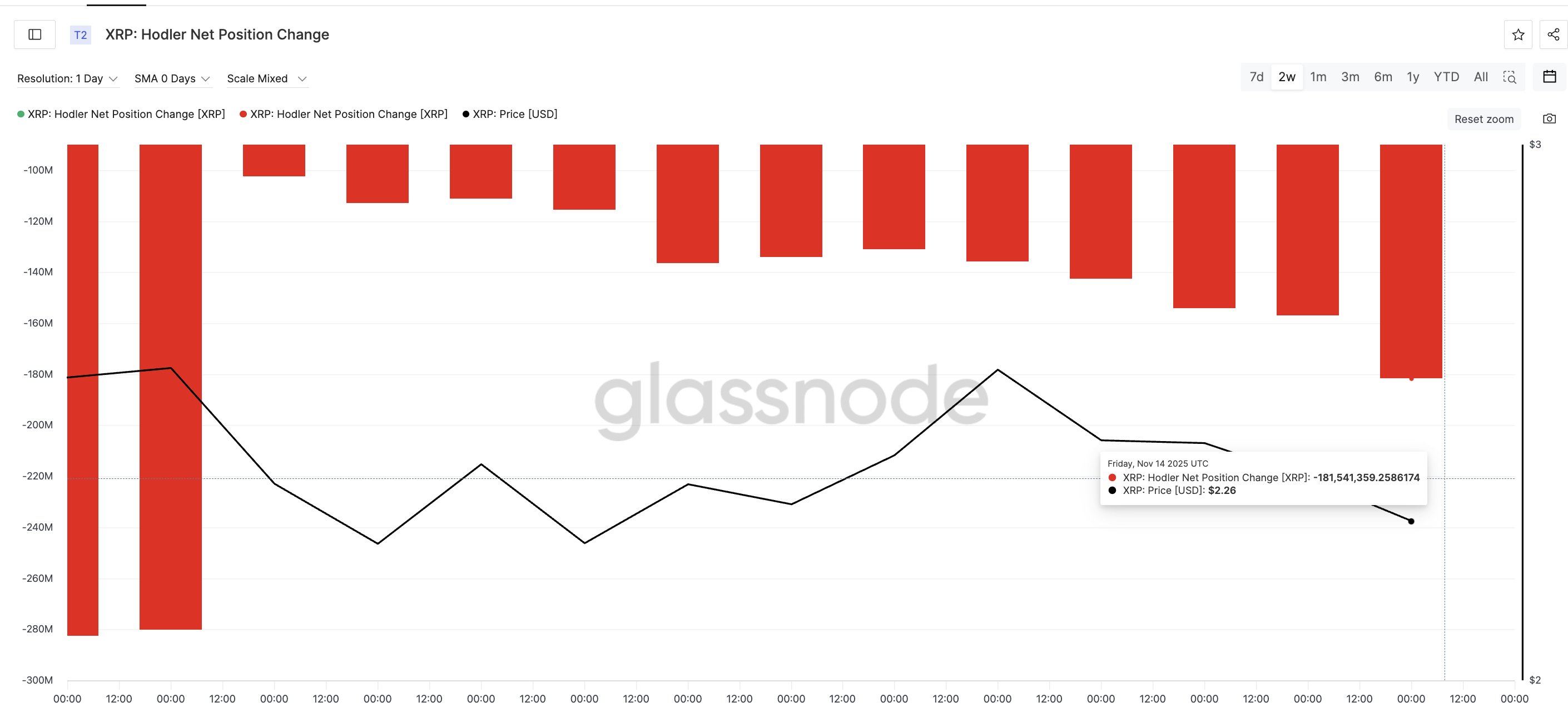

The Hodler Net Position Change — a metric that tracks the amount of long-term investor supply entering or leaving wallets — indicates that long-term holders are selling aggressively. It showed heavy negative flow on November 3, when long-term wallets removed 102.50 million XRP. Instead of easing, outflows continued to rise.

XRP HODLers Keep Selling:

Glassnode

XRP HODLers Keep Selling:

Glassnode

By November 14, the number had jumped to 181.50 million XRP: a 77% increase in long-term selling pressure in less than two weeks.

This is the core reason the XRP price was unable to bounce: short-term buying is being overwhelmed by long-term exits.

XRP Price Feels the Pressure as Big Money Steps Back

On the chart, XRP is still struggling to break above $2.26, a strong 0.618 Fibonacci resistance level. The push higher is weakening because money inflows are fading rapidly.

The Chaikin Money Flow (CMF) — which measures buying and selling pressure — has plunged since November 10. It now sits at –0.15, showing net outflows. CMF has also broken below a descending trendline, indicating that larger investors are withdrawing rather than adding. When CMF stays negative while breaking trend support, upside attempts usually fail.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

If weakness continues, XRP risks losing $2.17, exposing a deeper move toward $2.06. A breakdown below $2.06 would invalidate any short-term bullish attempts.

The only way to regain momentum is a clean daily close above $2.38 — a level that has rejected the price multiple times this month. Clearing it could open a path toward $2.57 and flip the near-term structure bullish.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can a Sixteenfold Increase in Throughput Overcome Skepticism as Celestia's Token Drops by 97%?

- Celestia launches "Matcha" upgrade, boosting network throughput 16x and reducing token inflation by half to 2.5%. - The update enhances cross-chain scalability by expanding block size to 128 MB, positioning Celestia as a modular infrastructure for dApps and DeFi. - TIA token saw 6% short-term gains post-announcement but remains 97% below its 2024 peak, raising questions about market confidence. - Analysts debate the upgrade's impact, with some praising its potential to drive adoption while others warn of

Levi's Shares Climb Amid Interest Rate Optimism, Yet Tariffs and Weaker Demand Weigh on Future Prospects

- Levi's shares rose 3.4% amid Fed rate-cut optimism, but CEO warned tariffs remain a supply chain challenge. - Trade barriers force operational adjustments as tariffs shift from temporary disruptions to long-term costs. - Analysts highlight sluggish demand and 3.2% projected growth, citing margin pressures and brand relevance concerns. - Stock trades at 14.4x forward earnings, underperforming rivals like VF Corp. amid evolving consumer spending patterns.

Bitcoin News Today: Experts Divided on Bitcoin's $200K Forecast—Brandt Predicts 2029, Others Push for 2025

- Veteran trader Peter Brandt predicts Bitcoin will hit $200,000 by Q3 2029, contrasting with peers like Tom Lee (2025) and Cathie Wood ($1M by 2030). - Bitcoin's current $86,870 price reflects a 30% decline from its 2025 peak, with ETF outflows correlating to 3.4% price drops per $1B withdrawal. - XRP gains institutional traction via $179.6M ETF inflows, while Solana struggles below $130 amid bearish pressure. - CME Group plans spot-quoted futures for XRP/Solana by Dec 15, 2025, aligning with rising altco

Telegram Connects Web3 and Traditional Finance Through AI-Driven DeFi Boom

- Telegram's TON token surged 8.33% to $1.60, outperforming crypto markets amid ecosystem growth and institutional adoption. - Pavel Durov's COCOON AI platform bridges DeFi and AI tools, integrated into Telegram's 900M-user base for decentralized finance. - Tokenized stocks, digital collectibles (e.g., Lamborghini NFTs), and Chainlink integration expand TON's utility in Web3 and traditional finance. - Bitstamp listing, Coinbase/Gemini backing, and 15% trading volume surge reinforce TON's bullish technical