Key Notes

- The largest whales on Hyperliquid are going short as Bitcoin consolidates around $96,000.

- Bitcoin’s social dominance signals severe retail panic and FUD.

- The broader crypto market is seeing pressure from both macro and micro factors.

Bitcoin’s ( BTC ) fall below the crucial $100,000 mark last week triggered a wave of short positions from massive whales on Hyperliquid.

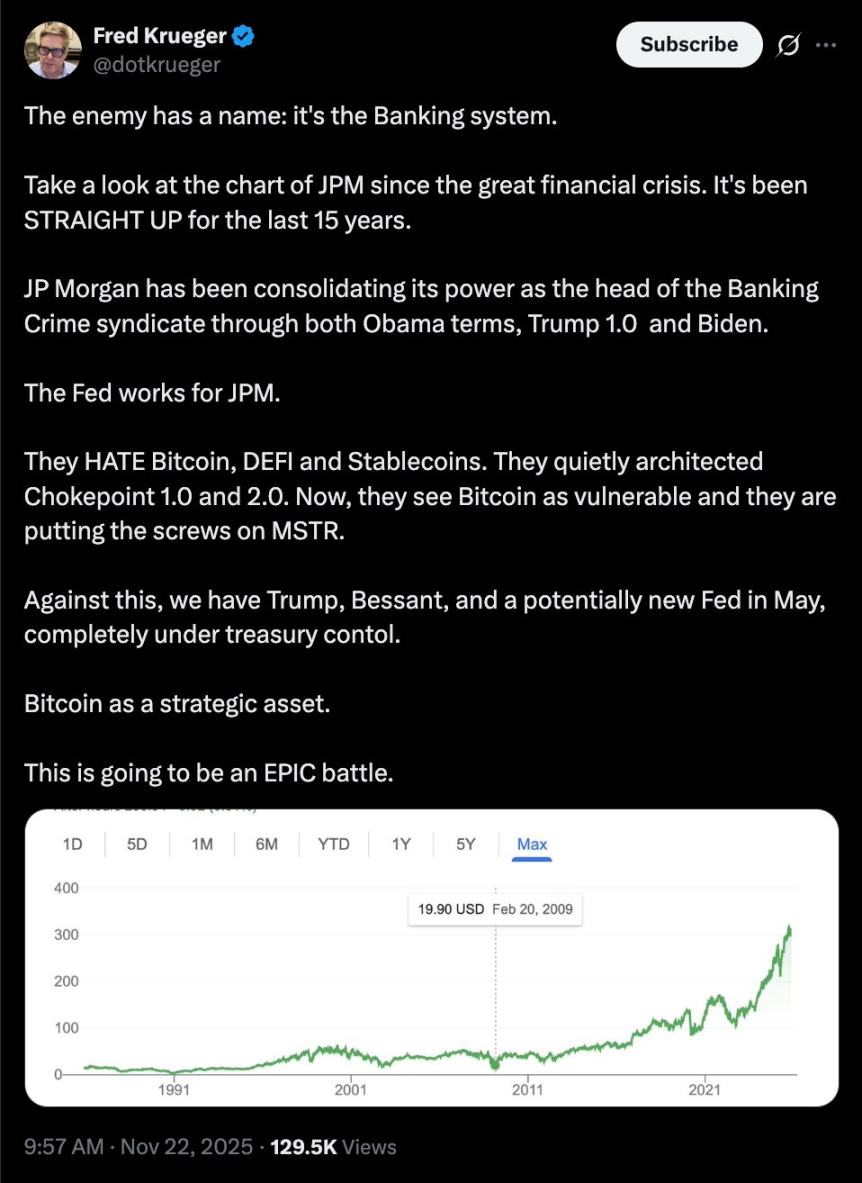

The largest Hyperliquid whales, with over $50 million in digital assets, have been heavily betting on a further crypto market correction, according to data from Coinglass.

Hyperliquid’s “Leviathans” dominating the market with short positions | Source: Coinglass

Data shows that the so-called Hyperliquid “Leviathans” – referring to a mythical sea monster to illustrate their size – currently have $3.44 billion in open positions, comprising $1.15 billion in longs and $2.29 billion in shorts, on the perpetual exchange .

These whales, with a size of over $50 million, are the only traders betting heavily on a deeper crypto market fall.

According to Coinglass data, the traders’ sentiment rises as their sizes decline; the most bullish traders are the so-called “shrimps,” which have a wallet size of up to $250.

Bitcoin’s Social Dominance Shows Panic

Following Bitcoin’s fall below $95,000 on Friday, Nov. 14, the sense of fear, uncertainty, and doubt among the crypto community skyrocketed.

According to an X post by Santiment, the Bitcoin social dominance spiked to four-month highs, a level last seen in mid-July.

📈 Though not a guaranteed crypto bottom signal, probabilities of a market reversal greatly increases when social dominance for Bitcoin surges. During Friday's dip below $95K, discussion rates hit a 4-month high, signaling severe retail panic & FUD.

pic.twitter.com/qn8HFmy3jv

— Santiment (@santimentfeed) November 16, 2025

The surge in Bitcoin’s social dominance was followed by retail panic and FUD, which consequently triggered a price correction , from $120,000 to $112,000 within two weeks, for the leading asset.

Currently, Bitcoin is seeing similar sentiment, and Santiment is hinting at “probabilities of a market reversal.”

One of the reasons behind the market-wide correction is the massive outflows from Bitcoin-based exchange-traded funds in the US. Coinspeaker reported that spot BTC ETFs recorded a net outflow of $1.8 billion last week.

According to a Barron’s report , investors are shifting away from riskier assets, such as cryptocurrencies, due to concerns about shaky economies and high valuations in tech and AI stocks.

However, this cannot be a guaranteed bottom signal for the crypto market. When large whales go against the broader market and the crowd wanders in uncertainty, history suggests something big might be brewing.