What Crypto Whales are Buying Amid the Bear Market

Crypto whales are buying three tokens even as the market slips. Optimism, Aster, and Maple Finance show strong 30-day accumulation across major holder groups, hinting at early positioning if the bear market arrives.

The cryptocurrency market has spent most of November in the red, with the TOTAL index dropping approximately 20% month-over-month, before rebounding briefly at press time. That weakness has revived talk that a new bear market may already be starting.

Yet despite the fear, crypto whales are buying, which shows that the biggest wallets are positioning early instead of exiting. These wallets are quietly adding to three tokens that are not hype-driven but supported by real activity and fundamentals. Their 30-day accumulation suggests early preparation in case the broader market breaks lower.

Optimism (OP)

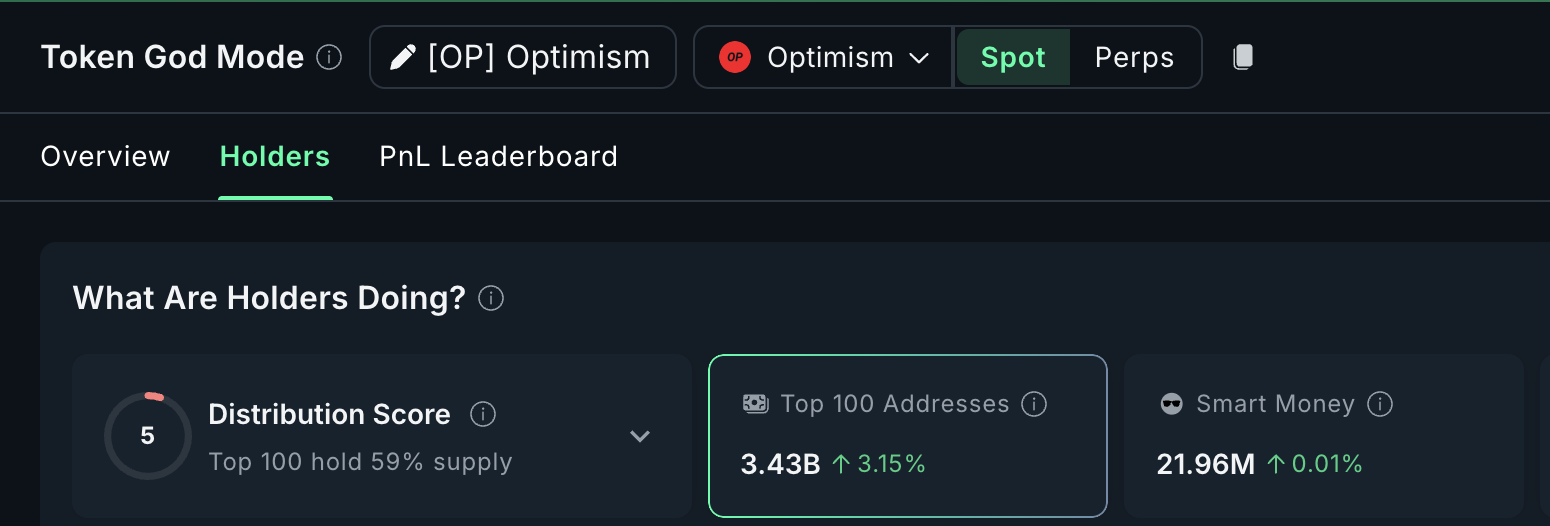

The first token that crypto whales are buying, while expecting a bear market, is Optimism (OP). The broader crypto market has dropped sharply over the past month, and this altcoin is down 13.3%, yet the biggest OP whales show firm conviction.

The top 100 Optimism addresses have increased their holdings by 3.15% over the last 30 days. At today’s OP price, that addition is worth roughly $54 million, showing that mega whales are not shaken by market weakness.

Optimism is one of the larger Layer-2 scaling projects, which could be why whales see long-term value even if market sentiment weakens.

OP Holders:

Nansen

OP Holders:

Nansen

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Their confidence lines up with the chart. On the two-day timeframe, OP’s price made a lower low between April 7 and November 3, while the Relative Strength Index (RSI) formed a higher low.

The RSI measures momentum to show when an asset is overbought or oversold. This mismatch is a bullish RSI divergence, a signal that often appears when downside pressure is fading and a larger trend reversal may be forming.

Crypto whales often look for these shifts when positioning early into altcoins.

For that reversal to activate, OP needs a clean break above $0.47, a level that has blocked every rally since mid-October. A breakout there opens the path to $0.61, and even $0.85 if sentiment improves.

Optimism Price Analysis:

TradingView

Optimism Price Analysis:

TradingView

On the downside, losing $0.38 puts $0.31 back in play. A breakdown below $0.31 exposes $0.23 and would invalidate the bullish setup whales seem to be positioning for.

Aster (ASTER)

The next token crypto whales are buying is Aster (ASTER). The pace here is significantly faster than what we saw in Optimism. Over the past 30 days, whales have expanded their holdings by 140%, pushing their total stash to 67.03 million ASTER.

At the current price of nearly $1.13, the total whale stack is worth approximately $75.7 million, with nearly $44 million coming from recent buying.

Smart money wallets have also moved in the same direction. Their holdings have jumped 678% over the past month.

Aster Holders:

Nansen

Aster Holders:

Nansen

The chart supports the actions these wallets are taking. The ASTER price has broken out of a falling channel on the 12-hour chart, indicating that the bearish trend is losing force. You can also see a clear standard bullish RSI divergence between October 17 and November 14.

The ASTER price made a lower low during that period, while the RSI made a higher low. That shift suggests momentum is turning, and price could follow if buyers stay active.

Short-term price action already reflects some of this. Aster is up almost 9% in the past 24 hours, but the bigger picture still leans toward a reversal rather than a simple bounce.

If this structure continues to hold, the next major hurdle sits at $1.29. This level blocked the rally attempt on November 2, so a clean close would confirm stronger upside.

If that break happens, Aster could stretch toward $1.59 next.

ASTER Price Analysis:

TradingView

ASTER Price Analysis:

TradingView

On the downside, $1.11 remains the first line of support. Losing $1.11 opens the path to $1.00, and if that fails, the deeper level at $0.81 would come into play.

Maple Finance (SYRUP)

The third token crypto whales are buying, expecting a bear market, is Maple Finance (SYRUP). Maple is a DeFi lending project that focuses on institutional credit. Its setup is bullish, but in a more measured way compared to Optimism and Aster.

Over the past 30 days, the top 100 mega-whale addresses have increased their holdings by 3.47%, raising their combined stash to 1.11 billion SYRUP.

At the current price, the total mega-whale stack is valued at approximately $499.5 million. Other holder groups are moving in the same direction.

Smart money wallets have added 1.86%, and regular whales have increased their holdings by 4.57%. When all these groups point in the same direction, it usually reflects rising confidence.

SYRUP Holders:

Nansen

SYRUP Holders:

Nansen

The chart shows why traders might be positioning here. SYRUP is trying to complete an inverse head and shoulders pattern (for quite some time now).

The neckline is currently positioned near $0.53. If the price moves above it, the breakout becomes valid, and the target would extend toward $0.65 or even higher.

There is also the On-Balance Volume (OBV) trend to consider. On-Balance Volume (OBV) is an indicator that tracks buying and selling pressure. Buying has appeared on OBV, but the indicator is still sitting under a falling trendline that began around October 14.

For a stronger trend reversal, whales likely want to see both: a break above the neckline at $0.53 and OBV breaking that trendline at the same time.

SYRUP Price Analysis:

TradingView

SYRUP Price Analysis:

TradingView

When price and OBV break together, rallies tend to hold better.

For now, the setup shows conviction, not confirmation. Yet, if buyers fail and the price slips, the invalidation sits at $0.38. A drop under $0.38 would weaken the pattern and could push SYRUP toward $0.28.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Today: "Solana Treasury Allocates Billions in Staking, Offering 7.7% Returns Amid Ongoing Market Skepticism About Crypto Rebound"

- Upexi , a Nasdaq-listed Solana treasury firm, reported $66.7M net income in Q1 2026, driven by $78M in unrealized gains from its 2.18M SOL holdings. - The Solana treasury sector now holds 24.2M SOL ($3.44B), with Upexi ranking fourth and staking yields averaging 7.7% as a corporate asset class. - Market volatility triggered defensive moves like Upexi's $50M share buyback, while its stock trades at 0.68x NAV amid broader crypto skepticism. - Solana's on-chain activity outpaces Ethereum , with TVL reaching

COAI's Significant Price Decline: The Result of Leadership Instability, Ongoing Legal Issues, and Ambiguous Regulatory Environment

- COAI Index fell 88% YTD in 2025, driven by AI/crypto AI sector selloff amid governance failures and regulatory uncertainty. - C3.ai's leadership crisis and unresolved lawsuit eroded investor trust, compounding COAI's decline as index cornerstone. - Vague CLARITY Act left AI-based crypto projects in legal gray zones, triggering risk-off trading toward established tech stocks. - C3.ai's $116.8M Q1 loss and sector-wide weakness highlighted structural risks despite 21% revenue growth. - Analysts debate if CO

MMT Value Forecast and Investor Outlook for November 2025: Evaluating Reliability During Economic Changes

- MMT token surged 1,300% in Nov 2025 due to Binance listings, airdrops, and institutional investments. - 1607 Capital increased MMT-linked fund stake by 84.7%, but dividend sustainability remains unclear. - Fed policy and missing inflation data (due to 2025 government shutdown) cloud macroeconomic alignment. - MMT's volatility ($4.40 to $2.54) highlights speculative nature despite structural catalysts. - Long-term credibility depends on macroeconomic clarity and Fed policy shifts, not just exchange-driven

LUNA Declines by 0.62% as Ongoing Yearly Downtrend Persists in Uncertain Market Conditions

- LUNA fell 0.62% on Nov 16, 2025, continuing an 80.61% annual decline amid crypto market volatility. - The drop reflects macroeconomic pressures, regulatory scrutiny, and waning investor risk appetite in digital assets. - Technical analysis shows broken support levels and weak buying pressure, indicating a prolonged bearish phase. - Backtesting reveals sharp declines often trigger panic selling and sector-wide market erosion, compounding losses. - Prolonged depreciation risks eroding investor confidence u