VeChain’s Historic Best Month Isn’t Helping: Why Traders Are Avoiding VET in November 2025?

VeChain is attempting a November rebound, yet stagnant open interest and fading trader confidence threaten its recovery outlook.

VeChain has posted a modest recovery this month after a sharp October decline, but the recent price bounce has not been strong enough to reclaim lost ground.

VET rose more than 20% in the past week, yet it remains far below pre-crash levels. November has historically delivered strong returns, but traders appear unconvinced this year.

VeChain Has Lost Traders’ Confidence

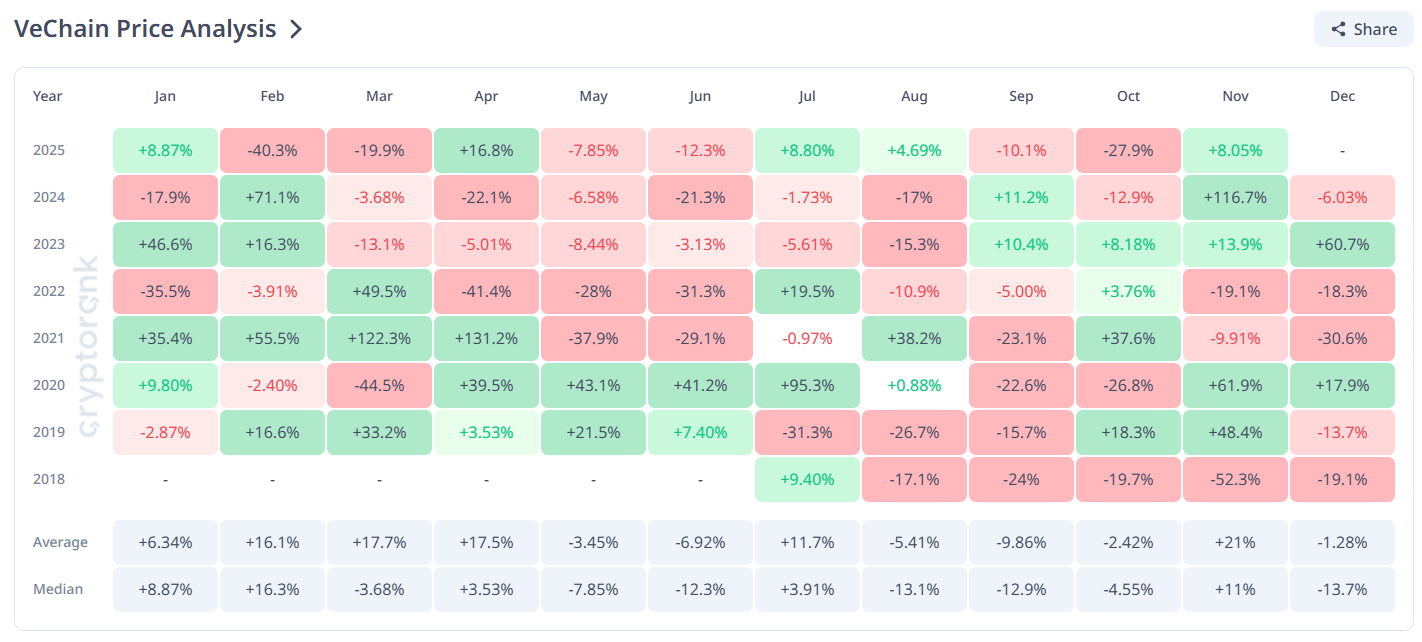

VeChain’s price performance over the last seven years shows November has usually been its strongest month. The median return of 10.9% and the average return of 20.9% stand as the highest among all months. These gains often come after periods of muted activity, giving long-term holders reason to expect seasonal strength.

However, investors should exercise caution. December has been a difficult month for VET, often reversing November’s momentum. The altcoin has regularly posted losses during this period, signaling that any gains in November may not carry into year-end.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

VeChain Historical Performance. Source:

VeChain Historical Performance. Source:

Market participants remain cautious despite historical tailwinds. VeChain’s open interest (OI) has not recovered since the October crash, when it fell from $110 million to $28 million. That figure has remained unchanged for more than a month, pointing to weak conviction among traders.

This stagnant OI suggests that investors are not yet willing to deploy fresh capital into VET. Low derivatives activity can limit price strength. Furthermore, the lack of renewed participation signals that sentiment remains fragile heading into the final weeks of 2025.

VET Open Interest. Source:

VET Open Interest. Source:

VET Price Is Breakout Remains

At the time of writing, VET is forming a descending wedge pattern and trades at $0.0168. The token sits just below the $0.0173 resistance. This is a key level that could determine whether short-term momentum builds or fades.

A breakout from the wedge would be historically bullish. Such a move could lift VET toward $0.0200, helping erase a portion of the 28% October decline. A push toward this level would also extend the recent 20% weekly rise, strengthening confidence in a near-term recovery.

VET Price Analysis. Source:

VET Price Analysis. Source:

If VET fails to break above resistance, the pattern may lose its bullish structure. A drop below the $0.0157 support could send the price toward $0.0147. This outcome would weaken the bullish thesis, contradicting VeChain’s typical November performance and signaling continued uncertainty.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Spot ETFs Record 96.6M Net Inflows With ETHA Adding 92.6M

Quick Take Summary is AI generated, newsroom reviewed. Ethereum spot ETFs recorded total net inflows of $96.67 million on November 24, reversing a recent trend of major outflows. BlackRock's ETHA dominated the day's inflows, accounting for $92.61 million of the total. The total net assets held by all Ethereum ETFs rose to $18.44 billion, representing 5.14% of Ethereum's market cap. The return of strong inflows suggests investors are repositioning into ETH after a period of market cooldown and volatility.Re

Bitcoin ETFs Record 151M Outflow While ETH and SOL ETFs Post Strong Inflows

Quick Take Summary is AI generated, newsroom reviewed. Bitcoin ETFs recorded a $151.08 million net outflow, showing continued rotation despite BTC trading near $89,000. BlackRock's IBIT saw the largest withdrawal with $149.13 million, while Fidelity's FBTC was the only BTC fund with inflows ($15.49 million). Ethereum ETFs posted a strong rebound with $96.67 million in net inflows, dominated by BlackRock's ETHA. Solana ETFs also saw significant momentum, attracting a net inflow of $57.99 million, signaling

Asset Manager Franklin Templeton Calls XRP Foundational for Settlement

Quick Take Summary is AI generated, newsroom reviewed. Franklin Templeton launched its new spot XRP ETF (XRPZ) on NYSE Arca this week. Roger Bayston, Head of Digital Assets, called XRP "foundational" for global settlement infrastructure. The ETF uses Coinbase Custody and BNY Mellon, providing strong institutional backing and regulated access. The new ETF reportedly drew $89.3 million in initial inflows, signaling strong institutional and retail demand.References Franklin Templeton Says $XRP Plays a Foundat

Canada’s QCAD Stablecoin: Where Innovation Aligns with Strict Regulatory Standards

- Canada launches QCAD, its first regulated CAD stablecoin, backed by fully reserved assets and public audits. - Regulators approve QCAD as a compliance benchmark, enabling e-commerce, remittances, and cross-border transactions. - Stablecorp partners with Circle and Coinbase to expand QCAD's utility, aligning with global standards for innovation and oversight. - The Ontario-trust structure and SEDAR+ transparency set a precedent for Canada's digital finance competitiveness.