Only 10% of crypto earns yield now — why most investors are sitting on dead money

Crypto has spent years building yield infrastructure, such as staking on Ethereum and Solana, yield-bearing stablecoins, DeFi lending protocols, and tokenized Treasuries.

The pipes already exist, the APYs are live, yet only 8% to 11% of the total crypto market generates yield today, compared to 55% to 65% of traditional financial (TradFi) assets, according to RedStone’s latest analysis.

That penetration gap isn’t a product problem, but rather a disclosure problem.

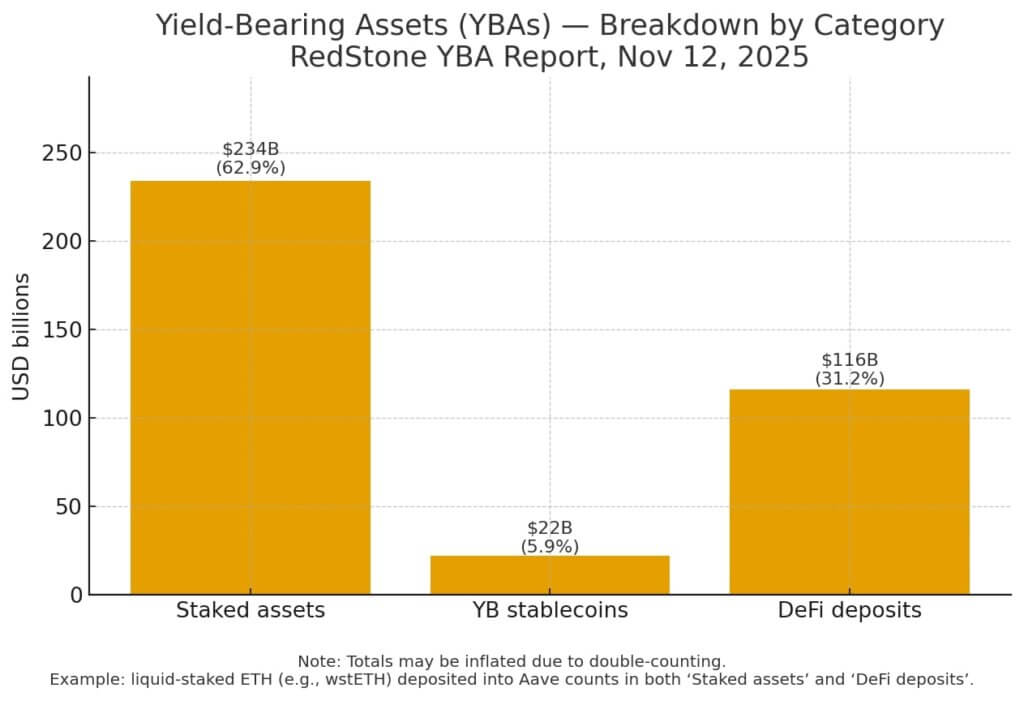

RedStone tallies roughly $300 billion to $400 billion of yield-bearing crypto assets against a $3.55 trillion total market capitalization to arrive at that 8% to 11% figure, with a caveat: the share is likely overstated because some positions get counted twice when staked assets are also deposited in DeFi protocols.

The comparison benchmark encompasses a wide range of investments, including corporate bonds, dividend equities, money-market funds, and structured credit.

TradFi’s advantage isn’t exotic instruments. It’s a century of standardized risk ratings, mandatory disclosure rules, and stress-testing frameworks that let institutions compare yield products on comparable terms.

Crypto has the products, but not the comparability, and that mismatch keeps institutional capital on the sidelines, even when yields run double digits.

Policy as catalyst, not solution

The GENIUS Act established a federal framework for payment stablecoins, requiring full reserve backing and oversight under the Bank Secrecy Act.

RedStone pointed to that clarity as the catalyst behind roughly 300% year-over-year growth in yield-bearing stablecoins, a segment that had stalled under regulatory uncertainty.

The law doesn’t mandate risk transparency, but addresses reserve composition and compliance, removing the binary question of whether stablecoins could operate in a legal gray zone.

That shift allowed issuers and platforms to move from “is this allowed?” to “how do we scale this?” and created the conditions for institutions to start asking more challenging questions about asset quality, collateral chains, and counterparty risk.

Independent coverage of the Act reflects a similar dynamic: regulation reduces uncertainty, but institutions still require more robust risk metrics before scaling up allocations. The law is necessary but not sufficient.

What’s missing is the apparatus that enables a treasury desk or asset manager to compare the risk-adjusted return of a yield-bearing stablecoin to that of a money-market fund, or to evaluate the credit exposure of a DeFi lending pool against a corporate bond ladder.

TradFi has that apparatus, with credit ratings, prospectuses, stress scenarios, and liquidity buckets. Crypto has APY leaderboards and TVL dashboards, which indicate where yield is generated, but not what risks underpin it.

Transparency deficit

RedStone’s analysis distills the problem into a single line: “The barrier to institutional adoption at scale is risk transparency.”

Unpack what that means in practice. First, there’s no comparable risk scoring across yield products. A 5% yield on staked ETH carries different liquidity, slashing, and smart contract risks than a 5% yield on a stablecoin backed by short-term Treasuries.

However, no standardized framework exists to quantify these differences.

Second, asset-quality breakdowns remain inconsistent. DeFi protocols disclose collateral ratios and liquidation thresholds, but tracking rehypothecation requires piecing together on-chain forensics and off-chain custodian reports.

Third, oracle and validator dependencies are rarely disclosed with the rigor TradFi applies to operational risk.

A yield product that depends on a single price feed or a small validator set carries concentration risk that isn’t surfaced in user-facing dashboards.

Then there’s the double-counting issue that RedStone explicitly flags. When staked ETH is wrapped, deposited into a lending protocol, and then used as collateral for another position, TVL metrics increase, and “yield-bearing” percentages overstate the actual capital deployed.

Traditional finance accounting rules separate principal from derivative exposure. Crypto’s on-chain transparency creates the opposite problem, with everything being visible, but aggregating it into meaningful risk metrics requires infrastructure that doesn’t yet exist at scale.

Closing the gap

The next leg isn’t about inventing new yield products. Staked blue chip assets, yield-bearing stablecoins, and tokenized government debt already cover the risk spectrum, ranging from variable to fixed, and from decentralized to custodial.

What’s needed is the measurement layer: standardized risk disclosures, third-party audits of collateral and counterparty exposure, and uniform treatment of rehypothecation and double-counting in reported metrics.

That’s not a technical problem, since on-chain data is auditable by design, but it requires coordination across issuers, platforms, and auditors to build frameworks that institutions recognize as credible.

Crypto’s yield pipes now exist. Staking on proof-of-stake networks delivers predictable returns tied to network security. Yield-bearing stablecoins offer dollar-denominated income with varying degrees of reserve transparency.

DeFi protocols offer variable rates that are driven by the supply and demand for specific assets. The 8% to 11% penetration rate isn’t a signal that crypto lacks yield opportunities.

It’s a signal that the risk attached to those opportunities isn’t legible to the allocators who control the bulk of global capital.

TradFi’s yield penetration didn’t emerge because traditional assets are inherently safer, but rather because their risks are measured, disclosed, and comparable.

Until crypto builds that measurement layer, the adoption bottleneck won’t be product gaps or regulatory ambiguity, but the inability to answer what is at risk for the yield.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SOL Price Forecast and Market Drivers: How On-Chain Enhancements and Macro Trends Combine to Shape 2025

- Solana (SOL) faces a pivotal moment in late 2025 due to technical upgrades and macroeconomic tailwinds. - Key upgrades like Firedancer (1M TPS) and ZK Compression v2 (5,200x cost reduction) enhance scalability and DeFi TVL to $10.3B. - Fed dovish pivot and institutional adoption (e.g., $417M Bitwise ETF) drive capital inflows despite short-term price corrections. - Upcoming Alpenglow upgrade (2026) and analyst projections (target $300 by mid-2026) highlight growth potential.

The Federal Reserve's Change in Policy and Its Impact on Solana (SOL)

- Fed officials Collins and Bostic oppose December 2025 rate cuts, citing high inflation and disrupted economic data. - Solana's TVL surged to $35B by 2025, driven by institutional inflows amid Fed liquidity and lower borrowing costs. - Experts link Solana's growth to macro signals, but October 2025 rate cuts triggered a 20% price correction. - Persistent inflation risks could curb altcoin valuations, while resolved inflation may reignite institutional crypto interest. - Despite volatility, Solana's ecosys

"Digital Privacy Advocate's Rights Reinstated, Underscoring Worldwide Disputes Over Technology Regulation"

- Telegram founder Pavel Durov regains full travel freedom after French judicial restrictions were lifted, following a year of compliance with supervision terms. - French prosecutors continue investigating Telegram for alleged complicity in criminal activity, including child abuse material, with potential 10-year prison charges. - Durov denies allegations, criticizes French procedures as "dystopian," and challenges legal classifications while seeking EU court rulings on digital governance issues. - The cas

dYdX Implements 75% Buyback: Synchronizing Holder Rewards with Platform Growth

- dYdX community approved 75% protocol fee allocation for token buybacks, up from 25%, via a 59.38% voter majority on November 13, 2025. - The revised distribution aims to reduce DYDX supply, enhance scarcity, and align token holder incentives with platform performance through automated, transparent buybacks. - 5% of fees now fund Treasury SubDAO and MegaVault for ecosystem development, balancing supply reduction with staking incentives and research-driven growth. - Analysts highlight this as a DeFi govern