Bitcoin News Today: The Major Transition: Bitcoin Mining Companies Evolve into Leading AI Infrastructure Providers

- Bitcoin miners shift to AI infrastructure as margins shrink due to rising energy costs and post-halving challenges, with companies like Core Scientific and Cipher Mining repurposing data centers for AI workloads. - Major contracts, including a $5.5B, 15-year AWS deal and a $9.7B Microsoft agreement, highlight AI’s 25x higher revenue per megawatt compared to Bitcoin mining, driven by stable demand from tech giants. - The pivot reshapes market dynamics, with AI-focused miners outperforming Bitcoin peers as

Industry experts and analysts say that Bitcoin mining companies are rapidly shifting their focus to artificial intelligence infrastructure as profit margins shrink due to rising energy prices and the effects of the latest halving. What was once a specialized approach has now become a widespread industry transformation, with firms such as

This strategic change comes after Bitcoin’s halving in April 2024, which cut block rewards and caused average hash prices—daily earnings per terahash—to fall below $0.05 by mid-2025, representing a 60% decrease from pre-halving figures, as reported by

“Miners have evolved beyond just Bitcoin—they now serve as digital infrastructure providers,” one analyst observed, pointing out that seven of the ten largest miners now earn income from AI or high-performance computing (HPC) ventures, according to

This transformation is altering the competitive landscape. Companies like TeraWulf and Core Scientific are prioritizing AI growth over expanding Bitcoin hashrate, with TeraWulf’s $3.7 billion Fluidstack partnership alone expected to generate $1.85 million per MW each year, according to

This industry pivot is also changing how companies are valued. Investors are now more interested in contracted AI megawatts and revenue per MW than in hash rates, with AI-centric miners like Core Scientific and TeraWulf outperforming those focused solely on Bitcoin, as

Industry watchers suggest that this shift may slow the growth of Bitcoin’s hashrate, as more power is allocated to AI GPU clusters. This development, together with increasing demand from tech giants like Microsoft and Google, has already pushed AI’s energy consumption in the U.S. beyond that of Bitcoin mining, according to

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: SEC's 20-day review period begins, launching the XRP ETF competition toward mainstream adoption

- SEC's 20-day automatic review period for 21Shares' XRP ETF filing signals potential fast-tracked approval, mirroring Bitcoin/Ethereum precedents. - XRP's institutional adoption gains momentum with custodian partnerships and index-linked pricing, driving 6% price surge to $2.32. - Ripple's ecosystem growth (100M+ ledgers, Mastercard/WebBank deals) strengthens XRP's cross-border payment advantages over Ethereum's scalability challenges. - International XRP ETFs ($114.6M AUM) and institutional interest in p

Bitcoin Updates: Lawmakers Seek Solution to Ongoing SEC and CFTC Dispute Over Crypto Oversight

- U.S. Congress proposes two crypto regulatory frameworks: CFTC-led commodity model vs. SEC's "ancillary asset" approach, creating dual oversight challenges for exchanges. - Emerging projects like BlockDAG ($435M presale) and privacy coins gain traction amid market rebound, emphasizing utility over speculation post-government shutdown. - Bitcoin exceeds $102,000 with ETF inflows and Ethereum sees whale accumulation, though profit-taking risks and regulatory delays remain key headwinds. - Senate drafts and

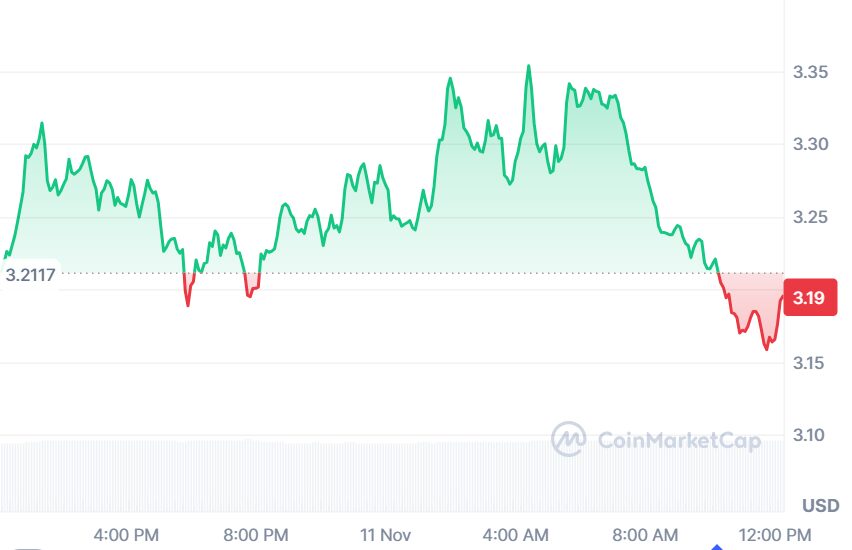

APT Price Update: Aptos Shows Early Recovery Signs to $3.50 as EV2 Presale Draws Web3 Gaming Interest

Jack Dorsey backs diVine, a new version of Vine that features Vine’s original video library