Tether taps HSBC executives to ramp up $12b gold strategy

Tether poached two senior executives from a bank that oversees one of the world’s most extensive gold vaults.

- Tether is doubling down on its gold bet by hiring two of HSBC’s top gold traders

- HSBC operates one of the largest private gold vaults in the world

- The stablecoin issuer currently holds more than $12 billion in physical gold

As macro uncertainty fuels renewed interest in precious metals, the world’s largest stablecoin issuer is doubling down on its gold bet. On Tuesday, November 11, Tether announced the hiring of two top gold traders from London-based HSBC.

HSBC’s global head of metals trading, Vincent Domien, will join Tether in the coming months. He’ll be accompanied by Mathew O’Neill, HSBC’s head of precious metals for Europe, the Middle East, and Africa.

The two executives’ role will be to aggressively expand the firm’s physical bullion holdings, which currently total $12 billion.

These include the reserves for the Tether Gold (XAUT) token, which has a market cap of $1.56 billion. The remaining physical gold is part of the reserves that back USDT.

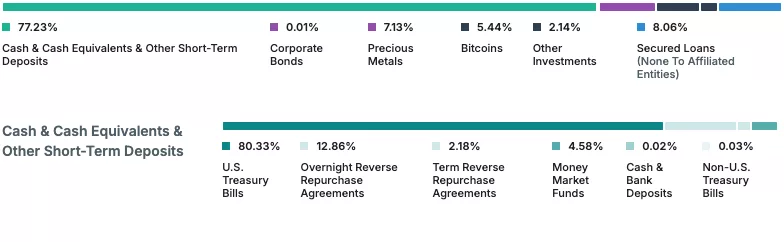

Reserves backing USDT stablecoins, as of September 30 | Source: Tether

Reserves backing USDT stablecoins, as of September 30 | Source: Tether

Tether plans major gold expansion

Tether has been adding gold to its reserves at an average pace of 1 metric ton per week during September of this year. According to Bloomberg, this makes Tether one of the largest non-state buyers of gold. For this reason, taping HBSC executives makes strategic sense for the firm.

HBSC operates a vast gold reserve in London, one of the largest in the world. The company is also one of the biggest market makers in spot gold, gold futures, swaps, and options. It is also one of the core clearing members in the London Bullion Market Association. HSBC was also one of the first companies to launch a tokenized gold offering, which went live in 2024.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Dawn: Solana's Fast Track to International Financial Markets

- Wormhole Labs launched Sunrise, a Solana platform for instant token listings via NTT framework, bypassing wrapped tokens. - MON became first token listed on Nov 23, enabling immediate trading on Jupiter and Orb DEXs with native liquidity. - Platform addresses Solana DeFi's fragmented liquidity by standardizing cross-chain entry for new assets from day one. - Sunrise aims to expand beyond crypto to tokenized commodities and real-world assets, competing with Ethereum's DeFi dominance.

Hyperliquid News Today: Crypto Faces Widespread Challenges as Short Sellers Profit and Long Positions Suffer Amid Market Volatility

- HYPE whale 0x082 faces $10M unrealized loss after 126% price drop, raising pre-announcement trading suspicions. - Abraxas Capital liquidates $620K in HYPE shorts while BitMine reports $3.7B ETH unrealized loss amid compressed crypto premiums. - Hyperliquid's 0x5D2F nets $51M BTC short profits as 53.2% of platform positions favor bearish bets. - Robinhood's $1.27B Q3 revenue surge contrasts with $1.5B insider share sales and tokenized stock expansion into Europe. - Market fragility persists with declining

ICP Jumps 30% in a Week: What’s Fueling the Buzz and What Could Happen Next?

- ICP token surged 30% in 7 days amid whale accumulation and rising network adoption metrics. - Daily active addresses rose 35% while DEX volumes hit $843.5M, signaling growing decentralized computing utility. - Futures open interest reached $188M as retail optimism clashes with technical concerns below EMA-9 at $5.40. - Key resistance at $6.47 could trigger further gains if ICP sustains above $5.40, but leveraged positions pose correction risks.

Grayscale & Franklin Templeton XRP ETFs Go Live: What’s Next for XRPs Price?