Traditional financial advancements paving the way for the next era of cryptocurrency

- Bitcoin's $200,000 target remains speculative, but traditional finance innovations in data services and post-trade tech hint at indirect crypto ecosystem support. - Information Services secures 9-year Ontario government contract for digital property modernization, boosting investor confidence despite CIBC's "Neutral" rating. - MarketAxess reports 9% post-trade services revenue growth in Q3 2025, yet faces U.S. credit market challenges amid 9% high-grade bond commission declines. - Macroeconomic uncertain

Although the idea of Bitcoin reaching $200,000 remains a distant and speculative goal, recent changes in market trends and corporate approaches point to a larger story of adaptability and progress. Historically, selling pressure has limited the growth of cryptocurrencies’

Information Services, recognized for its contributions to data and environmental technology, recently saw its fair value estimate increase to CA$38.20, reflecting positive sentiment about its strategic direction. The company landed a nine-year agreement with Ontario’s Ministry of Environment, Conservation and Parks to upgrade digital property records, a move that analysts say highlights its increasing importance in the digital transformation of the public sector, as detailed in the same

At the same time,

Wider economic factors further complicate these developments. Recent updates, including conflicting Federal Reserve comments on interest rate reductions and the adoption of stablecoins, highlight ongoing macroeconomic uncertainty, as reported on a

Investors are now considering whether these strategic shifts can maintain their momentum. While Information Services’ ongoing review and MarketAxess’s technological advancements suggest the potential for long-term value, immediate risks—such as volatility in the U.S. credit sector and rising operational expenses—remain significant obstacles, as reported in the

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Separating Hype from Reality—Crypto Market Shifts as BlockDAG, Ethereum, and XRP Aim for Leadership by 2026

- BlockDAG's $435M presale and hybrid DAG/Proof-of-Work model position it as a top 2026 growth candidate with 3.5M active miners. - Ethereum faces technical risks like potential death cross but retains 53% stablecoin dominance through JPMorgan/BlackRock partnerships. - XRP shows $2.40 recovery amid Bitcoin ETF inflows but needs sustained confidence to maintain $3.95B derivatives open interest. - Market shifts toward projects with institutional validation (CertiK audits) and real-world adoption (Seattle spo

Brazil's Cryptocurrency Clampdown: Combating Illicit Activity or Hindering Progress?

- Brazil's Central Bank enforces strict crypto rules by Feb 2026, requiring VASPs to obtain authorization or exit the market. - Stablecoin transactions and cross-border transfers are reclassified as foreign exchange operations under $100k capital controls. - $2-7 million capital requirements spark industry criticism, with concerns over stifling competition and compliance timelines. - Mandatory reporting for international transactions aims to combat money laundering, aligning with global standards like EU's

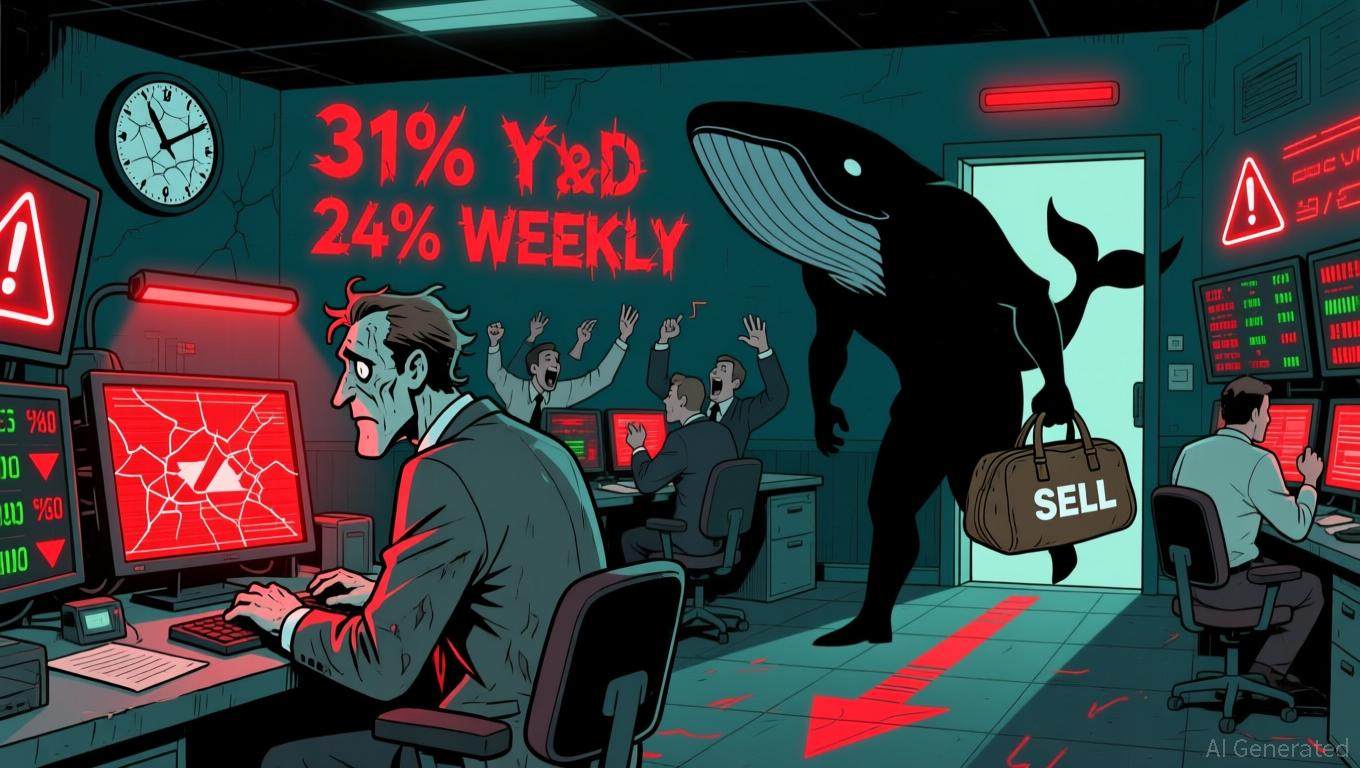

Whales Offload PEPE While Bulls Resist Decline, Forecasting Record High

- A major PEPE whale liquidated a $46M position this week, reflecting broader memecoin market weakness as prices fell 31% year-to-date. - Institutional holders offloaded 0.5% of PEPE holdings amid bearish technical indicators, while some long-term investors predict a new all-time high. - Cross-chain activity highlights volatile memecoin dynamics, with whales shifting focus to ASTER as Coinbase restructures in Texas over regulatory concerns. - Technical analysts warn of continued losses as PEPE forms a "bea

South Korea Seeks to Compete with USD Stablecoins Through Blockchain-Based VAT Reimbursements

- NH NongHyup Bank tests VAT refund system using stablecoin tech with Avalanche , Fireblocks, Mastercard , and Worldpay. - Aims to challenge USD stablecoin dominance by streamlining cross-border refunds via blockchain automation. - South Korea’s FSC plans KRW-pegged stablecoin rules by year-end, restricting non-bank issuers. - Domestic stablecoin transactions exceed $41B, as major banks collaborate on won-backed infrastructure. - Pilot could redefine cross-border payments with faster processing and reduced