Cardano Looks Dormant, But Whales Quietly Scoop Up $200 Million Worth of ADA

Cardano whales are quietly accumulating ADA at the fastest pace since May, echoing patterns that preceded past bull runs. As consolidation continues and the Summit 2025 nears, on-chain data hints at a potential upside for ADA.

Although Cardano (ADA) remains among the top 10 altcoins by market cap, its price is still hovering around 2024 levels. While many holders express disappointment with ADA’s performance, accumulation continues quietly beneath the surface.

What evidence supports this trend, and what impact could it have? The following analysis draws on on-chain data and expert insights.

How Have Cardano (ADA) Whales Been Accumulating in November?

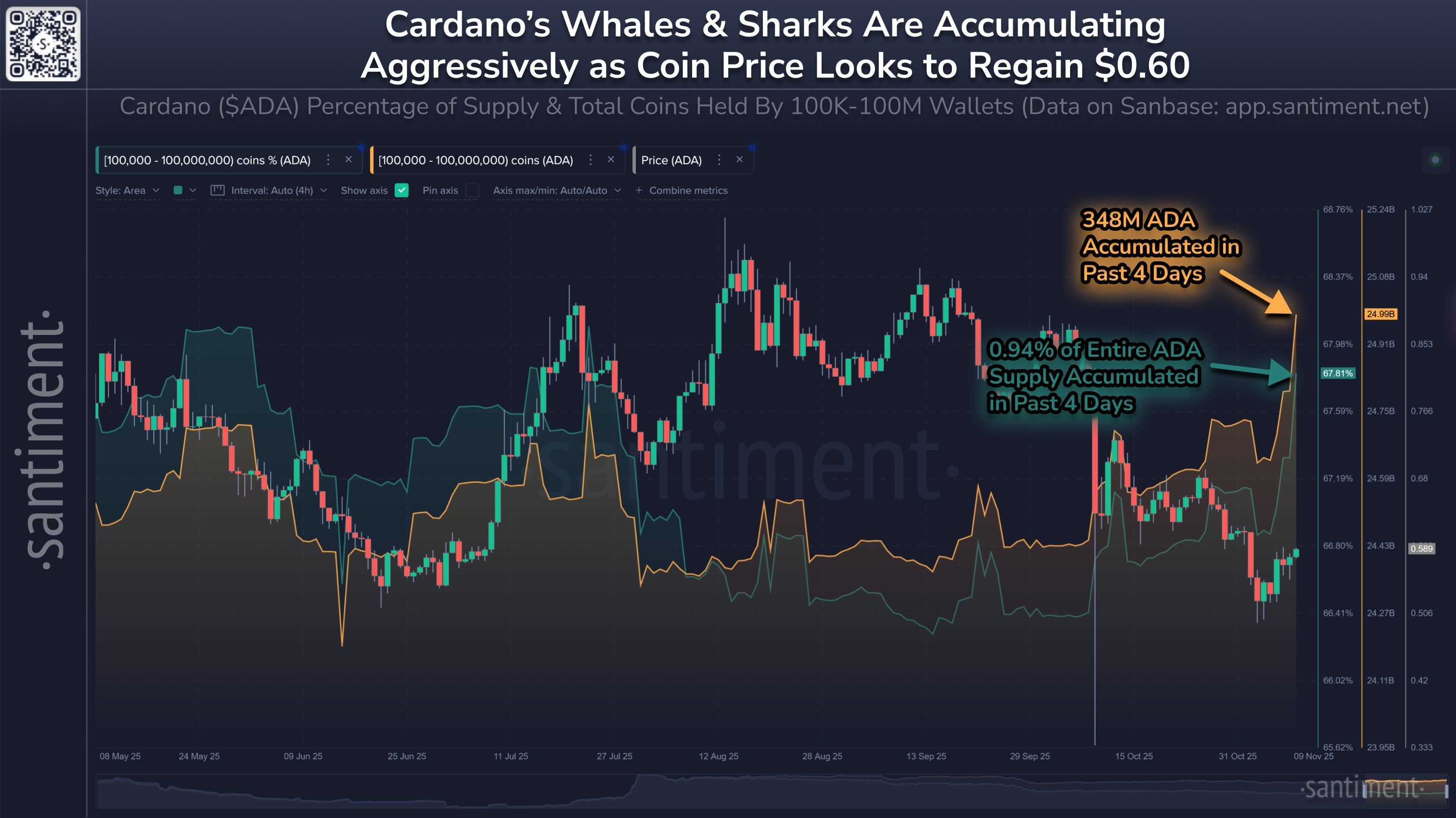

Data from Santiment shows that “whales” and “sharks” — investors holding between 100,000 and 100 million ADA — have been accumulating heavily in a short period.

Over the past four days, these large holders have purchased 348 million ADA, valued at approximately $204.3 million, which represents 0.94% of the total ADA supply.

Cardano Whales Accumulation. Source:

Santiment

Cardano Whales Accumulation. Source:

Santiment

This marks the strongest accumulation since May. Notably, this buying activity comes as ADA’s price has corrected by more than 30% from last month and remains below $ 0.60.

While many retail investors appear to have exited, whales seem to view the pullback as a chance to secure better entry positions. With smaller traders sidelined, smart money is accumulating quietly, creating minimal volatility. Analysts see this as a potential signal for an upcoming bullish phase.

“While many call Cardano (ADA) ‘dormant,’ the charts whisper a different story — millions of ADA are quietly being scooped up by whales and institutions. On-chain data shows this ‘silence’ isn’t weakness — it’s precision accumulation. With retail out of the picture, smart money is loading up without triggering alarms.” — BeLaunch.

Historical Patterns Suggest Possible Rally

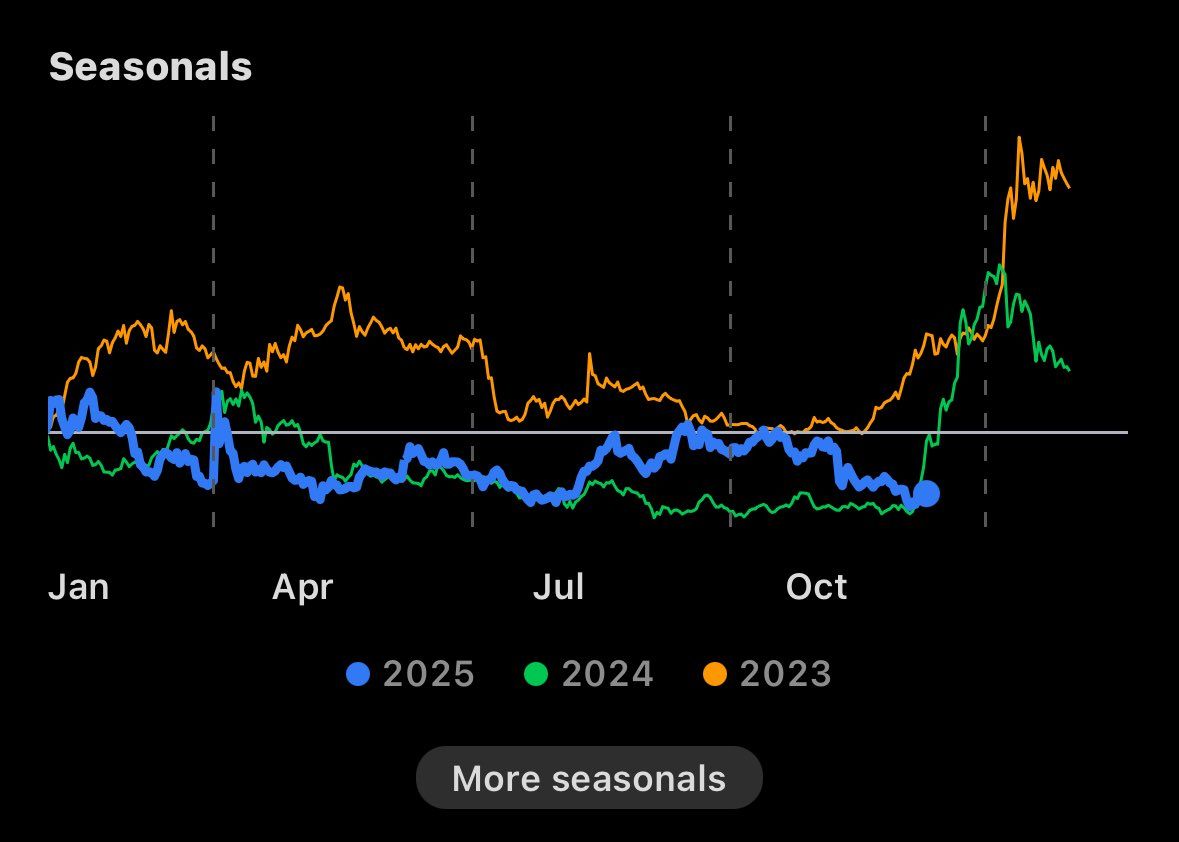

Historical ADA price patterns suggest that strong rallies frequently follow extended consolidation periods of approximately ten months.

The DApp Analyst highlighted this trend, comparing 2025’s behavior with that of the previous two years. In both 2023 and 2024, ADA experienced powerful bull runs following prolonged consolidation phases, delivering gains of 200% to 300%.

Comparing ADA Price Models in 2023, 2024, and 2025. Source:

The DApp Analyst

Comparing ADA Price Models in 2023, 2024, and 2025. Source:

The DApp Analyst

Now, in October 2025, conditions appear similar to those of historical setups — potentially forming a base for another upward move. Combined with current whale accumulation, this alignment strengthens the bullish outlook.

“Will 2025 be like ‘23 & ‘24? $ADA has spent the entire year consolidating between $0.5 and $1.3. Can we finally get a breakout?” — The DApp Analyst.

November also brings the Cardano Summit 2025 in Berlin. Statements from project leaders at the event are expected to renew optimism among ADA investors this month.

However, overall market sentiment remains cautious. The altcoin season index sits at a low 39 points, reflecting lingering fear — a potential headwind for ADA’s recovery despite growing accumulation and bullish setups.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Amundi’s Integrated Approach Connects Blockchain with Conventional Financial Regulations

- Amundi, Europe's largest asset manager, launched its first Ethereum-based tokenized money-market fund, enabling 24/7 settlements and transparent record-keeping via blockchain. - The hybrid model, developed with CACEIS, combines traditional fund operations with blockchain-based ownership, preserving regulatory compliance while expanding investor access. - Ethereum's dominance in stablecoin and RWA transfers ($105.94B in 30 days) underscores its role in accelerating tokenization, with Amundi positioning it

XRP News Today: XRP ETFs Drive Price Increases, While Solana ETFs Ease Selling Pressure

- XRP ETFs raised $587M in inflows since late November, outpacing Solana's $568M as investors favor altcoins with regulatory clarity and utility. - Bitwise XRP ETF's $107M debut and zero-fee strategy drove momentum, while Solana ETFs faced $156M weekly outflows due to network reliability concerns. - XRP's inflows acted as a "battering ram" pushing prices above $2.27, contrasting Solana's ETFs which merely dampened sell pressure without reversing its decline. - Analysts predict XRP could reach $3 by Decembe

The Federal Reserve's Change in Policy and Its Impact on Alternative Cryptocurrencies Such as Solana

- Fed's 2025 policy shifts, including rate cuts and stablecoin regulations, are reshaping altcoin markets by altering liquidity and risk appetite. - Solana's Alpenglow upgrade (150ms finality, 1M TPS) addresses scalability issues, aligning with Fed's AI-driven infrastructure focus despite network reliability concerns. - Institutional inflows into Solana ETFs ($100M AUM) contrast with retail caution (78% HODLers in red), highlighting divergent risk perceptions amid 30% price corrections. - Divergent ETF flo

Avail's Intent-Driven Nexus Addresses the Issue of Fragmented Liquidity Across Chains

- Avail launches Nexus Mainnet, a cross-chain solution unifying liquidity across Ethereum , Solana , and EVM networks. - The intent-solver model enables seamless asset transfers without technical complexities, streamlining user experiences. - Developers gain modular tools for multichain integration, reducing costs as cross-chain liquidity demand grows. - Nexus abstracts execution layers, offering unified balances and execution while addressing fragmentation challenges. - With $50B+ in cross-chain activity