Bitcoin Bounces Back as Trump’s $2,000 Dividend Plan and Michael Saylor’s Hint Spark Market Optimism

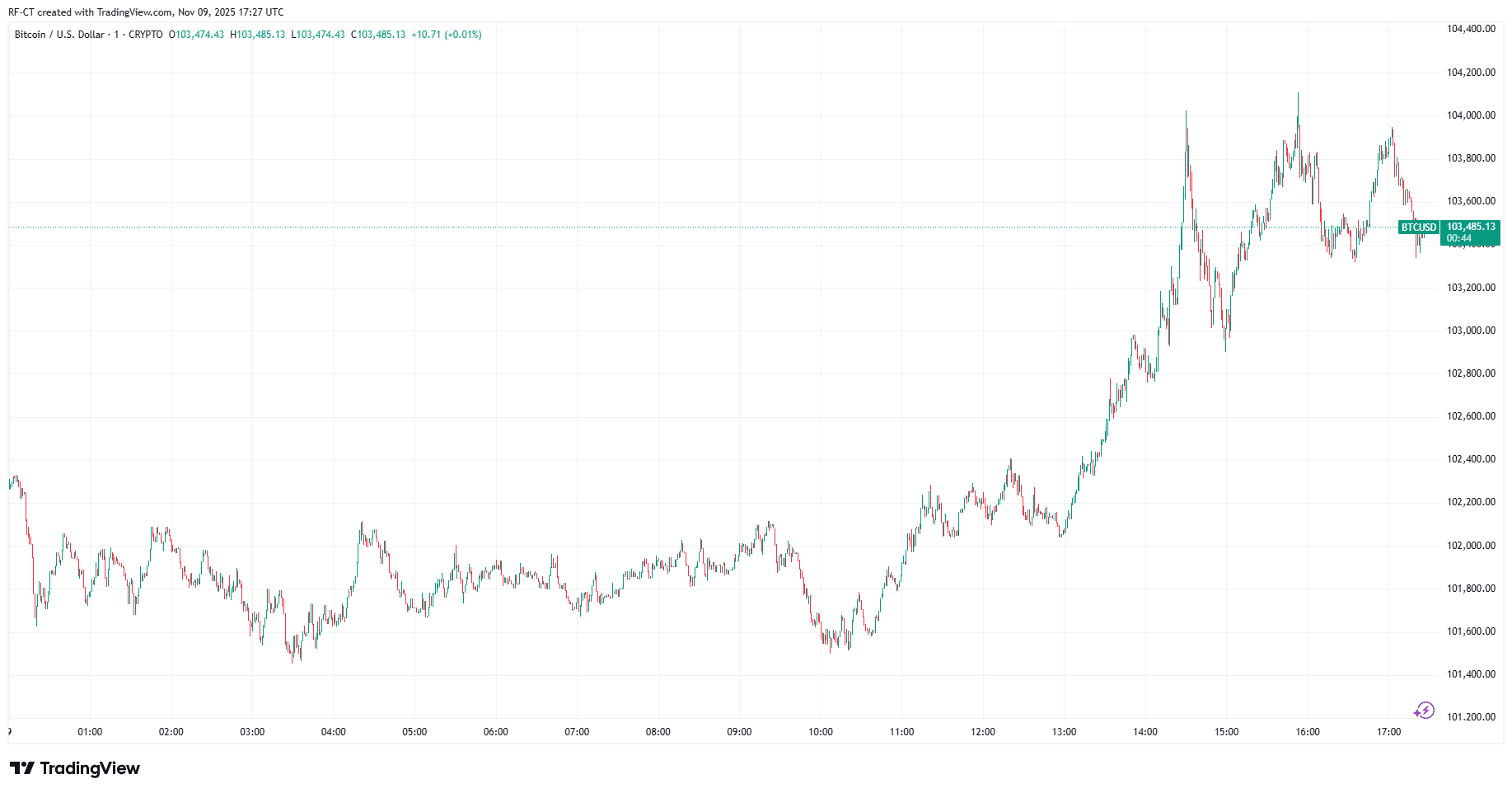

Bitcoin is showing renewed strength after a volatile week, climbing above $103,000 as two major catalysts dominate the headlines: President Trump’s $2,000 “tariff dividend” plan for U.S. citizens, and Michael Saylor’s cryptic message hinting at another round of Bitcoin accumulation.

These developments have revived optimism across the crypto market, reminding investors of the powerful link between fiscal policy, liquidity, and digital assets.

Bitcoin’s Rebound and Trump’s Dividend Plan

After briefly dipping below the key $100K support, Bitcoin bounced back strongly following Trump’s post announcing that every American could receive at least $2,000 as a “tariff dividend.”

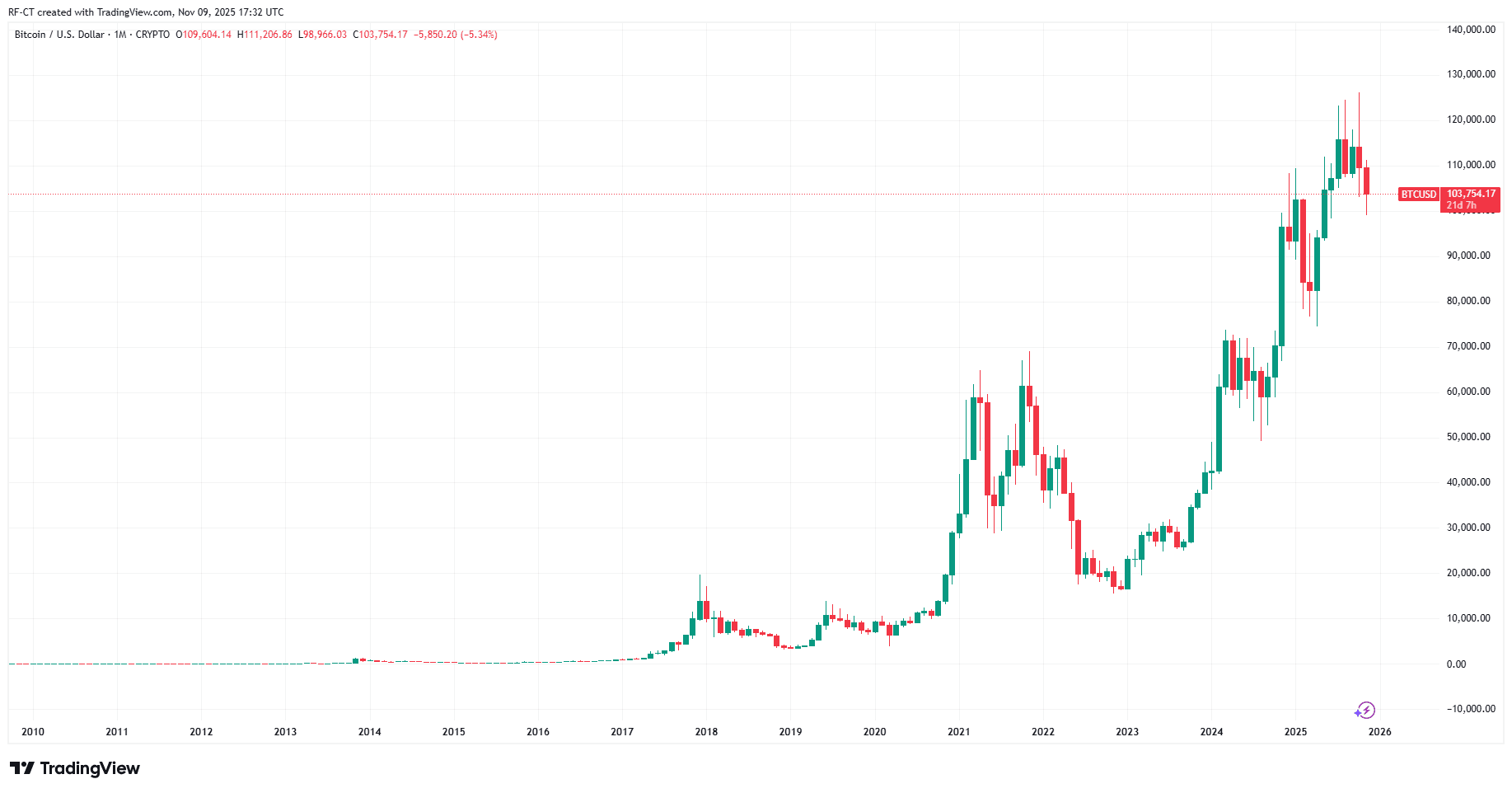

Crypto analyst drew an important parallel — the last time such direct payments occurred, during the COVID-19 stimulus checks in 2020, it triggered the 2021 crypto bull run, when Bitcoin surged from $3,800 to $69,000.

Trump’s exact post read:

“A dividend of at least $2,000 a person (not including high-income people!) will be paid to everyone.”

The announcement immediately energized markets, echoing the same liquidity boost that once fueled massive retail inflows into Bitcoin and altcoins. Traders now speculate that history could repeat itself if the dividend plan materializes in early 2026.

By TradingView - BTCUSD_2025-11-09 (1D)

By TradingView - BTCUSD_2025-11-09 (1D)

Michael Saylor’s Hint Adds Fuel to the Fire

While Trump’s announcement stirred excitement on the macro level, Michael Saylor — founder of MicroStrategy and one of Bitcoin’s largest corporate holders — added to the momentum with a subtle yet powerful post shared by Watcher.Guru.

His words, “Best continue,” came alongside data showing MicroStrategy’s Bitcoin portfolio now valued at $65.45 billion, holding over 641,000 BTC.

This has fueled speculation that Saylor may either be buying the dip or waiting for another correction before resuming large-scale accumulation — a strategy that has historically signaled bullish turning points for Bitcoin.

Market Context and Institutional Flows

Despite renewed optimism, institutional activity remains mixed. U.S. spot Bitcoin ETFs just recorded their largest daily outflow since August, suggesting that while sentiment is improving, some institutional players are still waiting for confirmation — or possibly aligning their entries with Saylor’s buying timing.

Meanwhile, Ethereum followed Bitcoin’s lead, recovering to around $3,480, as DeFi inflows and staking activity picked up after days of muted trading.

Can History Repeat Itself?

If Trump’s dividend plan injects real liquidity into the economy and Saylor’s next accumulation wave begins, Bitcoin could aim for the $110K–$115K range — a zone where short liquidations are heavily clustered.

On the other hand, if a short-term pullback emerges, it may set the stage for a “buy-the-dip” scenario that institutional investors like Saylor thrive on.

By TradingView - BTCUSD_2025-11-09 (All)

By TradingView - BTCUSD_2025-11-09 (All)

Between Trump’s fiscal stimulus rhetoric and Saylor’s unwavering conviction, the narrative driving Bitcoin’s next chapter is clear: liquidity meets belief.

Whether the market experiences another dip or pushes higher, the stage for a renewed bull phase appears set — and traders are watching every move closely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

November Sees a Dual Tech Revolution Fueled by Blockchain Accessibility and Sustainable Mobility

- Pi Network announces November 28 event as user base hits 60 million, promoting mobile mining without hardware costs. - Platform faces criticism for unlisted token, social recruitment model, and comparisons to multi-level marketing schemes. - Zeekr Group accelerates merger to build global new energy ecosystem, emphasizing software innovation and e-powertrain development. - Dual developments highlight blockchain democratization and green mobility as contrasting yet parallel tech innovation paths.

ALGO Falls 19.05% Over the Past Month After Allegro Secures $35 Million Veterinary Licensing Agreement

- ALGO fell 19.05% in 1 month as Allegro signed a $35M licensing deal for Synoglide™ in equine osteoarthritis. - The agreement grants American Regent global veterinary rights while Allegro retains human application rights and manufacturing responsibilities. - Synoglide™, based on INTRICATE nanotechnology, will launch in early 2026 after a December 2025 AAEP conference marketing push. - Despite milestone payments and cross-species translational potential, ALGO's decline reflects investor caution amid ongoin

Delaware Court Orders Edtech Founder to Pay $1 Billion for Failing to Meet Legal Obligations in Debt Case.

- Delaware court awarded $1.07B against Byju Raveendran for noncompliance in TLPL's $1B loan dispute involving Alpha Funds misdirection. - Judgment includes $533M principal, $540.6M penalties, and $10K/day contempt fines for refusing to disclose Camshaft LP transactions. - Raveendran's team claims denied due process, plans $2.5B counterclaims against GLAS Trust for alleged contractual and legal violations. - Case highlights cross-border governance tensions, with GLAS Trust alleging fund "roundtripping" whi

Bitcoin News Today: Bitcoin ETF Outflows Drive Price Drop, Yet New Inflows Hint at Potential Recovery

- Bitcoin faces extreme oversold conditions as record ETF outflows drive price declines, with $3.5B withdrawn in November 2025 alone. - Citi estimates $1B in outflows correlates to 3.4% price drops, creating self-reinforcing downward pressure on crypto markets. - Solana ETFs attract $531M through competitive staking yields, highlighting shifting investor priorities toward risk-adjusted returns. - Market analysts note early stabilization signs with $225M Bitcoin ETF inflows, though 36% price declines from O