ETF Greenlight? Government Shutdown Deal Could Trigger Massive XRP Rally

DTCC lists nine spot XRP ETFs, with a November 2025 launch eyed. Price peaks at $2.45, but SEC approval and US Senate deal are critical factors.

The US Depository Trust & Clearing Corporation (DTCC) has listed nine spot XRP Exchange-Traded Funds (ETFs), intensifying expectations of a November launch pending US SEC approval.

With the potential US Senate deal to end the government shutdown, this could speed up SEC reviews and push XRP’s price to a high of $2.46.

DTCC Listing Expands XRP ETF Landscape

The list includes Bitwise XRP ETF and Franklin XRP ETF, among nine spot XRP ETFs—Canary XRP ETF (XRPC), Volatility Shares XRP ETF (XRPI), ETF Opportunities T-REX 2x Long XRP (XRPK), CoinShares XRP ETF (XRPL), Amplify XRP 3% Monthly ETF (XRPM), ETF Opportunities T-REX Osprey XRP (XRPR), Volatility Shares 2x XRP ETF (XRPT), and Franklin XRP ETF (XRPZ)—indicating market readiness.

🚨 BREAKING:Nine XRP Spot ETFs are now listed on the DTCC signaling readiness ahead of a possible launch this month. 👀🤯📊 Listed ETFs:↪️Bitwise XRP ETF (XRP)↪️Canary XRP ETF (XRPC)↪️Volatility Shares XRP ETF (XRPI)↪️ETF Opportunities T-REX 2x Long XRP (XRPK)… pic.twitter.com/00usToMVhX

— Xaif Crypto🇮🇳|🇺🇸 (@Xaif_Crypto) November 10, 2025

The Senate’s progress in halting a 40-day shutdown may restore SEC staffing, aiding approval. However, Ripple’s unresolved SEC litigation since 2020, with a year-end decision expected, poses risks. Over the past week, XRP’s trading volume increased to approximately $27.3 billion.

XRP’s trading volume:

CoinGecko

XRP’s trading volume:

CoinGecko

Global Markets Monitor Regulatory Progress

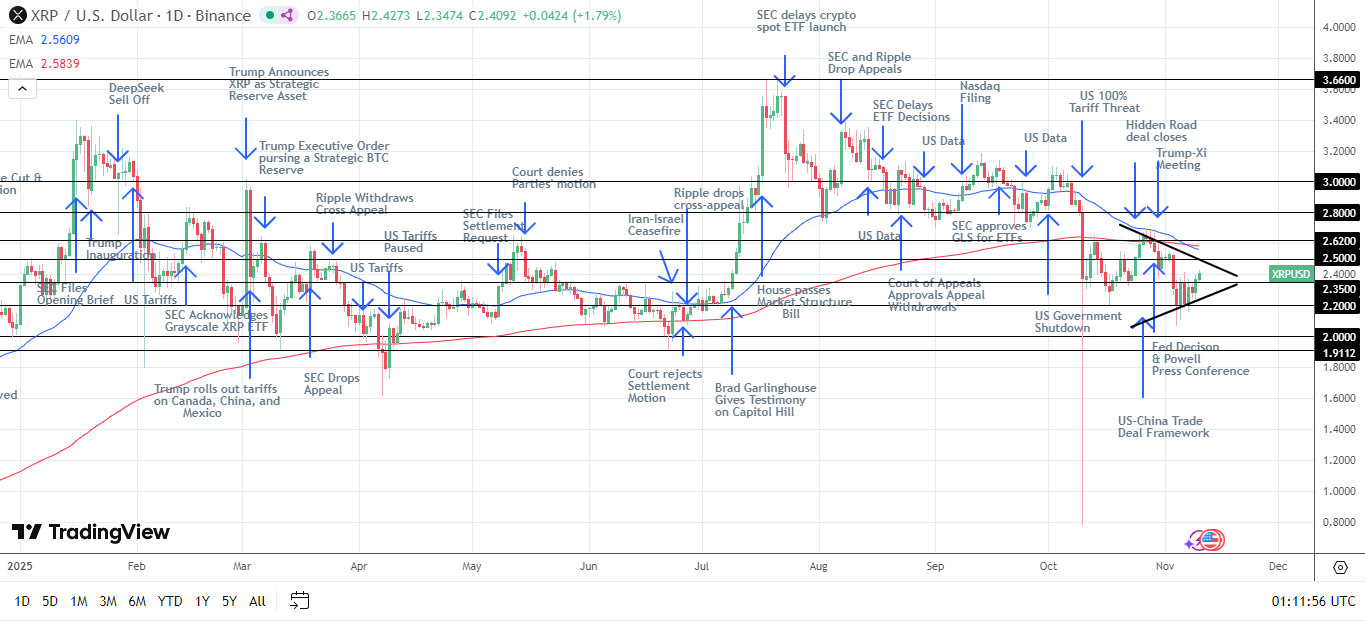

The XRP price surge to $2.45 follows a breakout above the 50-day moving average, with analysts targeting $3 by Q1 2026.

XRP price chart: BeInCrypto

XRP price chart: BeInCrypto

Technical analysis indicates that near-term support levels lie at $2.0 and $1.9, while key resistance lies at $2.5 and $2.62.

This movement occurs as XRP ETP success contrasts with Asia’s cautious stance. Asian exchanges like Bitget are awaiting clarity from US regulators. Analysts caution that a delay in the SEC’s regulatory approval could push prices down to $1.80.

the 50-day moving average, targeting $3 by Q1 2026 :

FXEmpire

the 50-day moving average, targeting $3 by Q1 2026 :

FXEmpire

JP Morgan estimates a launch could draw $3-5 billion in inflows, similar to Bitcoin ETFs, enhancing XRP’s institutional appeal. The Senate deal, if finalized, may accelerate this, though uncertainty persists. Europe’s success offers a global adoption model, but investors await clarity from the SEC and legislators.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Growing Optimism Faces ETF Withdrawals: The Delicate Balance of Crypto Stability

- Crypto markets show fragile stabilization as Fear & Greed Index rises to 20, but Bitcoin remains 30% below October peaks amid $3.5B ETF outflows. - Stablecoin market cap drops $4.6B and on-chain volumes fall below $25B/day, weakening Bitcoin's liquidity absorption capacity. - Select altcoins like Kaspa (22%) and Ethena (16%) gain traction while BlackRock's IBIT returns $3.2B profits, signaling mixed institutional confidence. - Technical indicators suggest tentative support at $100,937 for Bitcoin, but So

BCH Rises 0.09% as Momentum Fuels Outperformance

- BCH rose 0.09% in 24 hours but fell 4.22% in seven days, yet gained 22.72% annually. - It outperformed its Zacks Banks - Foreign sector with 0.66% weekly gains vs. -2.46% industry decline. - Earnings estimates rose twice in two months, boosting consensus from $2.54 to $2.56. - With a Zacks Rank #2 (Buy) and Momentum Score B, BCH shows strong momentum potential. - Annual 63.46% gains and positive revisions solidify its position as a top momentum stock.

DOGE drops 1.36% as Bitwise ETF debuts

- Bitwise launched the first Dogecoin ETF (BWOW) on NYSE, offering institutional-grade exposure to the memecoin. - DOGE fell 1.36% in 24 hours but rose 7.34% weekly, reflecting mixed short-term market sentiment. - The ETF aligns with growing institutional adoption and regulatory momentum for altcoins, despite a 52.35% annual decline. - Similar products like Bonk’s ETP and Ethereum upgrades highlight maturing crypto infrastructure and investor demand.

ZEC Falls 4.01% After Grayscale Submits Zcash ETF Conversion Application

- Zcash (ZEC) fell 4.01% in 24 hours as Grayscale files to convert its Zcash Trust into an ETF. - The ETF conversion aims to boost institutional exposure and regulated market access for ZEC. - ZEC shows 16.26% monthly gain and 736.04% annual rise despite recent 17.89% weekly drop. - Analysts highlight ETF approval could stabilize ZEC’s price and attract diversified investors. - The SEC’s decision on the ETF remains pending, shaping market perceptions and ZEC’s adoption trajectory.