The Bank of England proposes a £20,000 cap on individual stablecoin holdings

According to ChainCatcher, the Bank of England has proposed that 60% of the assets backing stablecoins can be held in short-term UK government bonds, and at least 40% must be deposited at the Bank of England.

The Bank of England has proposed a cap of £20,000 on individual stablecoin holdings, while the limit for corporate stablecoin holdings is set at £10 million.

For stablecoins transitioning from the UK Financial Conduct Authority (FCA) regulatory framework, up to 95% of their reserve assets may be invested in short-term government bonds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hourglass: Stable pre-deposit phase 2 KYC verification extended until November 13, 7:59

BNY Mellon: Stablecoins and Tokenized Cash Could Reach $3.6 Trillion by 2030

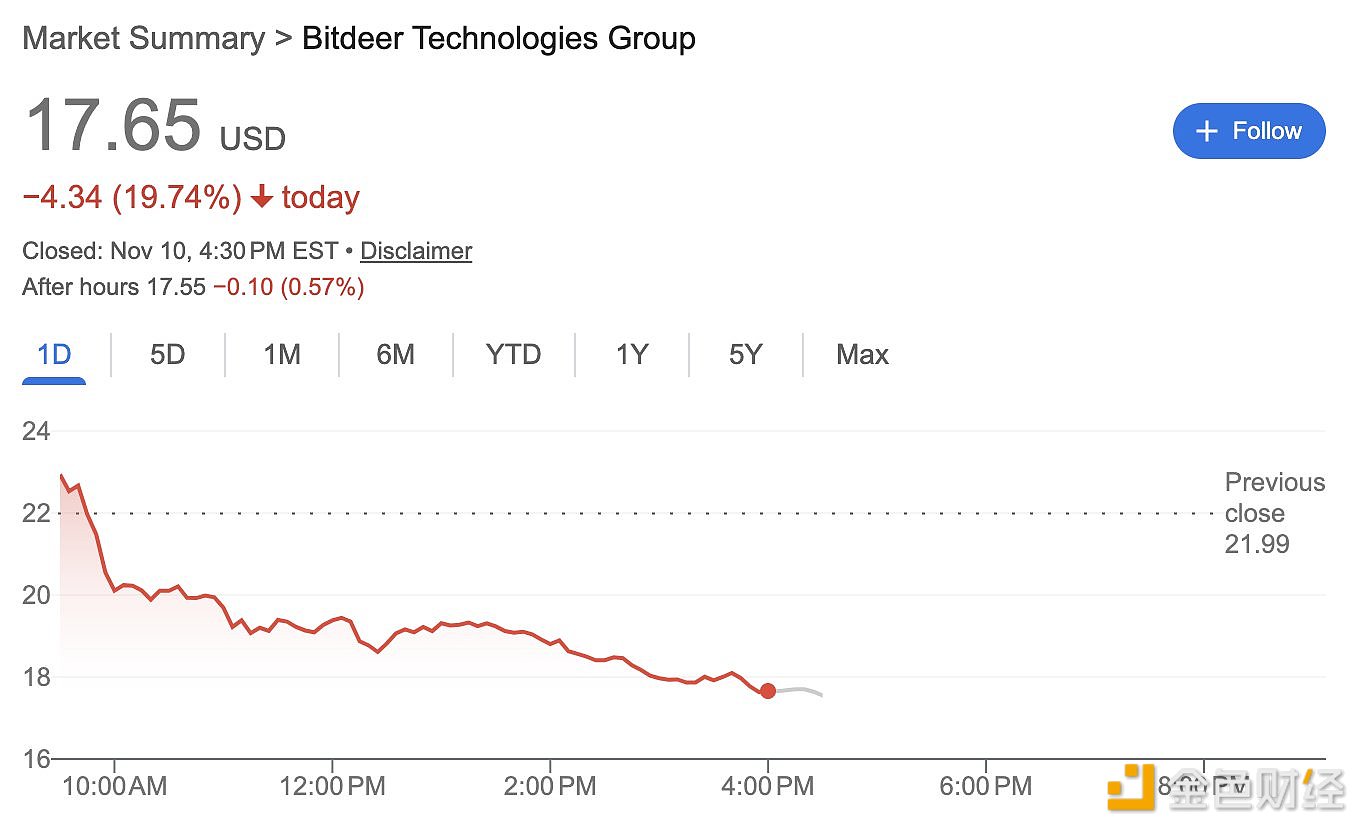

Bitdeer posts a net loss of $266 million in Q3, stock price plunges 20%