Bitcoin price crash calls are coming from self-serving sellers: Analyst

Some traders who are warning about an upcoming Bitcoin correction might be driven more by self-interest than by an unbiased view of the market, according to a Bitcoin analyst.

“If you sold, you really want lower prices,” Bitcoin analyst PlanC said on the Mr. M Podcast published to YouTube on Friday, reiterating that those who’ve recently sold Bitcoin (BTC) may become more vocal on social media, promoting the idea of Bitcoin’s price falling in hopes of seeing the market move in their favor.

“The whole point of you selling is to think that the bear market is coming,” he said. “So you’re going to get on social media,” he added.

Bitcoin social media sentiment is still leaning positive overall

Many market participants turn to social media to gauge overall sentiment about Bitcoin, paying close attention to community interactions and prediction posts.

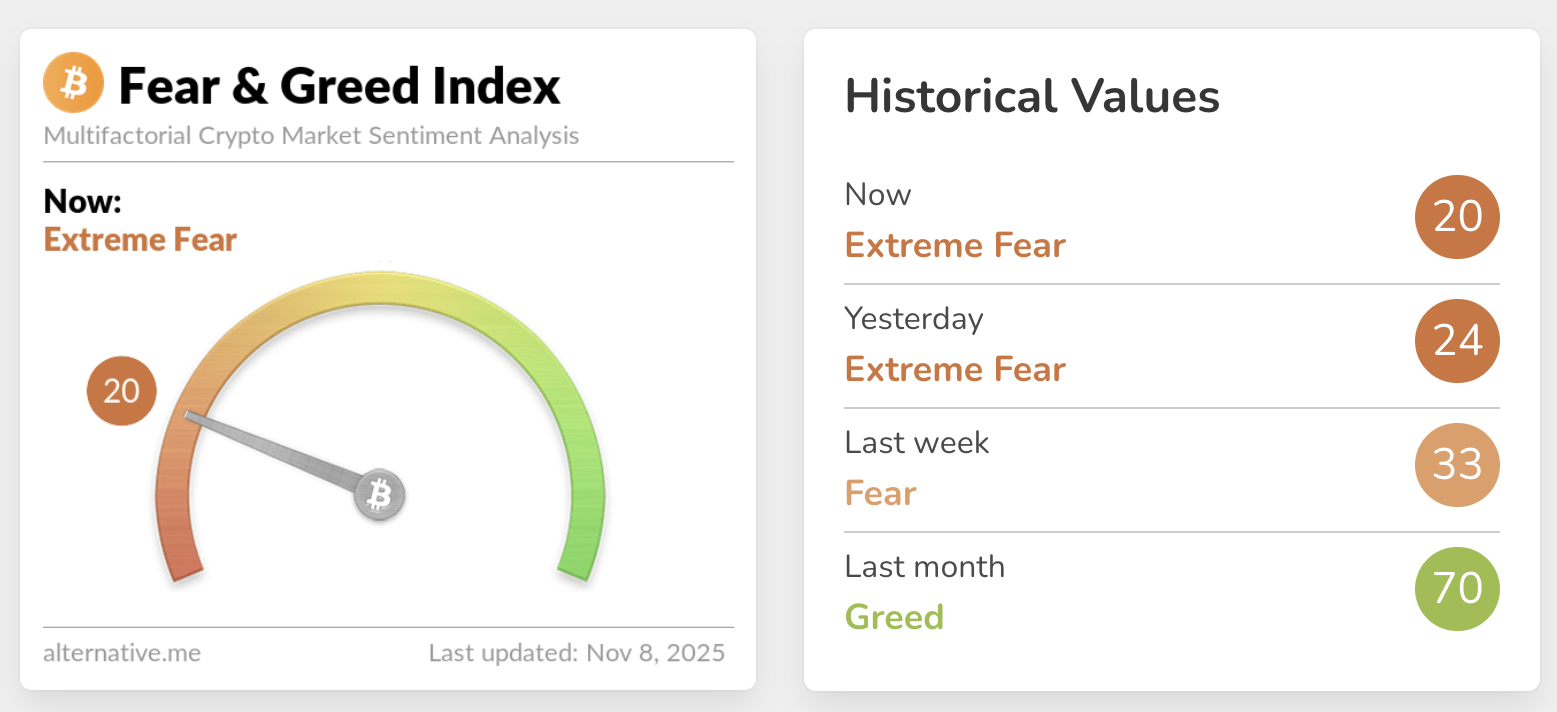

It comes as sentiment among the broader crypto market has plunged, with the Crypto Fear & Greed Index, which gauges overall market sentiment, posting an “Extreme Fear” reading of 20 in its Saturday update.

However, data from sentiment platform Santiment shows overall social media sentiment for Bitcoin (BTC) is 57.78% positive, 15.80% neutral, and 26.42% negative.

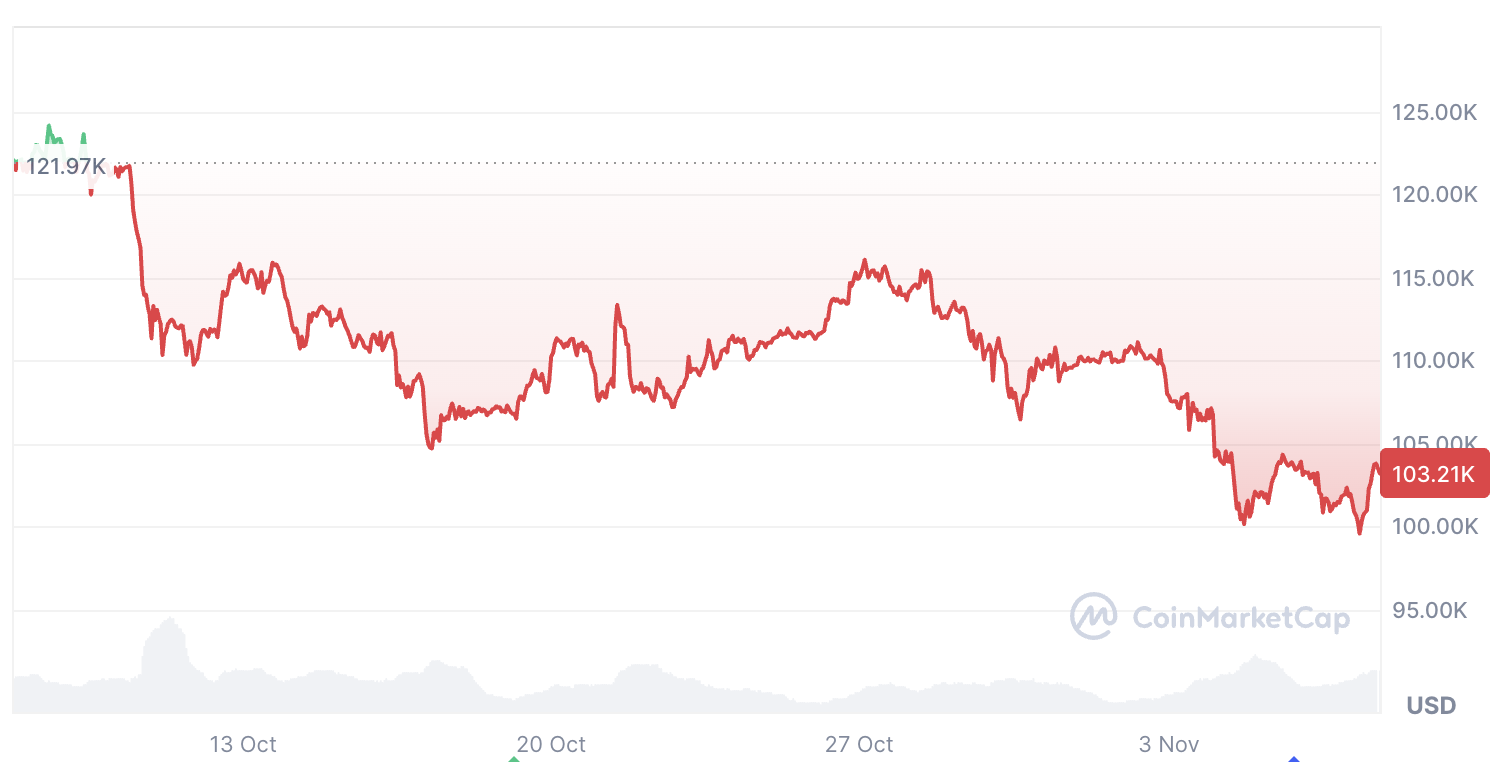

PlanC said that Bitcoin’s recent price decline below the psychological $100,000 price level to $98,000 may have been the local bottom for now.

PlanC forecasts a “decent chance” that Bitcoin just reached a bottom

“I think there is a good chance, again, it is hard to quantify exact probabilities, but from my perspective, there is a decent chance that was the major bottom,” PlanC said.

“If it wasn’t, I don’t see us going down much lower,” he added. Bitcoin has since rebounded to $103,562, according to CoinMarketCap, but PlanC cautioned that another brief pullback could still occur.

“Maybe we go for one more scare over the coming week or so lower,” he explained. “Maybe we go down to like 95 or something, right?” he added.

It comes on the back of more bearish forecasts from analysts over the past week.

Bloomberg analyst Mike McGlone said in an X post on Thursday that Bitcoin hitting $100,000 could be “a speed bump toward $56,000.”

Meanwhile, ARK Invest CEO Cathie Wood cut her long-term Bitcoin price projection by $300,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Update: XRP ETFs Confront Downtrend While Key Support Levels Face Pressure

- XRP faces downward pressure near $2.27 amid $15.5M institutional outflows and declining futures open interest ($3.61B), signaling waning speculative interest. - Four XRP ETFs launching this week, including Canary Capital's $58M-volume XRPC , could drive $4B-$8B in inflows to counter recent outflows and stabilize pricing. - Technical indicators show XRP trading below key EMAs ($2.49/2.56) with fragile $2.20 support level repeatedly tested, while RSI (43) and bearish MACD confirm short-term selling pressur

Regulated or Decentralized: Kalshi’s $11 Billion Boom Sparks a Prediction Market Frenzy

- Kalshi's valuation jumped to $11B after a $1B funding round led by Sequoia and CapitalG, doubling from October 2025. - The CFTC-regulated platform competes with decentralized rival Polymarket, which targets $12B-$15B in its next funding. - Kalshi dominates 61.4% of prediction market trading volume, boosted by NYC election accuracy and subway ad campaigns. - Partnerships with Google Finance, Robinhood , and Barchart expand Kalshi's reach, contrasting Polymarket's crypto-centric innovations. - The $17.4B+

Bitcoin’s Sharp Decline: Causes Behind the Fall and Future Outlook

- Bitcoin fell below $100,000 in Nov 2025 due to macroeconomic shifts, regulatory ambiguity, and ETF outflows. - SEC's reduced crypto enforcement and Trump-era tariffs created uncertainty, while Treasury volatility and supply chain disruptions pressured risk assets. - BlackRock's IBIT ETF saw record outflows, contrasting with Abu Dhabi's tripled stake, as technical indicators showed oversold conditions and bearish momentum. - Experts remain divided: MSTR predicts $150k by year-end, but prediction markets s

Senate Crypto Legislation Transfers Oversight to CFTC Amid Rising Partisan Debate

- U.S. Senate proposes bipartisan bill transferring crypto regulation to CFTC, limiting SEC's role and classifying most cryptocurrencies as commodities. - Trump's CFTC nominee Selig faces scrutiny over agency staffing and bipartisan governance, with Democrats warning of political bias risks under single Republican leadership. - Industry supports CFTC's expanded oversight for regulatory clarity, but critics question its capacity to enforce AML standards and manage crypto market growth. - Finalized framework