Elixir Halts Withdrawals of deUSD Stablecoin Amid Stream Finance $93M Loss, Triggering Market Instability

Quick Breakdown:

- Elixir has sunset its deUSD stablecoin following Stream Finance’s disclosure of a $93 million loss, which impacts liquidity.

- The stablecoin sharply depegged due to Stream holding significant deUSD positions and opting not to repay loans.

- Elixir has worked with other decentralized lenders to redeem holders and disable withdrawals to protect value amid ongoing uncertainty.

Elixir freezes withdrawals; coordinated effort underway to redeem deUSD holders.

Decentralized finance protocol Elixir has officially ended support for its synthetic stablecoin, deUSD, following a significant liquidity crisis triggered by Stream Finance’s $93 million loss earlier this week. The shockwave from Stream’s financial troubles caused deUSD to rapidly lose its peg to the US dollar, plummeting to just 1.5 cents, according to data from CoinGecko.

Stream Finance’s liquidity troubles began after an external fund manager disclosed a $93 million net asset loss, along with an estimated $285 million in debt owed to several lenders. Notably, approximately $68 million of that debt is owed to Elixir itself. The fallout has prompted Stream to halt withdrawals and led to a cascading effect within Elixir’s synthetic stablecoin ecosystem.

Elixir has worked tirelessly over the previous 48 hours and has successfully processed redemptions of 80% of all deUSD holders thus far (not including Stream).

As it stands now, Stream holds roughly 90% of the deUSD supply (~$75m), while Elixir holds a similar proportion of its…

— Elixir (@elixir) November 6, 2025

Stream’s use of deUSD to stabilize its own Staked Stream USD (XUSD) stablecoin worsened the impact. When Stream’s $93 million loss became public, XUSD plummeted as low as $0.10, compounding market fears. Stream currently holds roughly 90% of the remaining deUSD supply, estimated at $75 million.

Elixir revealed that Stream has decided against repaying or closing its deUSD lending positions, forcing Elixir to coordinate with other decentralized lenders like Euler, Morpho, and Compound. This effort aims to fully redeem all remaining deUSD holders, despite the unexpected market disruption.

To mitigate further risk, Elixir temporarily disabled deUSD withdrawals. The move aims to prevent Stream from liquidating positions prematurely before repaying its loans, which could worsen deUSD’s instability. Elixir remains optimistic that the repayment will be honoured fully on a 1:1 basis despite current challenges.

Meanwhile, Ripple and Mastercard, in collaboration with WebBank and Gemini, are testing the use of the RLUSD stablecoin for credit card transaction settlement. This initiative aims to integrate a regulated digital asset into mainstream financial infrastructure, specifically targeting the WebBank-issued Gemini Credit Card. The core purpose is to evaluate whether using the RLUSD stablecoin on the XRP Ledger can enable instant, blockchain-based settlement, thereby reducing the delays and complexity inherent in traditional multi-day banking workflows while maintaining consumer protections.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New Bitcoin highs could take 2 to 6 months but data says it’s worth the wait: Analysis

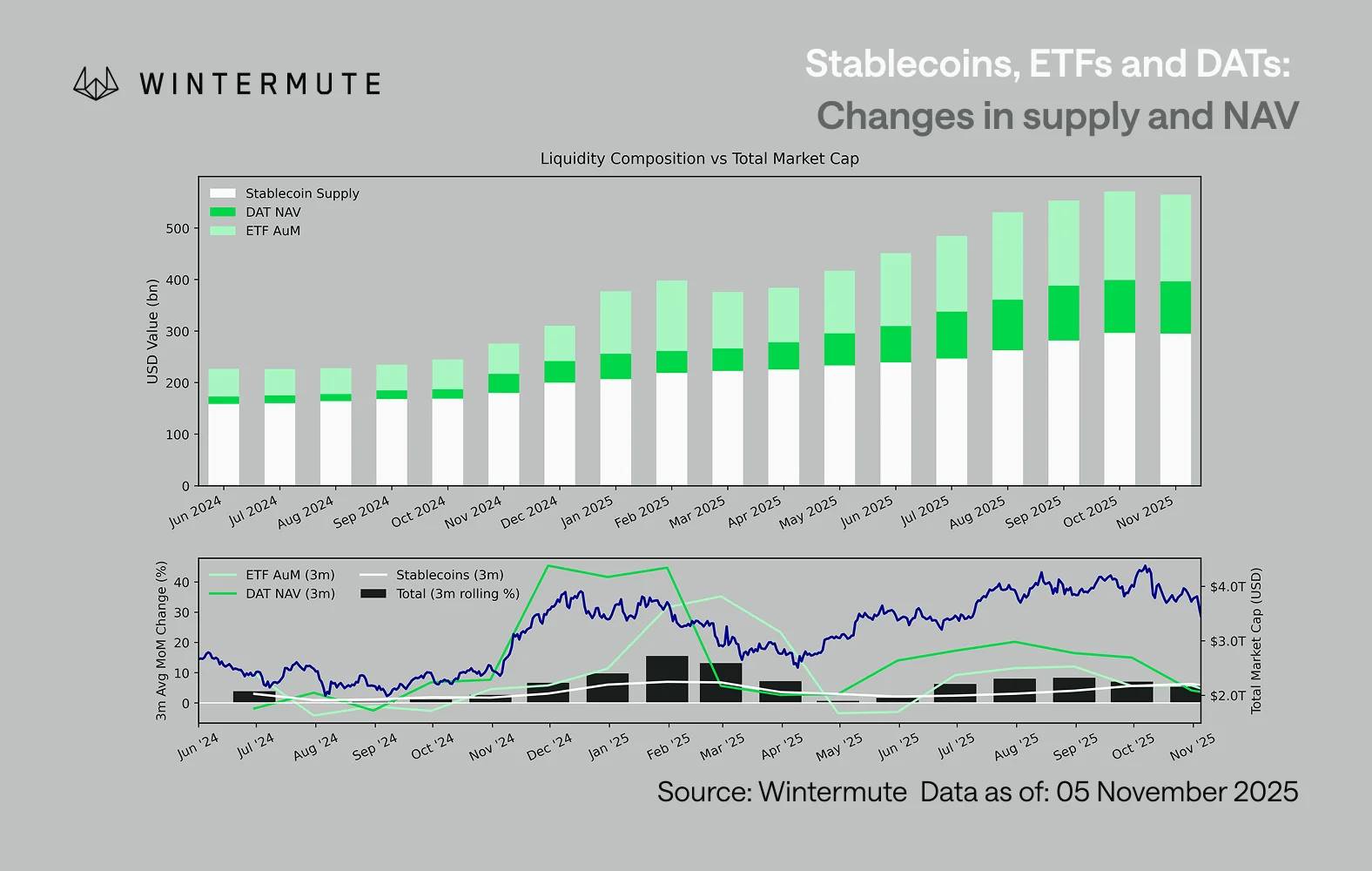

Wintermute: Liquidity, the Lifeline of the Crypto Industry, Is in Crisis

Liquidity determines every cryptocurrency cycle.

Ray Dalio's latest post: This time is different, the Federal Reserve is fueling a bubble

Because the fiscal side of government policy is now highly stimulative, quantitative easing will effectively monetize government debt, rather than simply reinjecting liquidity into the private system.

Famous Bitcoin bull "Cathie Wood" lowers target price due to the "replacement" by stablecoins

Cathie Wood has lowered her 2030 bitcoin bull market target price by about $300,000, after previously predicting it could reach $1.5 million.