Universal Exchange

This article will explore how Coinbase's diversified businesses work together to achieve its vision.

This article will explore how Coinbase's diversified businesses work together to achieve its vision.

Written by: Prathik Desai

Translated by: Block unicorn

Preface

Over the years, Coinbase has been given many titles: the representative enterprise of US crypto regulation, the entry choice for retail investors, and a crypto stock with dreamlike growth potential. As I delved into its quarterly performance ending September 30, 2025, I found that its greatest strength does not lie in trading itself, but in the ecosystem it has built and the value flows it facilitates within that ecosystem.

Thirteen years after its initial launch to simplify bitcoin trading, the company has transformed its massive customer base, assets under custody, and compliance capabilities into a powerful distribution channel. Although crypto trading activity has shifted from retail to institutions over the past two years, Coinbase continues to expand its total addressable market (TAM) through a range of new products covering spot, derivatives, custody, and Base applications.

The company calls this vision the "Everything Exchange." In today's analysis, I will explore how Coinbase's diversified businesses work together to achieve its vision.

Now let's get to the point.

From Exchange to Ecosystem

Crypto trading revenue typically disappears during bear markets, but today it has become part of Coinbase's ever-growing multi-product system.

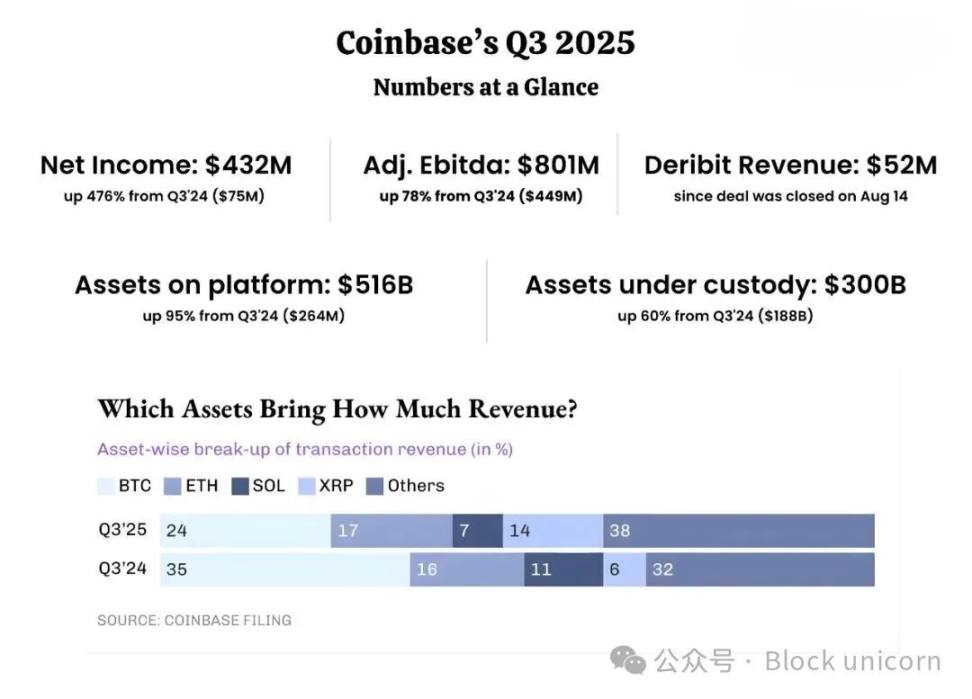

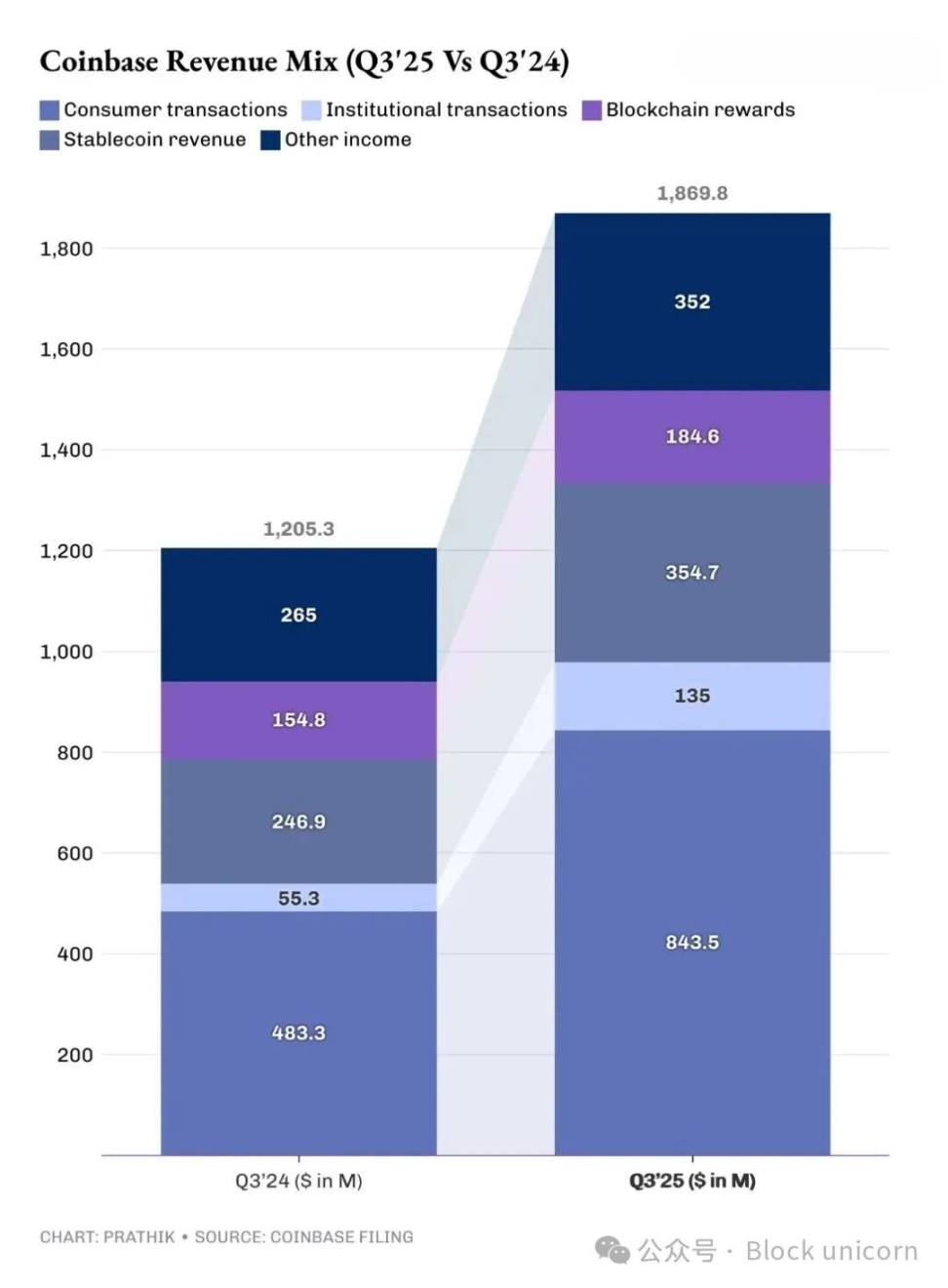

In Q3 2025, the company's net revenue reached $1.79 billion, up nearly 60% year-over-year. During the same period, as trading activity rebounded, trading revenue grew by more than 80% year-over-year, while recurring subscription and service revenue grew by about one-third.

However, what interests me is not how much money Coinbase made, but how it made that money.

Coinbase profits from every layer of the market connected to the entire crypto ecosystem, including institutional asset custody fees, earnings from USDC balances, and derivatives spread clearing. Trading used to be Coinbase's core business, but now it has become the gateway to its ever-expanding range of services, which cover custody, stablecoins, payments, and derivatives.

The company referred to this new architecture as the "Everything Exchange" on its earnings call. When I first heard the term, I thought it sounded like a marketing gimmick. But the simple idea behind it is: distribution channels are the new moat Coinbase is betting on.

This bet became especially clear in August when Coinbase acquired Deribit, the world's largest crypto options platform, for $1.2 billion.

This all-stock deal built a bridge for the largest US crypto exchange to the global derivatives market, which has long been outside the reach of US jurisdiction. For the first time, a US-listed company can clear both spot and derivatives trades on the same platform.

This deal greatly boosted Coinbase's institutional business. Within just six weeks of the acquisition, the Dutch company added $52 million to Coinbase's quarterly revenue. This accounted for about 40% of institutional trading revenue, which itself more than doubled from $55 million a year ago to $135 million.

The Stablecoin Game

Deribit expanded its tool coverage by adding options and futures, while USDC brought stable cash coverage.

With USDC circulation reaching a record high of $74 billion, Coinbase's USDC holdings on its platform also hit a record $15 billion. Stablecoin revenue rose 44% year-over-year to $354 million, becoming the largest single revenue item in the subscription and services category.

Through Base and its new payment API, Coinbase enables enterprises to embed USDC deposits, payments, and fund flows directly into their applications.

This entire stablecoin infrastructure and its fund flows have turned Coinbase into an on-chain clearing bank. The returns from all this are very lucrative: stablecoin balances generate yield, user adoption expands the network, and the convenience provided retains users. Unlike the volatility of trading, USDC yields continue to grow as adoption increases. Every additional developer using Base or merchant integrating USDC increases Coinbase's circulation.

The Trust Factor

Trust is the hardest asset to scale, but Coinbase has replicated the success of other enterprises in its custody business.

Last quarter, Coinbase's assets under custody (AUC) reached $300 billion, up 60% year-over-year, mainly due to strong ETF inflows and enterprises increasing their digital asset (DAT) holdings. Currently, Coinbase provides custody for over 80% of BTC and ETH in US spot ETFs. When institutions such as BlackRock, Fidelity, and ARK Invest create or redeem shares, the related assets are transacted through Coinbase's vault, and the fees for these services are counted as Coinbase's revenue.

Custody revenue accounts for less than 8% of Coinbase's total revenue, but its strategic value is significant. Custody builds trust, and trust expands distribution and retains users.

These custody clients are also more likely to try Coinbase's new product suite, including derivatives and USDC payments. Coinbase's latest acquisition, Echo, will become the newest beneficiary of the trust factor, as its clients can now issue, trade, and store tokens within the same compliance framework.

Custody creates stickiness. I believe it is the intangible barrier that makes the "Everything Exchange" vision possible.

Profit Evolution

When you look at the changes in Coinbase's revenue structure in both quantity and quality from a more macro perspective, the trajectory of Coinbase moving toward its "Everything Exchange" vision becomes more convincing.

In 2021, nearly 90% of Coinbase's revenue came from trading spreads. Today, nearly 40% of revenue comes from recurring sources such as custody fees, stablecoin yields, and blockchain rewards. Although its revenue is still heavily dependent on market cycles, these cycles no longer determine its survival.

Every product Coinbase has launched recently has brought in additional revenue. This is the benefit of leveraging distribution channels to bring new business lines to enterprises.

I like the "Everything Exchange" vision because it doesn't try to build a messy product portfolio; that would certainly be easier. I find it interesting because it treats crypto as a space where people are willing to stay, provided you offer a product ecosystem that naturally connects or creates value together.

Custody and stablecoins attract institutions and developers, while Base brings the creator economy on-chain. Deribit provides the leveraged market. Together, they form an infrastructure network rather than just a trading platform, and it is through this network that Coinbase profits from different areas of the crypto capital structure.

Coinbase's vast product network is everywhere, helping it become the distribution backbone of the entire crypto industry.

Looking ahead, Coinbase has expressed its intention to expand the "Everything Exchange" architecture beyond current assets.

On last week's earnings call, CEO Brian Armstrong admitted that the company's vision is at the core of the "next piece of the puzzle" it is building, including prediction markets and bringing assets on-chain. We will have to wait until Coinbase's December product showcase to learn more.

I see exciting potential for Coinbase here. If it can run prediction markets on the Base platform, the results can be tokenized, settled in USDC, and custodied within Coinbase's infrastructure, all under the same reliable regulatory framework.

If executed well, this will help Coinbase evolve from a platform that once traded assets to one that trades information, once again proving its distribution capabilities.

What is concerning about Coinbase is that most of its revenue relies on a few highly volatile pillars. This quarter, about 20% of its total revenue came from USDC yields, which are tied to short-term Treasury rates. If that rate drops by one percentage point, it could reduce quarterly stablecoin revenue by about $70 million.

Coinbase claims its architecture is designed to be diversified, but the next few quarters will show whether this diversification can still bring benefits when key businesses fail to deliver satisfactory results.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ray Dalio's latest post: This time is different, the Federal Reserve is fueling a bubble

Because the fiscal side of government policy is now highly stimulative, quantitative easing will effectively monetize government debt, rather than simply reinjecting liquidity into the private system.

Famous Bitcoin bull "Cathie Wood" lowers target price due to the "replacement" by stablecoins

Cathie Wood has lowered her 2030 bitcoin bull market target price by about $300,000, after previously predicting it could reach $1.5 million.

Crypto: Balancer publishes a preliminary report on the hack that targeted it

UNDP Launches Major Blockchain Training and Advisory Push for Governments