Bitcoin Updates: DeFi Breach Highlights the Vulnerability of the Crypto Market

- A $128M Balancer DeFi exploit triggered a 17% Bitcoin crash to $103,000, causing $1.3B in liquidations and pushing major altcoins into bear markets. - Technical breakdowns, Fed policy uncertainty, and broken stablecoins like xUSD ($0.30) exposed systemic vulnerabilities in crypto's infrastructure and risk models. - Panic selling spiked 160% as the Fear & Greed Index hit "fear" levels, with 327,790 traders liquidated amid renewed doubts about DeFi security and algorithmic stablecoins. - Analysts warn reco

The cryptocurrency sector has been hit hard by a combination of technical failures, unclear regulatory signals, and a major decentralized finance (DeFi) hack, all of which have heightened investor anxiety.

Monetary policy from the Federal Reserve added to the uncertainty. Although the Fed reduced rates by 0.25% last week and intends to halt quantitative tightening in December, officials such as Austan Goolsbee have suggested pausing further cuts due to ongoing inflation worries, CoinCentral reported. This ambiguity has left crypto traders uncertain, as digital assets often benefit from looser monetary policy.

As the Crypto Fear and Greed Index dropped to 30, entering the "fear" range, panic selling accelerated, CoinCentral reported. Daily liquidations soared by 160% in a single day, erasing 327,790 traders—though this is still less than the 1.6 million liquidated during the October 11 crash, CoinCentral added. The memory of that event, combined with fresh volatility, has made traders reluctant to buy the dip, fearing more losses ahead.

The market’s vulnerability was worsened by a significant rounding error in Balancer’s smart contracts, which enabled attackers to siphon off $128 million across several blockchains, as first reported by Yahoo Finance. The breach, which affected only

Other DeFi projects also suffered losses. Stream Finance saw $93 million vanish after its

Despite the turmoil, some market observers remain cautiously hopeful. Historically, crypto markets have managed to recover from steep declines, though the timing remains uncertain, according to

Currently, Bitcoin is trading near $103,000, with alternative coins lagging as risk aversion dominates, according to

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Regulatory Changes and Unprecedented Staking Returns Drive Institutional Growth for Ethereum

- Ethereum's institutional adoption accelerates due to SEC's in-kind ETF approval, boosting market efficiency and participation. - SharpLink and Bit Digital report record staking yields (up to 2.93%), highlighting Ethereum's "productive" treasury asset advantage over Bitcoin . - Justin Sun's $154M ETH staking via Lido signals growing confidence in Ethereum's infrastructure despite liquid staking centralization concerns. - Regulatory tailwinds and $12.5M ETH ETF inflows counterbalance price declines, with t

Vitalik Buterin Introduces New ZK Technology: What It Means for Ethereum's Development

- Vitalik Buterin leads Ethereum’s shift to ZK proofs, targeting modexp removal and GKR protocol integration to boost scalability and privacy. - Modexp precompile’s 50x computational burden on ZK-EVM proofs will be replaced by standard EVM code, prioritizing long-term efficiency over short-term gas costs. - GKR protocol enables 2M Poseidon2 hashes/sec on consumer hardware, accelerating verification and enhancing quantum resistance for Ethereum’s "Lean Ethereum" vision. - ZKsync’s 150% token surge and Citib

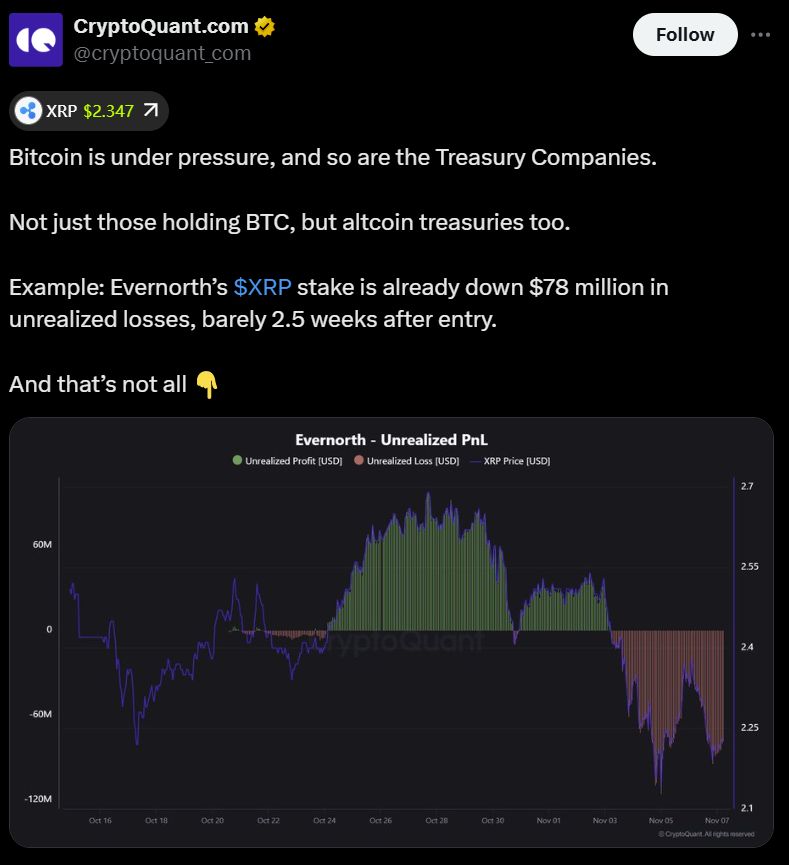

Evernorth’s unrealized XRP losses expose mounting pressure on DATs: CryptoQuant

Marina Protocol and Audiera Ally to Bring AI-Powered Music and Dance to Web3