Breaking! Gavin Wood drops another “thought bomb”: proposes to remove staking security incentives!

At yesterday's Web3 Summit event, Polkadot founder Gavin Wood once again dropped a "thought bomb":

Polkadot NPoS (Nominated Proof-of-Stake) is dragging down Polkadot's security model. We need a fundamental replacement and reconstruction.

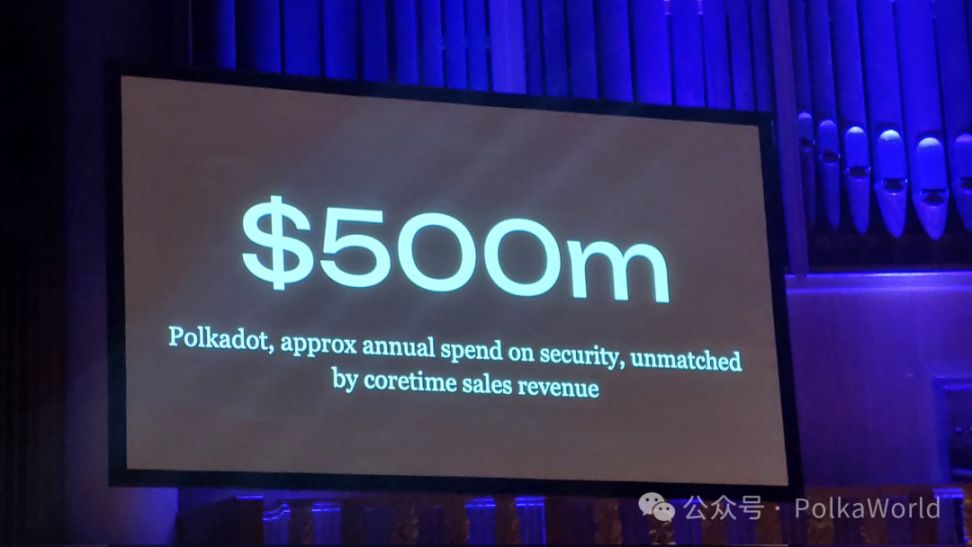

This may sound radical, but it's not out of thin air—it's rooted in an unavoidable reality: Polkadot pays up to $500 million in security costs every year!

This expenditure mainly comes from staking rewards, that is, DOT issued annually through inflation to reward validators and nominators. In the current structure, this cost accounts for 85% of Polkadot's annual inflation.

So where does this 85% go? Most of it is cashed out directly by validators and nominators, flowing out of the ecosystem, and does not actually translate into "network usage" or "ecosystem activity."

Gavin bluntly stated: this is an "unsustainable" fiscal structure. In the long run, it will not only drag down the network's fiscal discipline but also seriously weaken the precision and efficiency of ecosystem incentives.

The alternative path he proposed is: PoP (Proof of Personhood).

A brand new model that uses "who you are" as the basis for on-chain power and trust, rather than "how much money you have."

The Essence of the Problem: NPoS Treats "Capital Holders" as Security Providers

Since the mainnet launch in 2020, Polkadot has always used NPoS (Nominated Proof-of-Stake) as its core security mechanism—an innovative model where validators and nominators jointly maintain network security.

The original intention of PoS was good: to encourage positive participation and protect network security through token staking.

Over the years, it has indeed demonstrated good technical performance and censorship resistance: zero downtime, low latency, ultra-high elastic scalability, and even became one of the few "high-intensity mainnets" running under the PoS architecture in the industry.

But in reality, NPoS incentivized capital hoarding, raised the price of "security," and also created a paradox:

You need to own a lot of DOT to protect Polkadot; instead of being rewarded for what you do for Polkadot.

Gavin's thinking is profound. What he sees is not just a fiscal deficit, but a logical loop problem behind the NPoS design—it relies too much on token capital while ignoring identity, fairness, and actual contribution.

Five years have passed. With the launch of the Coretime model and the maturation of the ecosystem structure, Gavin Wood began to reflect: Is NPoS really the ultimate solution? Polkadot's annual security cost for staking incentives is as high as $500 million—far higher than the income from core resources, far higher than the "security budget" of most chains, and even further beyond the marginal benefits brought by this mechanism.

This number is not only shocking, but also triggers a collective reflection on the essence of NPoS:

If so-called "security" relies on inflationary rewards and continuously consumes ecosystem resources, is it really a moat, or is it a shackle?

Gavin Wood's answer is clear and radical. He suggests that NPoS may not be the end, but only a transitional security mechanism. It relies too much on capital, is not conducive to long-term governance fairness, and causes huge fiscal internal friction.

Solution Approach: Short-term Bleeding Control, Mid-term "Blood Change," Long-term Logic Reconstruction

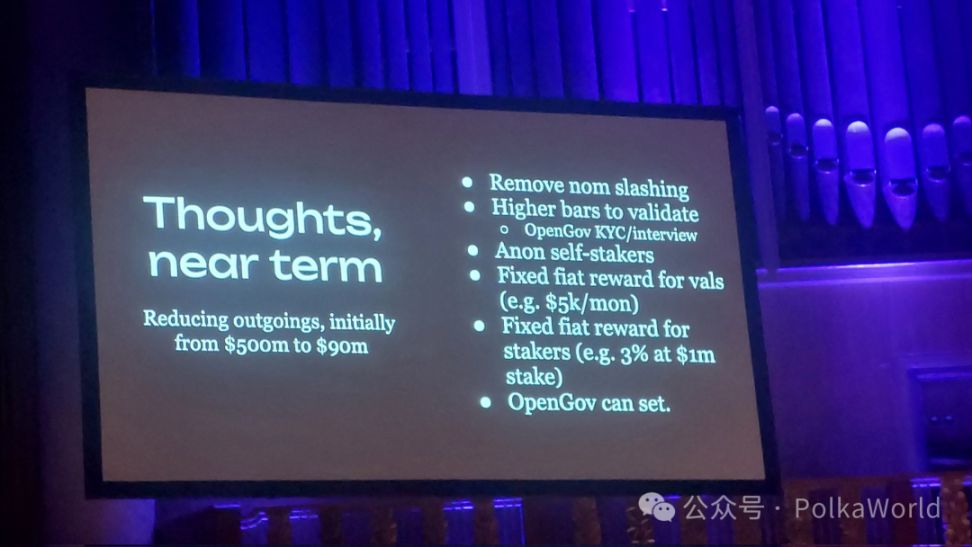

Short-term goal: from $500 million → $90 million, cut security spending by 80%

In his speech, Gavin proposed a set of mechanism reforms that can be quickly adjusted by OpenGov, possibly including:

Setting fixed fiat salaries for validators (e.g., $5k/month);

Limiting self-staking and overly high return expectations;

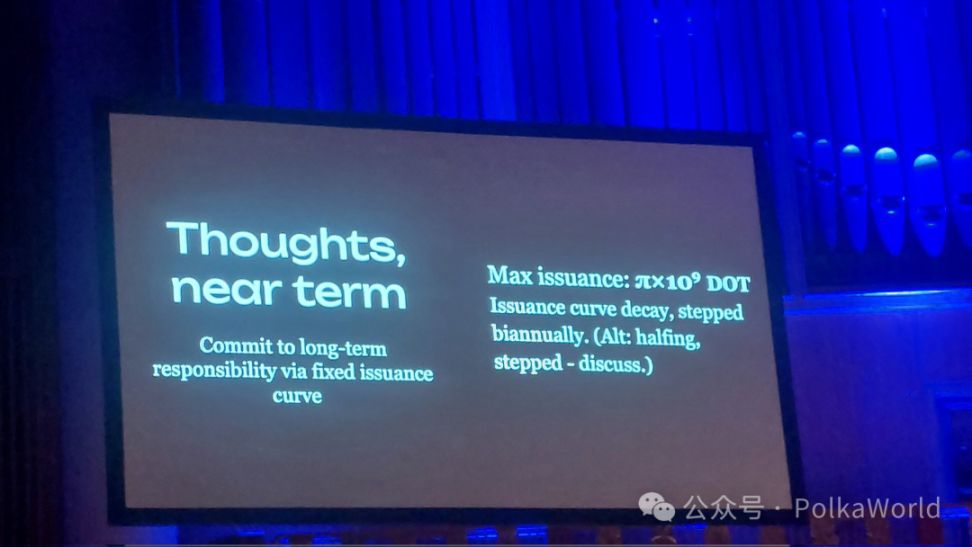

Introducing a "stable issuance model" for DOT: for example, halving every two years, with a total cap of 3.14 billion;

Raising the validator threshold, introducing KYC, interviews, and other mechanisms.

Perhaps this is not just another "parameter optimization," but a move to cut off the root cause of incentive over-issuance, and to redefine "security expenditure" with a more pragmatic institutional logic.

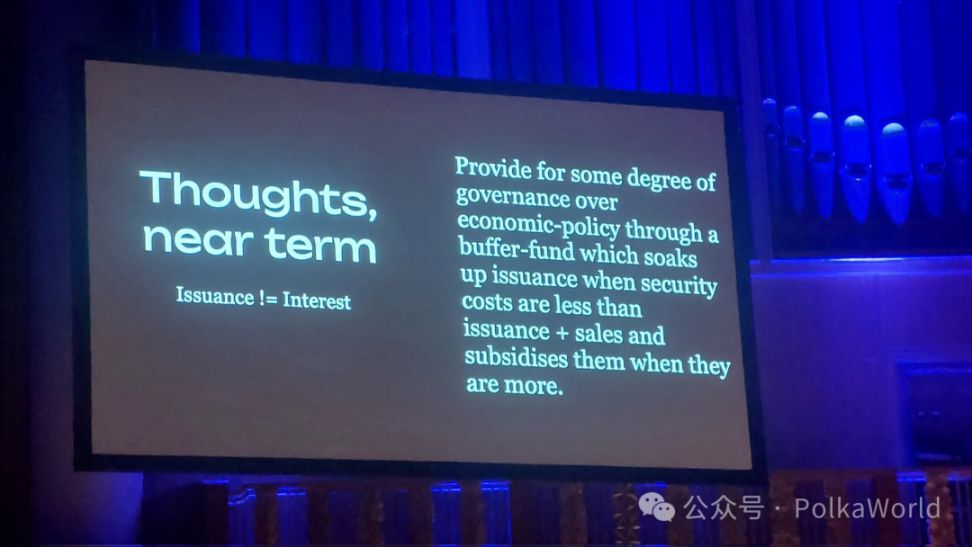

In addition, in the short term, Gavin also hopes to introduce a "new funding pool" mechanism—where inflationary funds are no longer sent directly to validators, but instead enter an intermediate funding pool, with disbursement decided by governance.

This mechanism is actually one of the cores of the fiscal structure reform proposed by Gavin, aiming to make "reward distribution" more restrained and controllable, rather than automatically sending money to validators.

In the current PoS design, Polkadot's inflationary issuance is "automated": the system mints new DOT each year according to the set inflation rate, then sends it directly to validators and nominators as "security incentives."

Although this process is simple, it has a serious problem:

- Money is distributed without asking for need, regardless of whether validators have truly provided valuable security;

- If network demand drops and core resources are underutilized, the system still distributes money as usual;

- The result: a lot of money is spent, but there is little utility or growth on-chain.

So Gavin proposed a new structure:

In the future, newly issued inflationary DOT will not be sent directly to validators, but will first enter an "intermediate funding pool (buffer pot)."

The use of this "new funding pool" is decided by governance, for example:

- Does the network currently need more security investment? → Allocate to validators;

- Are there more urgent ecosystem funding needs? → Allocate to developers, projects, events, etc.;

- Is the network already over-incentivized? → Leave it in the pool as future reserves;

- It can even be used to offset future inflation, buy back DOT, or support stablecoins.

The essence of this mechanism is: turning the "automatic money distribution mechanism" into a "governance decision mechanism."

That is, returning the "right to use inflationary currency" to community governance, rather than defaulting to sending it all to validators.

National finances no longer allocate new tax revenue directly to the military, but first put it into the treasury, then decide whether to build bridges and roads, schools, or expand the military based on the country's overall development needs.

Gavin believes we should seriously consider how much security Polkadot really needs. He thinks the security cost needed in the early stage is actually much lower than our planned issuance.

Therefore, it is better to keep the surplus as backup funds, rather than overpaying the security budget. This "intermediate pool" is to prepare for "rainy days": whether it's security needs, insufficient transaction fees, or sluggish core time sales.

Some may question: since we once advocated the ideal of "extremely low block space cost," why are we now talking about using the buffer fund to deal with sluggish core time sales? Is the vision of zero-cost block space still alive?

Gavin's response: "This is not a betrayal, but evolution. To reach the extreme state, we must first become practical."

Currently, Polkadot has only about 40 cores being effectively used, and the core utilization rate of many chains is even less than 20%.

Under this premise, rather than empty talk about "each transaction approaching zero cost," it is better to be pragmatic—first build real demand, then welcome the day when marginal costs decline.

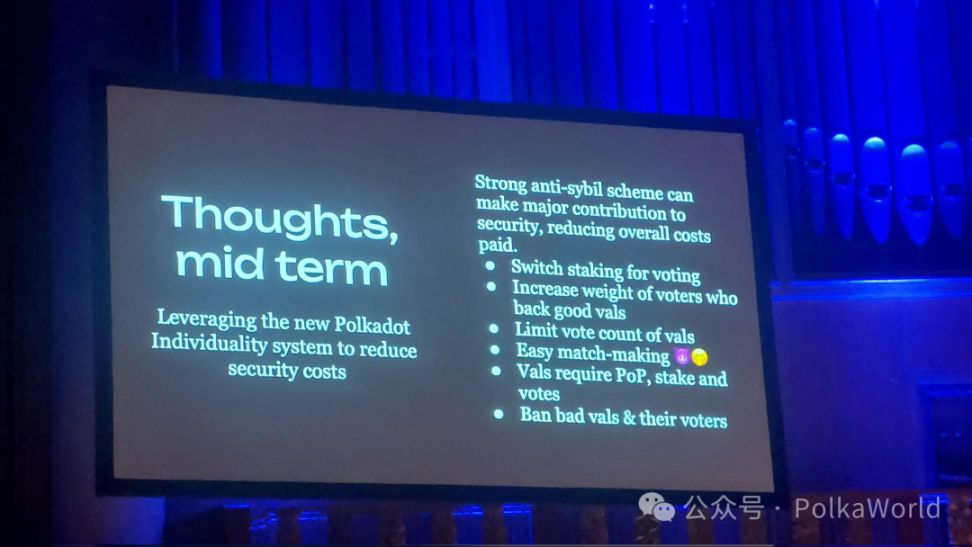

Mid-term strategy: Introduce PoP and Individuality, start an identity-driven security model

If the short-term goal is "stop the bleeding," then the mid-term path is "change the blood"—exploring a new security structure based on PoP (Proof of Personhood) and Individuality. Security, originally determined by "money," will now be determined by "people."

In this architecture:

- You must be a "real, independent" person (not a bot, not multiple identities);

- Your voting support for validators determines whether they can participate in block production;

- The number of votes each validator receives is limited, to prevent centralization;

- Those who support poor-performing validators will be identified and removed by the system; that is, if a validator performs poorly (e.g., downtime, malicious behavior, poor performance, violations, etc.), not only will the validator be punished or removed, but their supporters (i.e., those who voted for them, also called "electors") will also bear responsibility, and may even be removed from the elector pool or have their weight reduced

- Staking still exists, but it is no longer "earning by money alone," but a combination of money + identity + voting support.

This is a typical anti-sybil security mechanism, attempting to build a fairer and more sustainable governance structure through "decentralized digital identity."

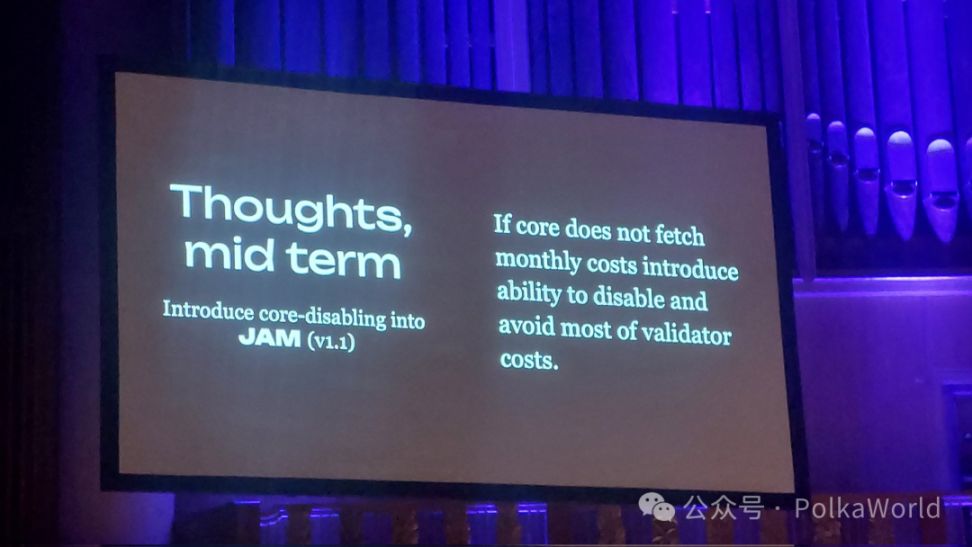

Mid-term supplementary tools: shutting down invalid resources + introducing native stablecoins

In the medium and long-term system design, Gavin also plans to introduce:

1. JAM Core Disabling: If a certain core block space is invalid, it can be directly "shut down" and no longer burn money to maintain it.

"Core" in JAM refers to the smallest execution unit for block production—similar to a parachain's "slot" or Execution Core.

In Polkadot, or in the future JAM, each Core will be responsible for block production and endorsement by validators in turn. Even if the chain or service on that Core has no real business running, it still occupies validator resources; so validators will still be incentivized for maintaining these Cores, i.e., receive inflation from staking. This creates "invalid core expenditure"—you're spending money to maintain a piece of land that no one uses.

This means the system is continuously paying for "useless security."

And "JAM Core Disabling" means that in the future under the JAM architecture, when a Core has no actual value output, the system can shut it down, stopping the allocation of validator resources and block production opportunities for it.

Gavin proposed this mechanism to address the issue of "disconnection between resource usage and inflation expenditure": we cannot treat security incentives as a "universal payroll" mechanism. We must only pay for the parts that truly generate value.

JAM Core Disabling is the embodiment of this concept.

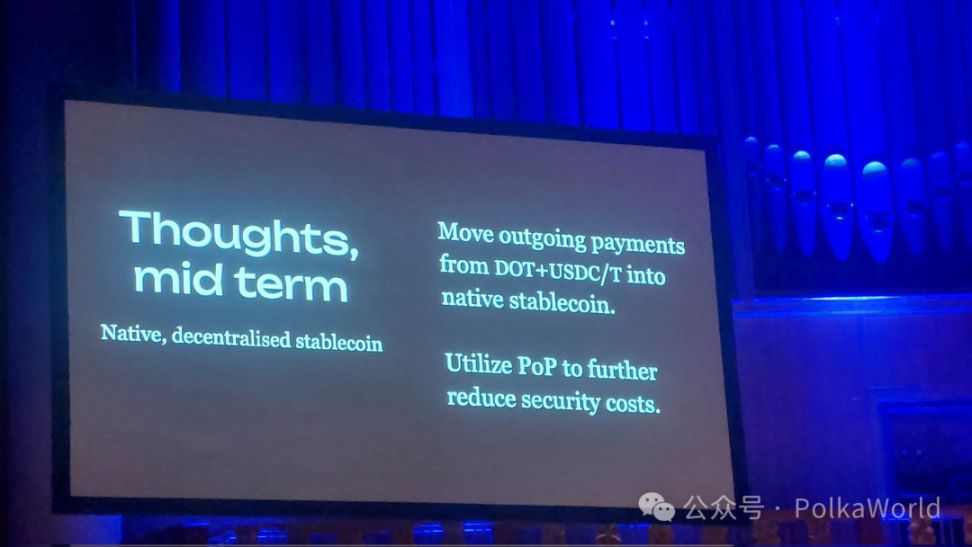

2. Native stablecoin payment structure: shifting treasury expenditure from DOT/USDC to Polkadot's native stablecoin, improving capital internal circulation efficiency;

I think this mechanism is quite significant! Let's first look at what Gavin means by "native stablecoin payment structure."

In the current operation of the Polkadot treasury, most expenditures (such as event funding, team salaries, development rewards, etc.) are usually paid in DOT or USDC and other general crypto assets.

But this presents two problems:

- Expenditure easily flows out of the ecosystem: many teams, after receiving DOT or USDC, immediately exchange it for fiat currency, making it difficult for funds to circulate within the ecosystem;

- DOT as a payment token is highly volatile: DOT is a circulating asset, and using it to settle project expenses is too volatile, making budgeting difficult.

Therefore, one of the reforms Gavin proposed is:

Launch a Polkadot native stablecoin and shift the treasury expenditure structure to settle with this stablecoin.

The benefits of doing this are:

- Avoid frequent selling of DOT, protecting the token market;

- Increase the "secondary use" rate of funds within the ecosystem (for example, a project receives stablecoins and is willing to use them to hire another ecosystem developer);

- Facilitate governance system budget management, making settlement more stable and predictable;

- Build a closed payment circulation system within the ecosystem, enhancing "economic endogeneity."

In short:

Converting DOT or USDC into "the ecosystem's own stablecoin" for expenditures is to ensure that money is spent as much as possible "on our own people," rather than always flowing out.

It's like a city government subsidy not being paid in US dollars, but in "local consumption vouchers," encouraging citizens to spend money at local businesses and thus promoting internal circulation.

Security Is Not a Bidding Game, but a Social Contract

In the Polkadot NPoS paradigm, security is a "pay-for-service" transaction. But in the logic of PoP + Individuality, security is an institutional agreement jointly maintained by people.

This reflects Gavin's shift in political philosophy: from incentive mechanism-driven to "social trust structure"-driven.

He no longer tries to explain everything with capital logic, but acknowledges: identity, trust, and individuality are the key variables for building on-chain order.

NPoS → PoP: Not Just Technical Evolution, but a Paradigm Revolution

Gavin does not completely deny NPoS. He acknowledges its historical role and its short-term value. But his goal is to gradually weaken its dominance and replace it with a more human-centric mechanism.

This is not a light update, but a deep institutional reconstruction.

It challenges the industry consensus of "capital equals security" and reignites the idealistic spark of blockchain technology.

PoP is not simply "identity verification"; it is a redefinition of the Web3 social contract.

Polkadot's Reform Is Still Worth Looking Forward To

In this era full of Ponzi narratives and false on-chain data prosperity, Polkadot's self-reflection and structural reform are especially precious.

It does not rely on NFT hype, nor does it chase the L2 craze, but quietly builds the foundational logic for the next era.

This reform may be slow, and perhaps imperfect, but it deserves the attention, participation, and even contribution of all of us.

You may not yet have a PoP identity, but you are already a witness to this new narrative.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Behind the x402 Craze: How ERC-8004 Builds the Trust Foundation for AI Agents

If x402 is the “currency” of the machine economy, then what ERC-8004 provides is the “passport” and “credit report.”

JP Morgan Forecasts BTC At $170K Amid Market Doubts

Bitcoin Loses Ground To Stablecoins, Says Cathie Wood

Japanese Regulators Back Major Banks’ Push to Issue Yen-Backed Stablecoins