OpenAI CFO: AI doesn’t need to cool down, the enthusiasm is far from enough!

As Wall Street grows increasingly concerned about an AI bubble burst, OpenAI's CFO is instead calling for "more enthusiasm." She also stated that going public is currently not in the company's plans.

OpenAI Chief Financial Officer Sarah Friar stated that concerns about a potential bubble in the AI sector are overly focused, and instead, more “enthusiasm” should be shown for the potential of this technology.

During an on-stage interview at The Wall Street Journal’s Tech Live conference in California on Wednesday, Friar said: “In my view, there’s not nearly enough excitement about the real-world applications of AI and the changes it can bring to individuals. We should continue to push forward with full force.”

In recent months, there has been increasing skepticism about the soaring valuations of AI companies and the massive investments tech firms are making in data centers and chips to support AI development. OpenAI alone has committed to investing over $1.4 trillion in AI infrastructure, even though the company has yet to turn a profit.

To support its AI data center construction, OpenAI has entered into a series of major deals with companies such as Nvidia (NVDA.O) and AMD (AMD.O), but some have criticized these collaborations as “circular financing.” For example, Nvidia agreed to invest up to $100 billion in OpenAI to support its data center expansion, while OpenAI committed to deploying millions of Nvidia chips in these centers. However, Friar responded in the interview: “I completely disagree with that characterization.”

“We are all building out complete infrastructure right now to provide more computing power globally,” she said. “I don’t see this as a circular relationship at all.” She added, “We’ve done a lot of work over the past year to diversify our supply chain.”

In addition to partnerships with chip manufacturers, OpenAI, the developer of ChatGPT, is also considering multiple financing channels to fund its infrastructure expansion. Friar stated that OpenAI is “looking for an ecosystem composed of banks and private equity” to support these ambitious plans. She also hinted that the U.S. government might play a role in “providing financing guarantees,” but did not elaborate on the specific mechanism.

In response to this statement, an OpenAI spokesperson later clarified that Friar’s remarks were made from the perspective of the entire AI industry, and OpenAI is not currently seeking federal government guarantees.

Additionally, OpenAI expects to potentially raise more funds through a public listing in the coming years, but Friar said the company is not currently preparing for this. “We are not preparing for an IPO right now,” she said, “Going public is not currently in our plans.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

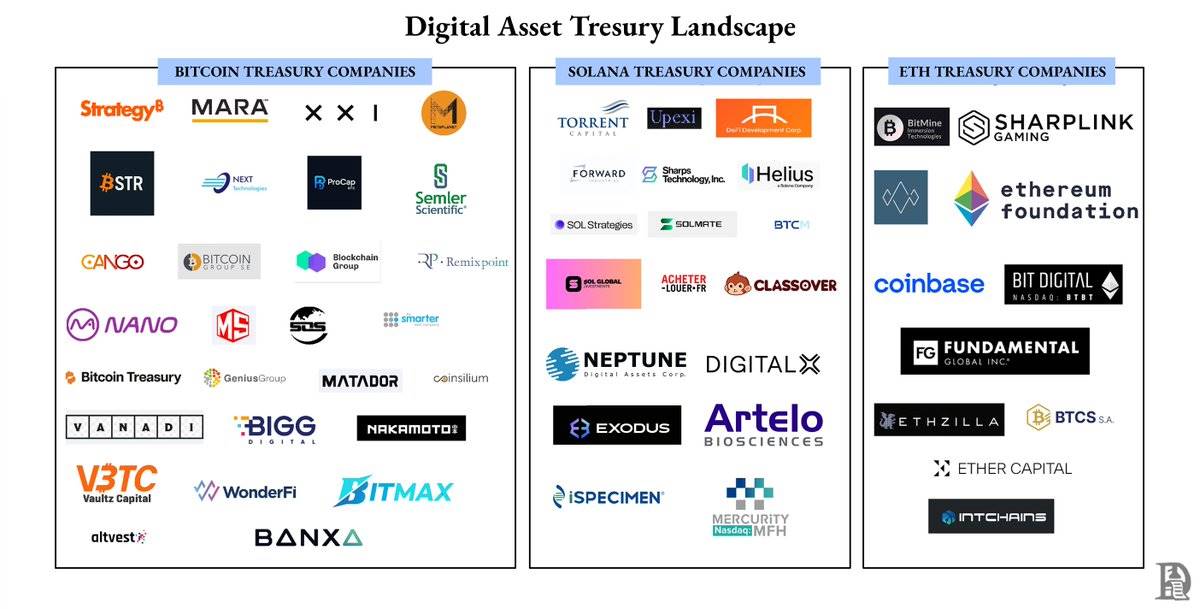

A bucket of cold water: Most Bitcoin treasury companies are facing doomsday

They imitated the asset and liability structure of Strategy, but did not replicate its capital structure.

Dive into Altcoin Strategies that Shape the Market

In Brief Arthur Hayes shares insights on the genuine emergence of an altcoin season. Investors now focus on income-generating and share-distributing projects. This shift reflects the evolving maturity of the crypto market.

Ripple and Mastercard Propel XRP to New Heights

In Brief XRP's price surged by 4.9%, reaching $2.35, driven by institutional trading. The XRP Ledger pilot by Ripple and Mastercard boosts XRP's market demand. Dogecoin maintains its trend with institutional support around $0.1620-$0.1670.

Cryptocurrency Analyst Highlights Recovery Hints in Key Altcoins

In Brief Analyst Ali Martinez identifies potential recovery signs in key altcoins. Martinez highlights critical support re-tests in SEI, PEPE, VET, ALGO, and AVAX. Technical indicators suggest possible trend shifts in these altcoins.